Week Ahead FX outlook:

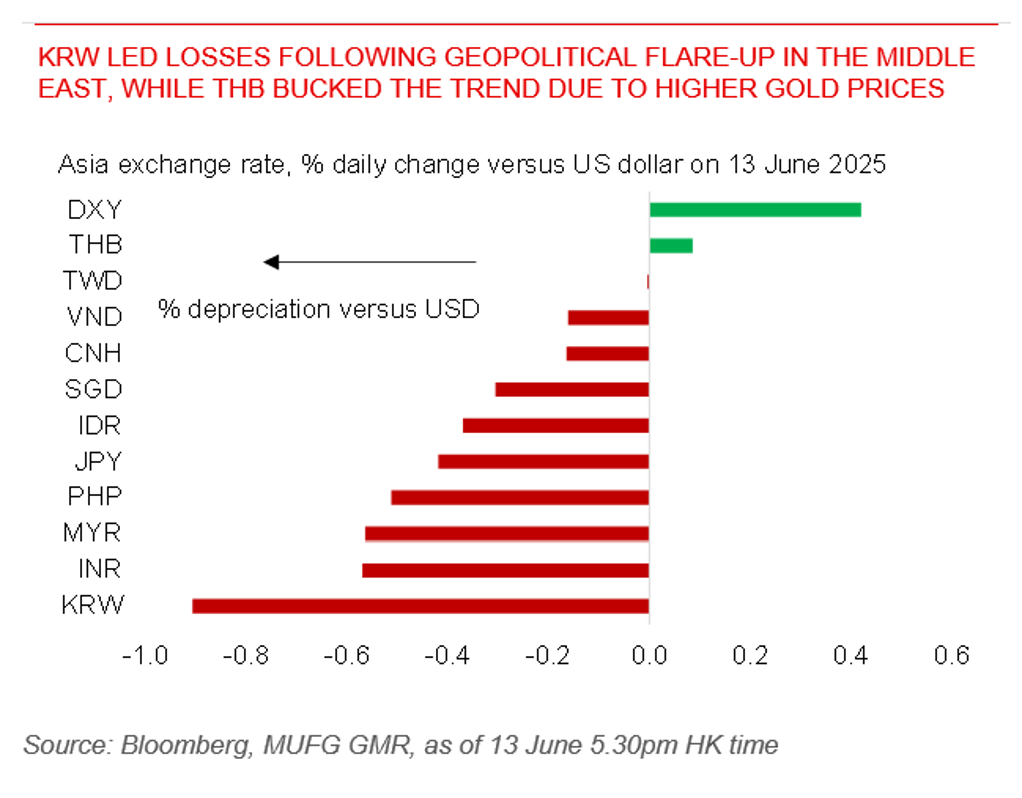

FX view: Geopolitical tensions have surged following Israel’s strike on Iran, driving oil prices up by as much as 10% and triggering broad global risk-off sentiment. Despite being under pressure for quite some time, the US dollar has caught a bid on safe-haven flows, while Asian currencies, particularly KRW, PHP, and INR, have weakened against the US dollar, given their sensitivity to risk and relatively higher reliance on oil imports. With Iran threatening retaliation, further escalation could keep Asian FX on the backfoot in the week ahead.

USD/CNY may face upward pressure next week amid muted optimism from the recent US-China London talks, which produced a framework for implementing the Geneva consensus but still require approval from both leaders. We also assess the outlook for the Indian rupee following Middle East turmoil. Rising geopolitical tensions have overshadowed positive inflation data from India, driving USDINR above the 86.00-level. Higher energy costs could weigh on India’s trade balance and stoke inflation. Nonetheless, India’s macro starting point is still stable, with inflation nearing 3%yoy and a modest current account deficit of 1% of GDP.

Separately, a flurry of central bank policy meetings next week will be closely watched, with scheduled policy rate decisions from the Fed, BoJ, BI, Taiwan’s central bank, and BSP. In this report, we have provided a preview of the upcoming Bank Indonesia policy meeting. We expect Bank Indonesia to keep its policy rate unchanged at 5.50% on 18 June, following a 25bps cut in May. Policymakers are expected to remain cautious amid escalating tensions in the Middle East. Middle East tensions could exert some upward pressure on USD/IDR, though sharp rupiah weakness looks unlikely, supported by foreign interests in its local government bonds.

KRW led losses following geopolitical flare-up in the Middle East, while THB bucked the trend due to higher gold prices