Week Ahead FX outlook:

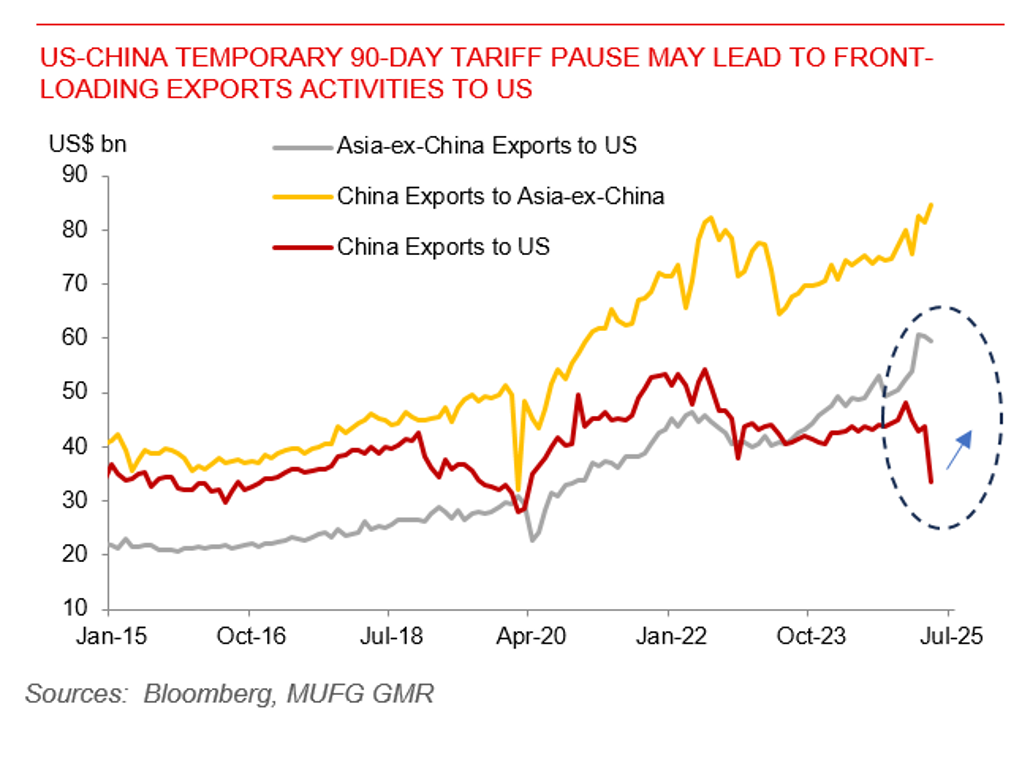

This Monday, an agreement between the US and China to lower tariffs was announced and helped to de-escalate the tensions in global market significantly. S&P 500 rose by 4.5% last week, and HSI rose by 2% and SHSZ300 index rose by 1%. Amid a net 0.3% strengthening of the US dollar (measured by the DXY index), Asian currencies strengthened against the Dollar, with CNY strengthening about 0.5%. The much lower temporary tariffs on China may give pressure for other Asian economies in negotiating tariffs so to remain advantageous in the global supply chain shift. Trump said today that he would set tariff rates for US trading partners “over the next two and three weeks”. Potential tariffs would likely move the market and CNY in near term. It is possible for some countries willing to make concessions to avoid a return to much higher tariff rates by reducing re-routing of Chinese goods. Trade negotiations between US and China could be challenging, especially on those non-tariff matters like market assess, exports and investment restrictions and etc.

In Asia, the balance of risks for central banks have shifted towards supporting growth. Inflation conditions and recent strength in Asian currencies have created policy space for regional central banks to cut rates. We look for Bank Indonesia to cut its policy rate in Q2, possibly as early as this month, given recent rupiah strength. The key highlights in Asia next week include China’s April activity indicators (retail sales, industrial production, and fixed asset investments), Thailand’s Q1 GDP growth, Singapore’s final Q1 GDP data, Bank Indonesia policy rate decision, Taiwan export orders, Thailand’s trade data, India PMI, and Singapore inflation. China’s activity data for April could show the economy being impacted by higher US tariffs and tariff related uncertainty.

US-China temporary 90-day tariff pause may lead to front-loading exports activities to US