Brighter spots for Singapore in 2023 – Food and beverage services

Special focus: Domestic-oriented services in Singapore are likely to continue normalising after the hit taken during the Covid-19 pandemic. We estimate that Singapore’s Food and Beverage services sector will possibly grow by around 10% in 2023, while retail sales will expand by around 5%.

FX views: Ahead of an important week packed with meetings from the Fed, ECB, and BOJ, coupled with key monthly datapoints out of China, Asian FX markets experienced divergent performance last week. KRW and IDR outperformed helped by resilient inflows, while MYR underperformed Asian FX pairs.

Week in review: China’s economic data disappointed, with both exports and inflation coming in lower than expected. Meanwhile, China’s largest banks said they lowered deposit rates. Exports for Taiwan and Philippines remained weak, while inflationary pressures continued to ease in Taiwan and Indonesia.

Central bank monitor: This week, we see a 50-50 chance that PBOC would cut China’s 1-year MLF rate. Meanwhile, Taiwan’s central bank will likely keep rates on hold.

Week ahead: The Fed, ECB and BOJ all announce their monetary policy decisions, with US May CPI also released just before the FOMC meeting. We expect the Fed to pause but leave the door open for further hikes. Meanwhile the ECB is likely to hike by 25bps but pare back hawkish messaging (see Global FX Weekly). China’s key monthly economic indicators will be closely watched. We expect industrial production to remain weak but offset by resilient retail sales.

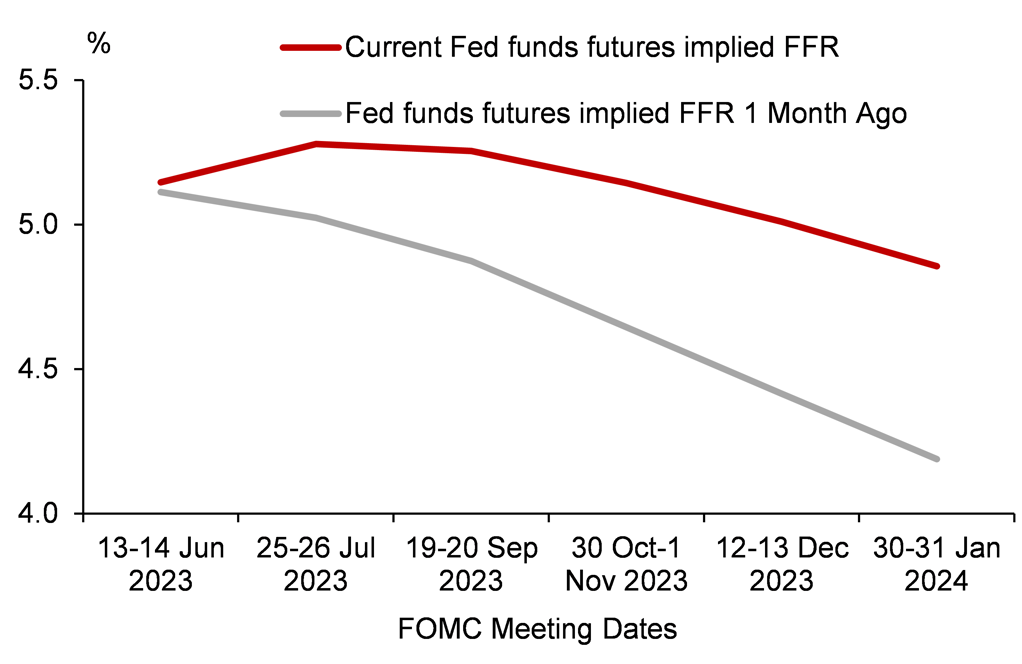

OVER THE PAST MONTH, THE MARKET HAS PRICED OUT THE BULK OF FED FUND RATE CUTS IT WAS EXPECTING

Sources: Bloomberg, MUFG GMR