Week Ahead FX outlook:

Key FX views:

Asian currencies face a pivotal week ahead, with three major drivers likely to shape market direction. They include the FOMC meeting, China’s August economic activity data, and political uncertainty in Indonesia, Thailand, and Japan.

The FOMC is widely expected to cut rates by 25bps next week, given emerging signs of labour market weakness. Initial jobless claims jumped by 27k to 263k in the first week of September, the highest level in four years. This comes on top of the Bureau of Labor Statistics’ record downward revision of job growth by 911,000 for the period from March 2024 to March 2025. The key factor for markets will therefore lie in the Fed's messaging and the dot plot. A dovish shift in Fed's guidance could ease external pressures and support Asian currencies broadly. However, if the Fed signals a hawkish cut and emphasizes upside inflation risks, the dollar could rebound pressuring Asian FX.

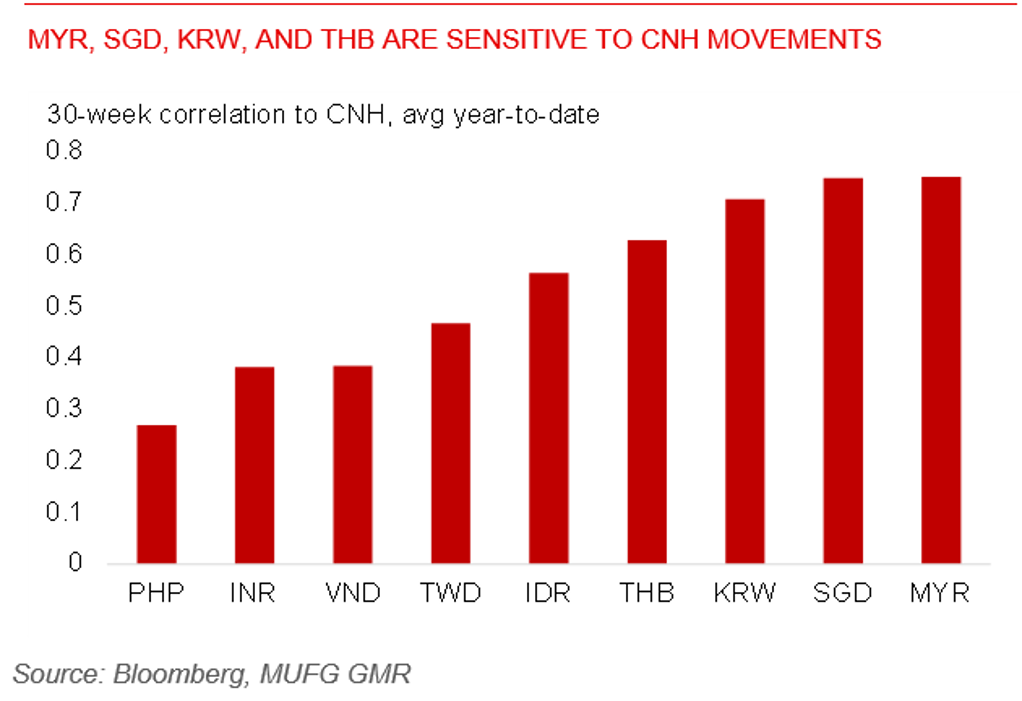

Meanwhile, China’s upcoming releases on retail sales, industrial production, and fixed asset investment could broadly support sentiment in the region. China’s improving credit impulse suggests a pickup in domestic economic activity, corroborating with market consensus for a modest improvement. Year-to-date correlations show that the MYR, SGD, KRW, and THB have been particularly aligned with the CNH, underscoring their sensitivity to CNY and China’s economic outlook.

However, there remains selective weakness in the rupiah and rupee. The rupiah has been weighed down by recent protests and a change in the finance minister, though Bank Indonesia's FX intervention and the government's increased fiscal support provide policy buffers. BI is likely to hold rates unchanged at 5.00% next week amid political challenges. Elsewhere, BOJ policy decision and Japan CPI are in focus, though political developments may continue to drag on the yen.

MYR, SGD, KRW, and THB are sensitive to CNH movements