Week Ahead FX outlook:

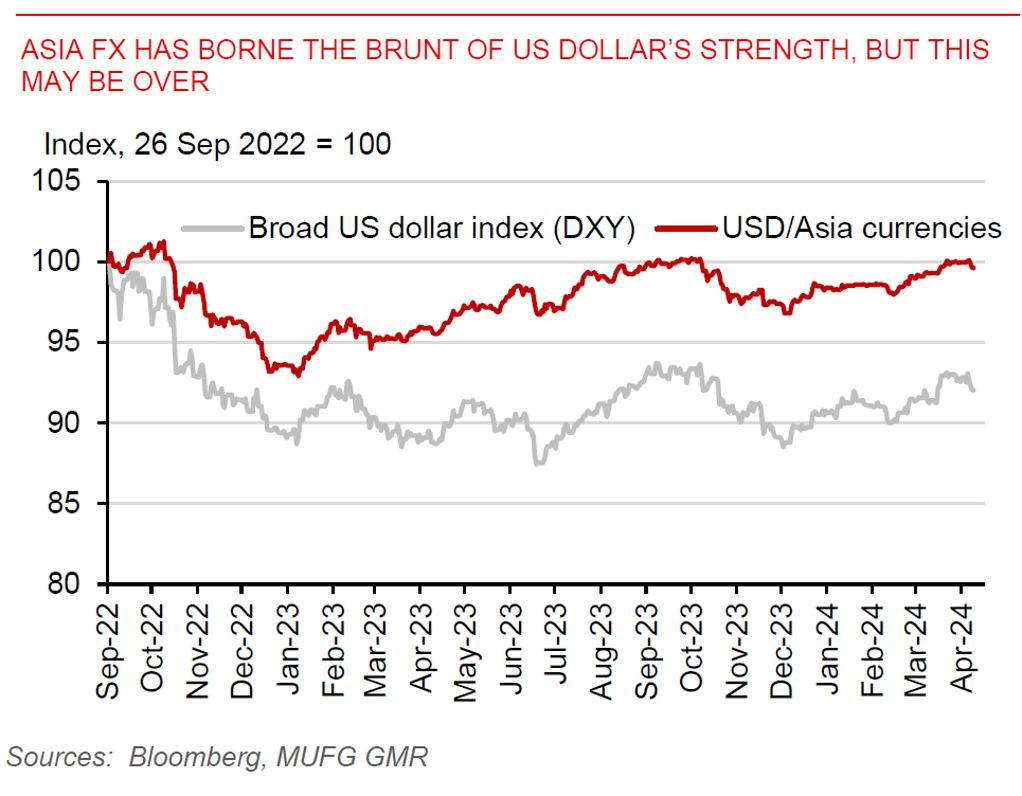

Asia FX’s huge underperformance relative to the broader US dollar trend will likely pause for now, even if the USD continues to strengthen. Authorities from Japan, South Korea, and China have pushed back against excessive currency weakness. Moreover, regional sentiment could be lifted, as China has announced for more supportive macro policies to be implemented to support growth. Asian equity markets saw net inflows of US$1.6bn last week, adding to the US$3bn net inflows in the week ending 26 April.

Meanwhile, most Asian central banks will likely stay or become more hawkish to protect the value of their currencies, despite inflation being less of a worry in the region. Rate cuts in the region could be delayed till next year, while further currency weakness could lead to potential rate hikes. For instance, Bank Indonesia raised interest rates to support the rupiah last month. China can be an exception though.

This week, markets will look for further clues on whether the US labour market and households are able to continue to hold up amid high interest rates. Key data include initial jobless claims and the University of Michigan sentiment. More signs of a softening US economy could lead to more US rate cuts being priced in by markets and a weaker US dollar. In Asia, the focus will be on any follow-through of China’s plans for stimulus to support growth and whether China’s export growth is sufficient to offset domestic headwinds from weak consumer confidence and falling residential property prices. Bank Negara Malaysia will meet on 9 May. Our view is that the overnight policy rate (OPR) will stay on hold at 3.00%. But we do not rule out the BNM hiking rates, given upside risks to inflation and a loss of competitiveness due to yen weakness.

Asia FX has borne the brunt of US Dollar's strength, but this may be over