Rate differentials over the US are driving Asian currencies

FX views: Most Asian currencies weakened against the US dollar last week by a strong dollar that was boosted by a surge in US Treasury yields amid geopolitical risks in the Middle East and the Fed's messaging that interest rates may stay higher for longer. IDR underperformed regional peers, followed by THB and MYR. The CNY was flat against the US dollar last week, pinned down by lingering concerns over China’s property market versus upbeat headline economic data.

Week in review: China’s real GDP growth slowed to 4.9%yoy in Q3 from 6.3%yoy in Q2. On a sequential basis, GDP growth climbed to 1.3%qoq in Q3 from a revised 0.5%qoq in Q2. For September headline data, IP and retail sales beat market expectations while FAI and property investment surprised market to the downside in the first three quarters. Last month’s trade figures for Singapore and Malaysia surprised market to the upside. Elsewhere, Indonesia’s exports fell more than expected in September.

Central bank monitor: PBOC kept its 1-year MLF rates unchanged at 2.5% for the second month as expected on 16th October, and held its 1-year and 5-year LPRs steady at 3.45% and 4.2% respectively on 20th October. On 19th October, BOK maintained its benchmark interest rate at 3.5%, while BI increased its seven-day reverse repurchase rate by 25bps to a fresh four-year higher of 6%.

Week ahead: Asian calendar features 3Q GDP for South Korea, industrial profits for China, industrial production for Taiwan and Singapore, trade data for Thailand and inflation report for Singapore.

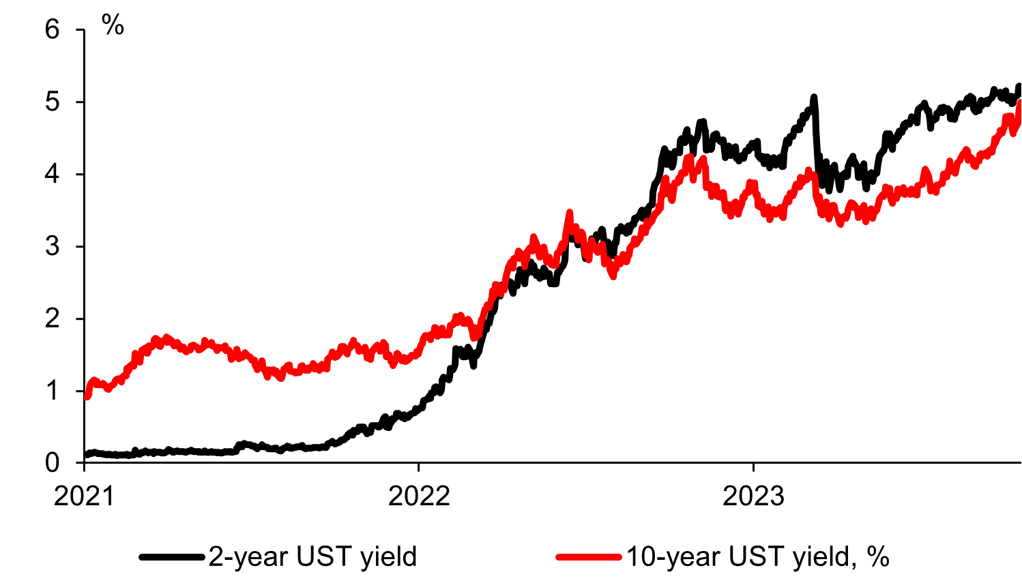

US TREASURY YIELDS ROSE AMID GEOPOLITICAL RISKS IN THE MIDDLE EAST AND THE FED'S MESSAGING THAT INTEREST RATES MAY STAY HIGHER FOR LONGER

Sources: Bloomberg, MUFG GMR