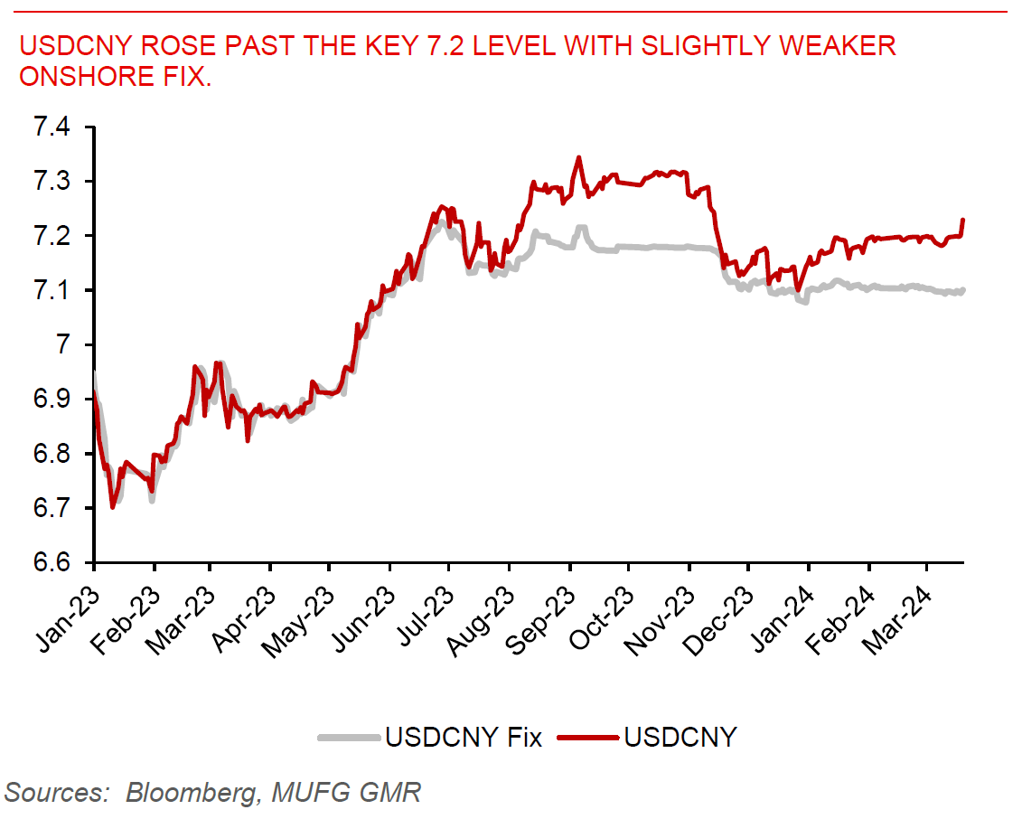

Week In Review: It was an action-packed week in markets both globally and in Asia. First, the Fed boosted global equity market risk sentiment by sticking to its forecast of 3 rate cuts in 2024, with Chair Powell highlighting the willingness to look past recent bumpiness in inflation prints. Second, the G10 central banks outside the Fed turned more dovish, with the Swiss National Bank surprising markets by cutting rates, two hawkish members of the Bank of England removing their preference to hike rates, while the Reserve Bank of Australia turned more neutral in its tone. Third, the Bank of Japan removed its negative interest rate policy in a seminal move, but FX markets were perhaps disappointed by the lack of commitment on the path forward for further rate hikes, with USDJPY rising further to 151.4. Last but not least, China’s onshore CNY rose past the 7.2 level, with a slightly weaker than expected onshore fix coupled with negative news flow on possible restrictions on US mutual fund investments in Chinese stock markets. The combination of these developments pulled Asian currencies weaker.

Capital Flows: Inflows into Asia’s equity markets reversed amidst a stronger Dollar and weaker CNY, led by outflows from China, Taiwan, and Thailand. Taiwan’s stock markets could have been impacted by the surprise rate hike by the CBC. Foreign inflows into Asia’s bond markets were also weaker, with outflows seen in Thailand in particular. Nonetheless, outside of China, Asian equity markets were generally stronger on the back of stronger global risk sentiment.

Week ahead: This week, the key market moving events will be China’s official manufacturing PMIs, coupled with the PCE deflator estimate out of the US. Markets will also watch closely for any clues on the path forward from speeches by Fed Chair Powell and Governor Christopher Waller. There will likely be focus on any further weakness in CNY given the moves last week.

USDCNY rose past the key 7.2 level with slightly weaker onshore fix.