Week Ahead FX outlook:

Key FX views:

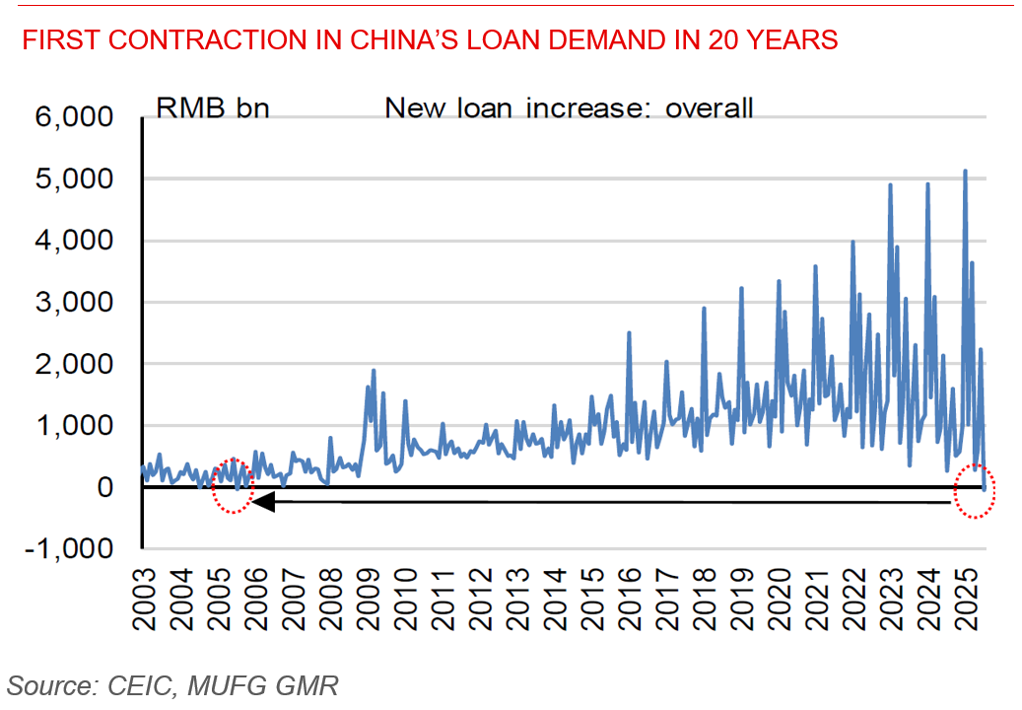

The past week was a mixed bag for Asian FX, with a generally weaker dollar given softer US CPI inflation helping to an extent, but offset partially by weaker than expected China macro data. The China numbers showed insufficient financing demand by both households and enterprises, with household loan stock declining for the first time in 20 years, while correspondingly July macro numbers surprised on the downside including retail sales, industrial production and fixed asset investment. We are forecasting the PBOC to cut rates through 2025 with only some incremental fiscal support in 4Q, as the negative impact of weaker exports and payback from prior exports front-loading start to bite.

Meanwhile, amidst continued uncertainty around the tariff rate that India will ultimately receive, we saw some good news. S&P upgraded India’s credit rating to BBB from BBB- with a stable outlook, placing India in the same category as countries such as Indonesia, Mexico and Greece. The credit rating upgrade resulted in a rally in India government bonds. On our end, while we generally agree with the logic of the credit rating upgrade, we are also left wondering “why now”? With the huge uncertainty of US tariffs hanging over India, we think that many commentators – S&P perhaps included – seem too sanguine on the longer-term impact on India’s growth prospects.

This is not to say that we disagree with the logic that a more domestic oriented economy provides meaningful cushion for India – we do. But as we argued in our recent report, what is far more impactful for India over the medium-term are the potential lost opportunities in terms of future manufacturing FDI arising from the tariffs, beyond just the gross goods exports exposure to US and the near-term growth hit (see India – Restore, Rebalance, and Reform?). On that front, we think it is a positive that Prime Minister Modi has talked about reforming the GST tax system and also setting up a panel to recommend and push through further reforms. Nonetheless, the details will be key here including on the impact to India’s long-term fiscal deficit trajectory from these changes.

First contraction in China's loan demand in 20 years