Near term stress remains for KRW

Special focus: New tax rule, new patterns of income transfer and ODI, and portfolio inflows due to surging interest in AI supported KRW. However, the initial contribution that artificial Intelligence can bring to the semi-conductor industry will only be limited in near term, a sustained KRW appreciation is more likely to happen in medium term.

FX views: Most Asian currencies were marginally weaker on a 0.8% gain in dollar index. KRW underperformed regional peers, followed by THB, MYR and SGD. The CNY and TWD both had a depreciation. In contrast, PHP outperformed Asian FXs.

Week in review: Taiwan’s export orders fell 17.6%yoy in May after an 18.1%yoy in April, while Malaysia’s exports slid 0.7%yoy in May after a revised 17.6%yoy contraction in April. On the contrary, South Korea’s exports advanced 5.3%yoy in the first 20 days of June following a 16.1%yoy drop in the same period of May. Inflationary pressures continued to ease in Malaysia, with headline CPI inflation slowing more than expected to 2.8%yoy in May from 3.3%yoy in April.

Central bank monitor: Bank Indonesia and the Philippines central bank kept their policy rates on hold at 5.75% and 6.25% respectively. The post policy statement for BSP was unchanged, but with a slight trim to its inflation forecast for 2023.

Week ahead: China’s PMI numbers will be released on 30 June. In May, manufacturing PMI contracted with a 48.8 print. Non-manufacturing expanded with a 54.5 result. We forecast that Singapore’s industrial production may contract by 7.3% y/y in May, after a 6.9% decline in April.

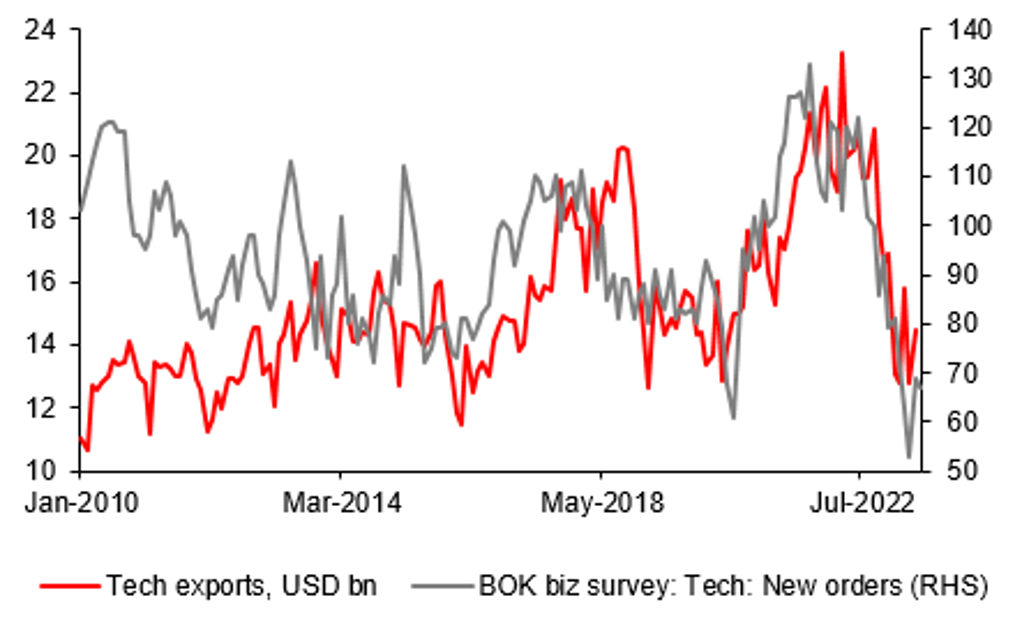

SOME IMRPOVEMENTS WERE SEEN IN SOUTH KOREA’S TECH EXPORTS

Sources: CEIC, MUFG GMR