More positive developments in China’s property market

FX views: The KRW outperformed regional currencies, strengthening 0.5% against the dollar on continuing foreign equity inflows in the week, followed by CNY, IDR, SGD and THB. The gain in the yuan was driven by the Chinese authorities’ efforts to boost the property market by cutting down payment and mortgage rates. The PBOC’s move to cut banks’ FX reserve ratio also helped to alleviate the yuan’s weakness. In contrast, VND underperformed Asian peers, while TWD, INR, MYR and PHP closed almost flat.

Week in review: Manufacturing PMI for China and Taiwan rose in August from their numbers in July, though remained in contraction; South Korea’s PMI fell deeper into contractionary territory this July; PMI for Philippines and Thailand dropped sharply to below the 50-mark; PMI for India and Indonesia rose further above the 50-mark. Exports for South Korea and Vietnam exports declined less than expected in August; Indonesia’s headline CPI inflation accelerated less than expected to 3.27%yoy in August from 3.08%yoy in July, while Vietnam’ headline CPI inflation rose far more than expected to 2.96%yoy in August from 2.06%yoy in July.

Central bank monitor: Bank Negara Malaysia is set to meet, and we think the central bank will keep its overnight policy rate (OPR) at 3% on cooling consumer prices. Meanwhile, signs of a weakening global economy likely keep the BNM to hold the OPR at 3% for the rest of the year.

Week ahead: Asian calendar features services PMI for China and India, exports data for China, Taiwan and Philippines, inflation data for Taiwan, South Korea, Philippines and Thailand. Amid softness in global demand, we see August exports for China and Taiwan are set to remain weak. Inflationary pressures are expected to re-accelerate slightly for Taiwan, South Korea and Thailand this August.

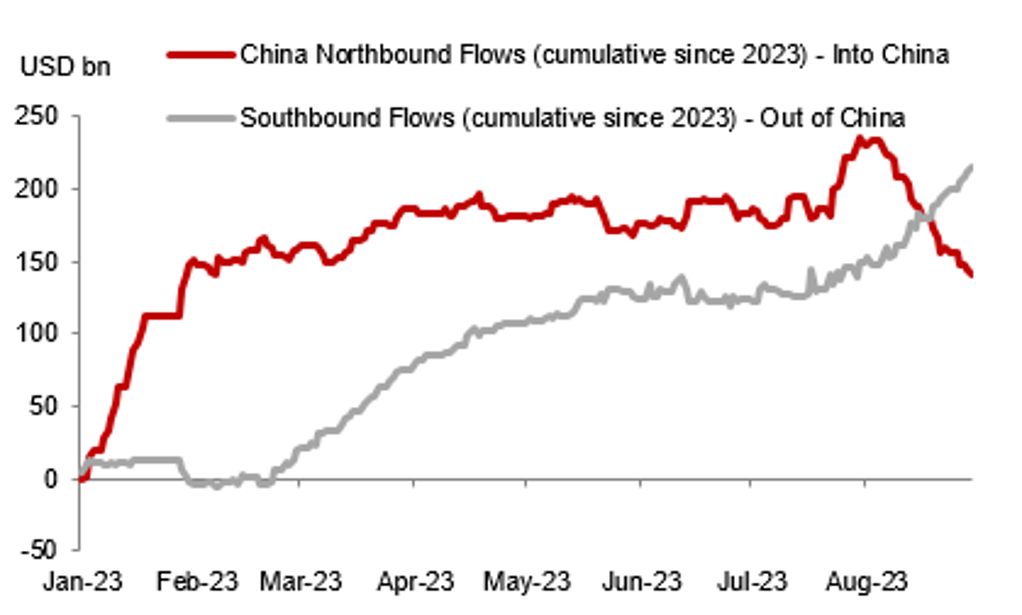

BOTH FOREIGN AND RESIDENT EQUTIY OUTFLOWS ACCELERATED OVER THE PAST MONTH IN CHINA

Sources: Bloomberg, MUFG GMR