Higher-for-Longer Fed

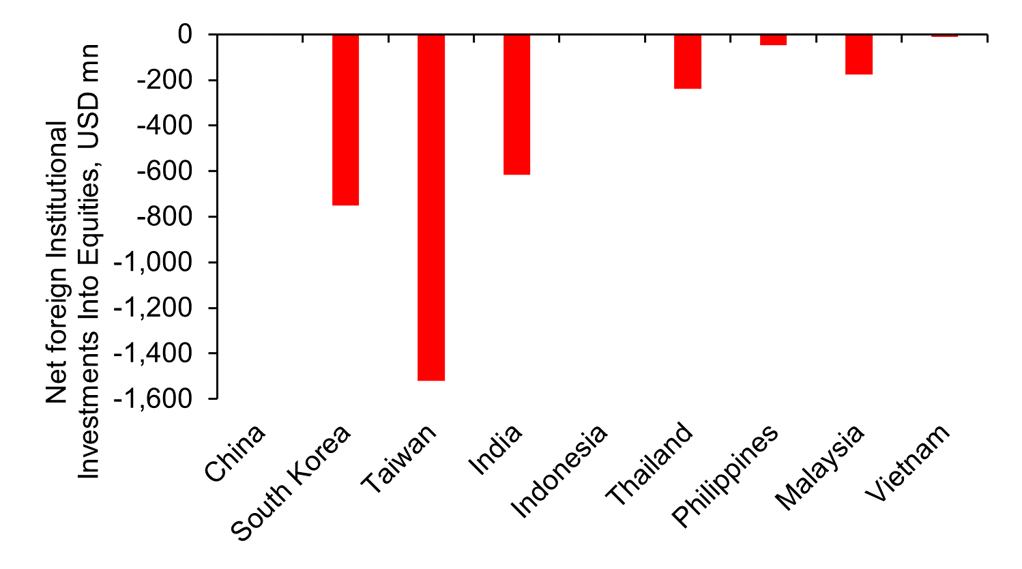

FX views: Most Asian currencies weakened amid a stronger US Dollar, led by THB and IDR. Despite continued foreign equity outflows, TWD was the sole one among regional peers which managed a marginal rise against the Dollar, on the back of a rise in TAIEX index. While USD/CNY trading was closed for holidays last week, USD/CNH edged higher. This week, September US CPI data and the latest Fed minutes, likely drive markets and Asian currencies.

Week in review: Asian economies’ manufacturing PMIs continued to diverge last month, with PMI for China, India, Indonesia, Philippines and Singapore registering above the 50-mark, while PMI for Hong Kong, Taiwan, South Korea, Malaysia, Thailand and Vietnam coming in below the 50-mark. Re-acceleration in headline consumer price index inflation was seen in Taiwan, South Korea and Philippines this September, while headline for Thailand and Indonesia moderated.

Central bank monitor: The Reserve Bank of India kept the repo rate unchanged at 6.50% for the fourth consecutive policy meeting on 6th October. We expect MAS to keep its exchange rate policy on hold, given the fight against inflation has not yet been won. We expect SGD to move more in line with the Dollar.

Week ahead: Asian calendar features 3Q GDP for Singapore, industrial production for India and Malaysia, trade figures for China, Taiwan, India and Philippines, credit data for China, inflation report for China and India. Exports for China, Taiwan, India and Philippines are expected to remain in contraction this September amid softening global demand. China’s headline CPI inflation likely ticks up slightly, but stay struck near zero, while India’s headline CPI inflation is expected to fall back into the RBI’s target range.

FOREIGN INVESTORS CONTINUED TO SELL SHARES IN ASIAN MARKETS LAST WEEK

Sources: Bloomberg, MUFG GMR