Week Ahead FX outlook:

Key FX views:

During China's National Day and Mid-Autumn Festival Golden Week, the overall holiday spending remained subdued, with daily travel spending per person lower than the same period last year. Seems that the strong rally of A-share stock market before the holiday has little impact on spending. This week, the US government shutdown is still ongoing, with Republican and Democratic lawmakers making little progress on negotiations so far, and Trump threatening to use government shutdown to permanently cut government projects popular with Democrats. Releases of a list of US economic indicators were delayed by the US government shutdown. The US Department of Labour reportedly has recalled some employees to prepare the release of September CPI report scheduled on October 15th. Next week, major data releases also include China’s trade, CPI/PPI and liquidity data for September. It is likely to see a moderate improvement on China’s exports growth in September due to low base last year and pick-up in shipments to non-US markets. But September China inflation data likely still paints for a deflationary picture, consistent with recent subdued holiday consumption sentiment. China’s credit growth may slow too due to lower local government bond sales and weak demand for loans. For Singapore, we expect a slower expansion in GDP for the third quarter, which would lead MAS to maintain its monetary policy stance at the October meeting and keep the policy parameters of S$NEER unchanged, while signalling that it is ready to respond if growth conditions weaken sharply.

Some complications on US-China negotiation front. China announced it would tighten export controls on rare earths and other critical materials, and launches antitrust probe into US chip giant Qualcomm. Trump is raising pressure on China, by threatening exports restrictions to China in response. The US blacklisted more than 20 Chinese entities, individuals, and vessels for facilitating Iranian energy sales and transportation. Trump said he would discuss with Xi Jinping during their APEC summit to resume purchases of American soybeans among other things.

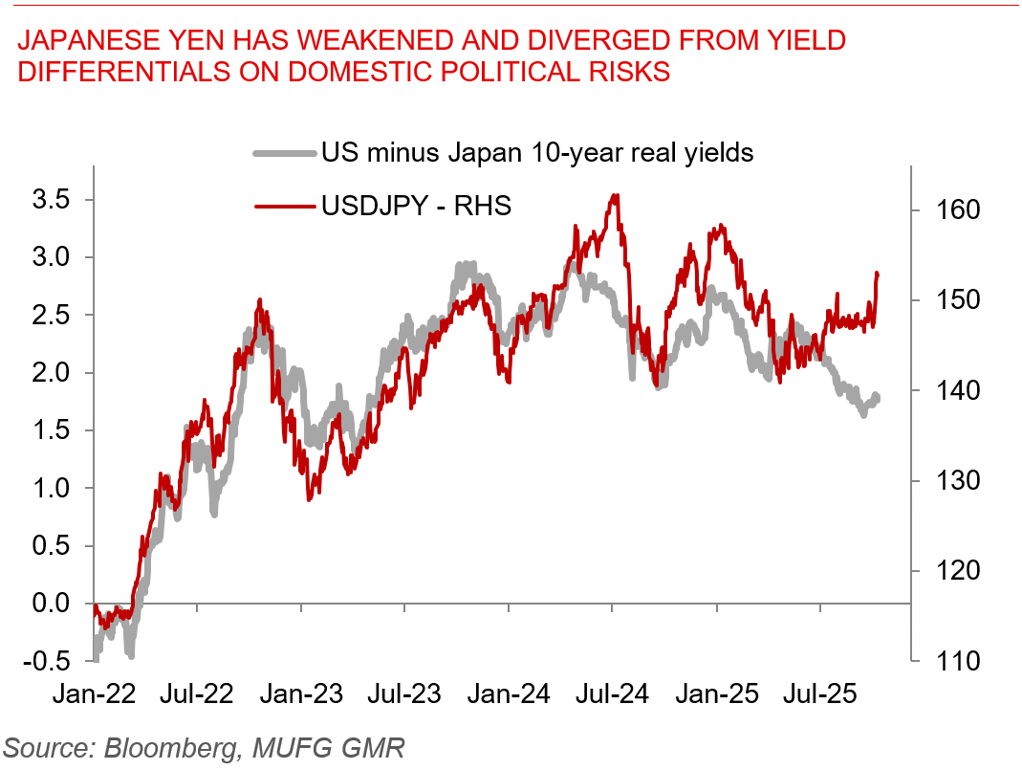

Japanese Yen has weakened and diverged from yield differentials on domestic political risks