Week Ahead FX outlook:

Key FX views:

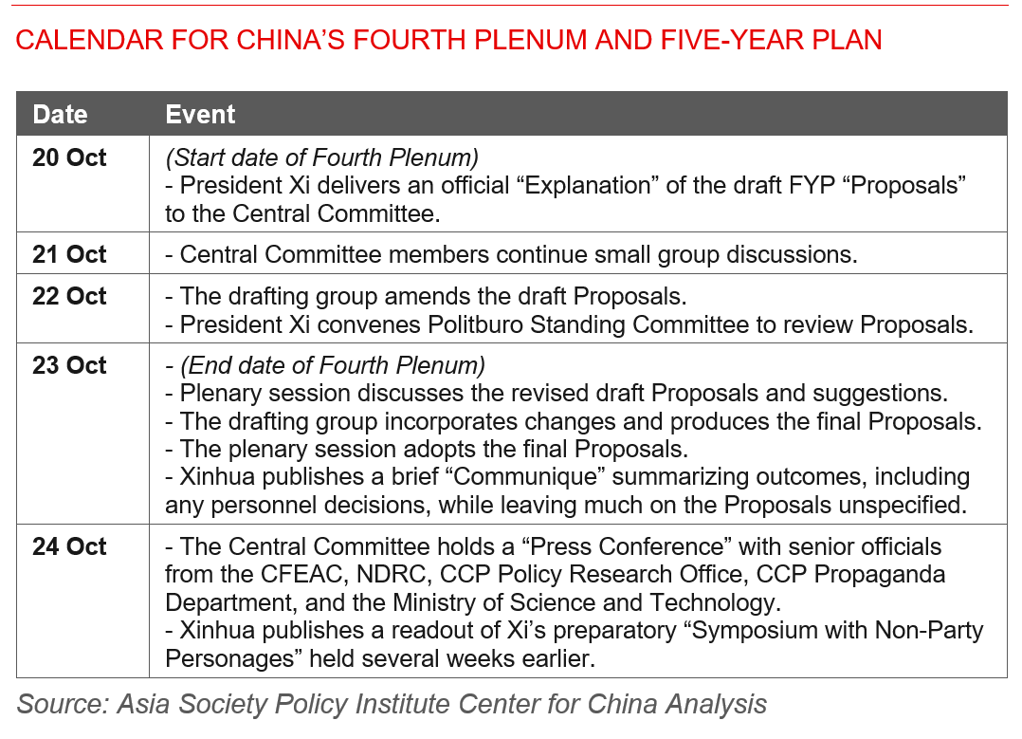

The upcoming week will bring important developments from Asia. In particular, China will hold its Fourth Plenary Session from 20 to 23 October. One of the main agenda items is the review of important economic plan, China’s 15th Five-Year Plan for the period 2026-2030. Usually, the Fifth Plenary Session is the main platform for reviewing medium- and long-term development plans. This Fourth Plenary Session focusing on economic issues ahead of usual schedule may indicate that the CPC attaches great focus to the current economic pressure. Next week, China will also release key macroeconomic data including its Q3 GDP and September monthly data. We expect some softening in growth of Q3 compared with Q2, and overall soft September macro data including property data. Market would watch for any signs from this high-level meeting for policy support and reforms for the Chinese economy. In particular, key focus areas for the markets could include any emphasis on China’s growth structure, various explicit targets, and industrial policies. This meeting happens right before the Apec Summit later this month and during the heightened tariffs tension between the US and China, we expect a comprehensive development strategy to ensure economic and technological growth amid ongoing challenges.

On the tariffs side, China’s recent expansion of export controls on rare earths and other critical minerals on 9 October were a meaningful move (see China significantly expands export controls and Trump threatens 100% tariffs). However, how it all started depends of course on whose perspective you look at, and the gulf in expectations between the US and China remains wide. From China’s perspective, the US has been imposing additional restrictions since the Madrid talks, indicating bad faith policy moves even in the midst of trade negotiations. From the US’ perspective, the export controls by China are seen as a meaningful escalation, which could among other things severely hamper the US interests. Our best sense is that both sides may still seek to de-escalate, but the path towards that destination could be long and arduous and full of pitfalls.

Calendar for China's Fourth Plenum and Five-Year Plan