Week Ahead FX outlook:

This week, Asia currencies strengthened on improving market sentiment on hopes for easing trade tensions, particularly on China Ministry of Commerce’s statement this Friday that China is evaluating the possibility of trade talks with the US. Earlier this week, President Trump eased tariffs on autos and auto parts, and several bilateral trade negotiations with the US have also appeared to make some progress, including that for Singapore, Malaysia, South Korea, and India. The Bloomberg Asia Dollar Index rose 1.35% this week, with broad-based gains across Asian currencies. TWD was the front-runner this week, rallying 3.7% against the US dollar this Friday (the largest one-day move in history) and a total 5.22% for the week. TWD was supported by the strong and better-than-expected 5.4%yoy Q1 GDP growth but not affected by the weaker April manufacturing PMI.

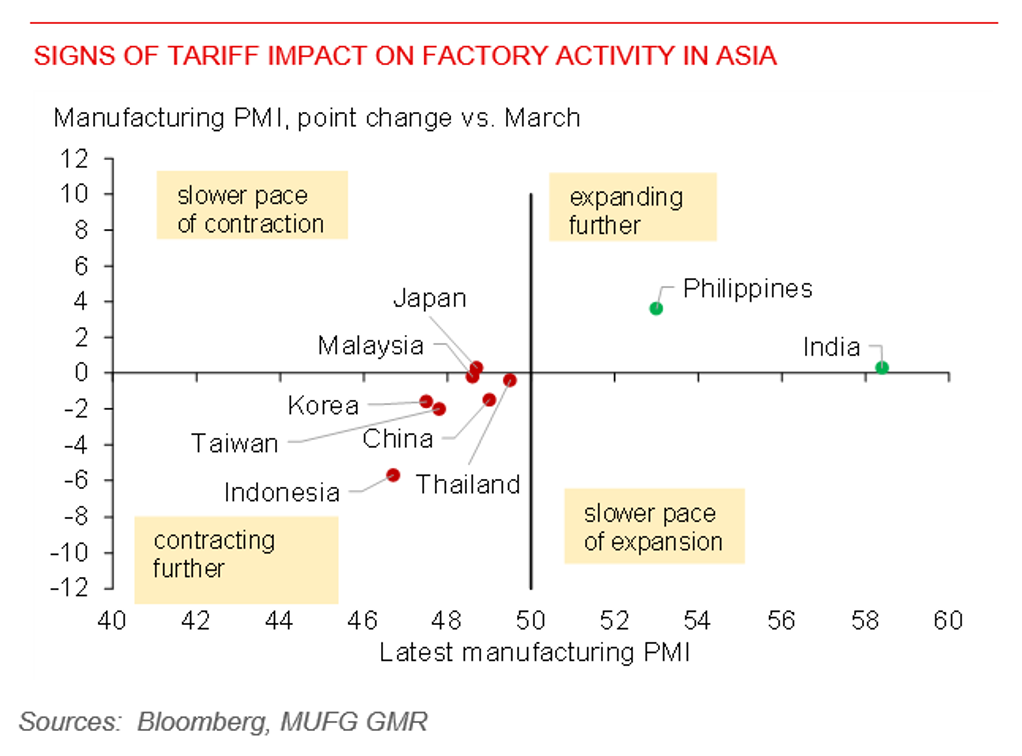

Asia FXs market behaved as if the tariffs uncertainty has already peaked. However, the path towards a deal is still far and bumpy, especially for the negotiation between US and China. China Ministry of Commerce’s statement also mentioned that “if the US wants to talk, it should show its sincerity and be prepared to correct its wrong practices and cancel unilateral tariffs”. Near term, we expect continued negative data releases on exports and other activity numbers. Poor April manufacturing PMIs across Asian economies (except Philippines and India) gave clear signs of negative impact of the tariffs on the economy. Still, the basis for a sustained rally for Asian currencies isn’t solid.

Next week, the FOMC meeting will be a focal point for markets. This comes after the release of nonfarm payrolls data later today. While we look for the Fed to stand pat in May, given uncertainty over tariff impact, a large negative surprise in the jobs data could still lead to a dovish Fed capping recent gains in the US dollar. Meanwhile, in Asia, the key highlights include Indonesia’s Q1 GDP, China’s trade data, and Singapore’s general election on 3 May.

Signs of tariff impact on factory activity in Asia