Week Ahead FX outlook:

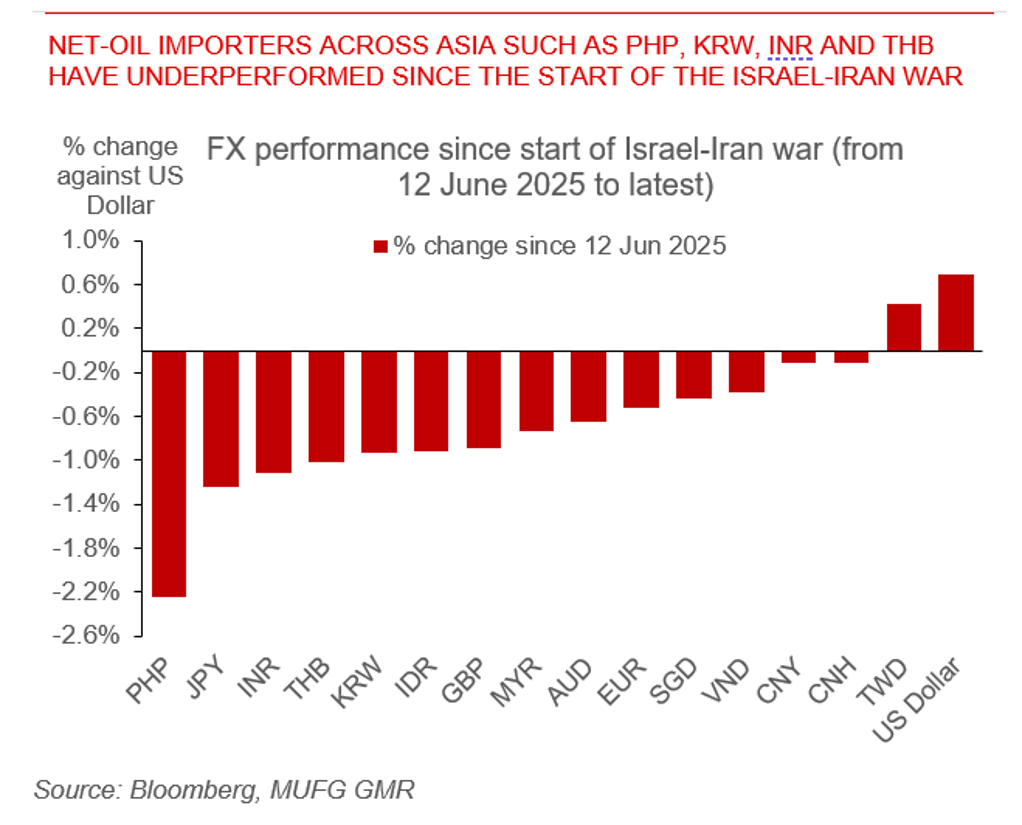

FX view: Since the start of the Israel-Iran war, the Philippines Peso, South Korea Won, and the Indian Rupee have underperformed amongst the key currencies we cover, while the Taiwan Dollar, and Chinese Yuan have outperformed at least so far. Meanwhile, across broader FX markets, G10 currencies such as the US Dollar, and EUR have outperformed to some extent, with the Dollar also supported near-term by a neutral tone from Fed Chair Powell earlier this week. This dispersion of outcomes thus far makes sense to our minds, with most of Asian economies outside of Malaysia net importers of oil and gas.

Moving forward, the key for oil and markets more broadly remains on three key elements. First, whether there are actual physical disruptions to global oil supplies including out of Iran. Second, whether the Strait of Hormuz is disrupted – a key chokepoint where a third of all seaborne oil and gas supplies go through. And lastly, the involvement of the US on the conflict. The good news thus far is that there have not been physical disruptions of global oil supply, and neither has there been signs of meaningful disruptions in the Strait of Hormuz. Nonetheless what has gotten markets jittery has been the possible participation of the US in military strikes against Iran, and what comes after that. Over here the recent announcement from US President Trump that the decision will be made over the next two weeks together with possible talks with Iran has led to some short-term bounce in risk assets, although uncertainty is still extremely high.

Looking ahead in Asia, markets will focus on the Bank of Thailand policy decision, coupled with PCE inflation data out of the US. We expect the BOT to keep rates on hold, but the tone from the Thai central bank is likely to be a dovish one. We maintain a cautious outlook on the Thai baht due to a confluence of fresh political troubles and external uncertainties. For now, markets have not priced in a significantly probability of domestic political risk in Thailand.

Net-oil importers across Asia such as PHP, KRW, INR and THB have underperformed since the start of the Israel-Iran war