Expect near term volatility of TWD

FX views: On 13th January, Lai from ruling Democratic Progressive Party (DPP) won Taiwan’s presidential election in the three-way race, marked the first time a party won three consecutive terms in Taiwan. At the same time, DPP lost an absolute majority in the Legislative Yuan which could create some difficulties for Lai in garnering support for his policies. As Lai will take office on 20th May, more policies are to be clarified. Thus, we expect near term volatility of TWD.

Week in review: December prices data and credit data showed China’s growth remained soft, although exports growth was stronger than expected providing some positive. Meanwhile, Taiwan’s exports were stronger than expected, in line with regional electronics exporters, while Philippines saw a wider than expected trade deficit. On 13th January, DPP’s Lai, labelled as a separatist by Beijing, won the Taiwan presidential election and emphasized he would adopt Tsai’s approach towards the cross-strait relationship. In legislative yuan, no party secured a majority. Thus, uncertainties remain in cross-strait situation.

Central bank monitor: The Bank of Korea kept rates on hold at 3.50%, but removed a reference in its policy statement around further rate increases, and raising expectations around possible rate cuts this year. BOK Governor pushed back against market speculation on imminent rate cuts. Bank Indonesia is expected to keep rates on hold this week, and market will watch closely for any change in tone by BI.

Week ahead: This week, market will take a close watch on China. PBOC will announce its decision on 1-year MLF rate and China will release 4Q GDP and a batch of detailed data for December economic activity. In addition, Bank Indonesia will announce policy rate decision and we will have 4Q GDP for Malaysia and trade data from India, Malysia, Singapore and Indonesia.

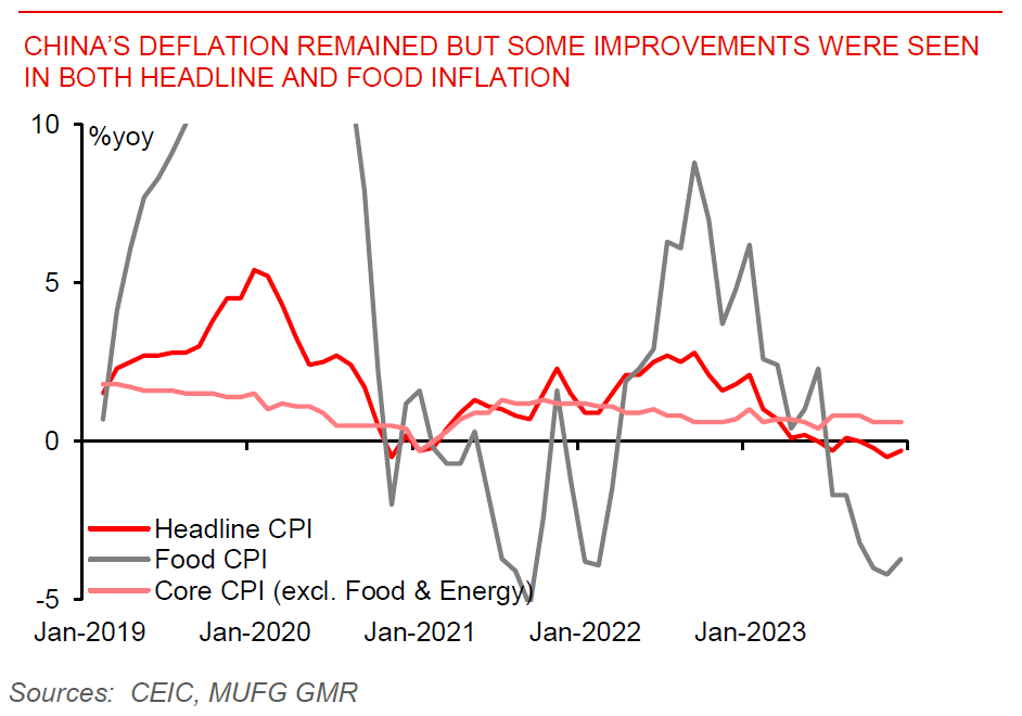

China's deflation remained but some improvements were seen in both headline and food inflation