China policies stimulate positiveness

FX views: FX markets were mixed in Asia amid a stronger dollar, where THB strengthened 1.1% against the US dollar, followed by CNY, KRW and MYR, which each up 0.5, 0.5% and 0.2% respectively, while TWD and IDR underperformed with a 0.5% loss. The appreciation of the CNY last week was due to improved sentiment and associated strong equity inflows. It is key to observe government’s follow-up in Politburo meeting on July 24th.

Week in review: Industrial production for Taiwan, South Korea and Singapore remained in contraction on a yearly basis amid softening overseas demand. Thailand’s logged a trade surplus of USD58 million in June, with market expecting a deficit of USD900 million. Singapore’s headline CPI inflation came in slightly higher than market consensus, though down from 5.1%yoy in May. In Malaysia, headline CPI inflation fell in line with market consensus to 2.4%yoy in June from 2.7%yoy in May.

Central bank monitor: The Bank of Japan started the path adjusting its YCC policy, while the target range for the 10yr JGB remains at +/-50bps but the fixed-rate operations moved to 1%. The Fed and ECB both hiked by 25bps as expected, with both central banks emphasising data dependence from here. Meanwhile, Bank Indonesia kept policy rates unchanged at 5.75%, but cut Reserve Ratio Requirements for banks lending to priority sectors.

Week ahead: For the week ahead, markets will focus on US non-farm payrolls, US ISM Manufacturing and Services PMIs, China’s official and Caixin PMIs, coupled with Eurozone’s inflation and GDP prints. Markets are expecting gradual moderation in US non-farm payrolls to 200k (from 209k previously), while for average hourly earnings to slow to 0.3%mom from 0.4%mom. China will release official NBS PMIs for July, and we expect manufacturing activity to contract, while the non-manufacturing sector likely remains in expansion, though at a slower pace given the weakness of domestic demand.

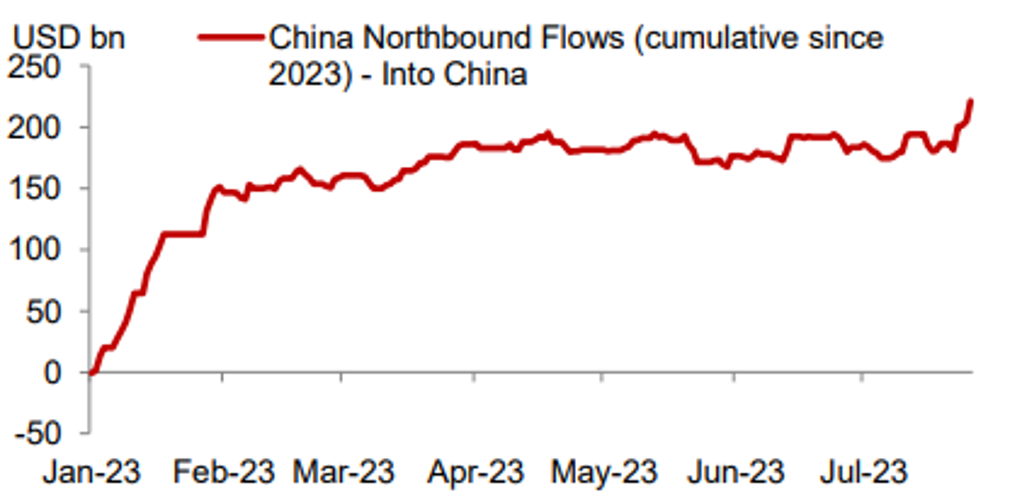

NORTHBOUND FLOWS INTO CHINESE EQUITY MARKETS SHOWING INTIIAL SIGNS OF PICKING UP

Sources: Bloomberg, MUFG GMR