Ahead Today

G3: US initial jobless claims, factory orders, durable goods orders

Asia: Hong Kong retail sales, Singapore PMI

Market Highlights

US ADP employment fell by 32,000 in September, after a revised decline of 3,000 (previously reported as +54,000) in August. The revision reflects ADP’s recent data adjustment. Nonetheless, the report aligns with a broader slowdown in hiring, with the hiring rate easing to 3.2% in August, the slowest pace since June 2024. The US ISM manufacturing index remained in contraction territory at 49.1 in September, albeit improving slightly from 48.7 in August. The employment sub-index rose to 45.3 from 43.8, but still reflects weak employment conditions in the manufacturing sector. This was partially offset by a drop in the new orders sub-index, which fell to 48.9 from 51.4, pointing to cooling demand. ISM prices paid eased to 61.9 from 63.7. Markets are fully pricing in a 25bps Fed rate cut in October and a cumulative 114bps of cuts through end 2026.

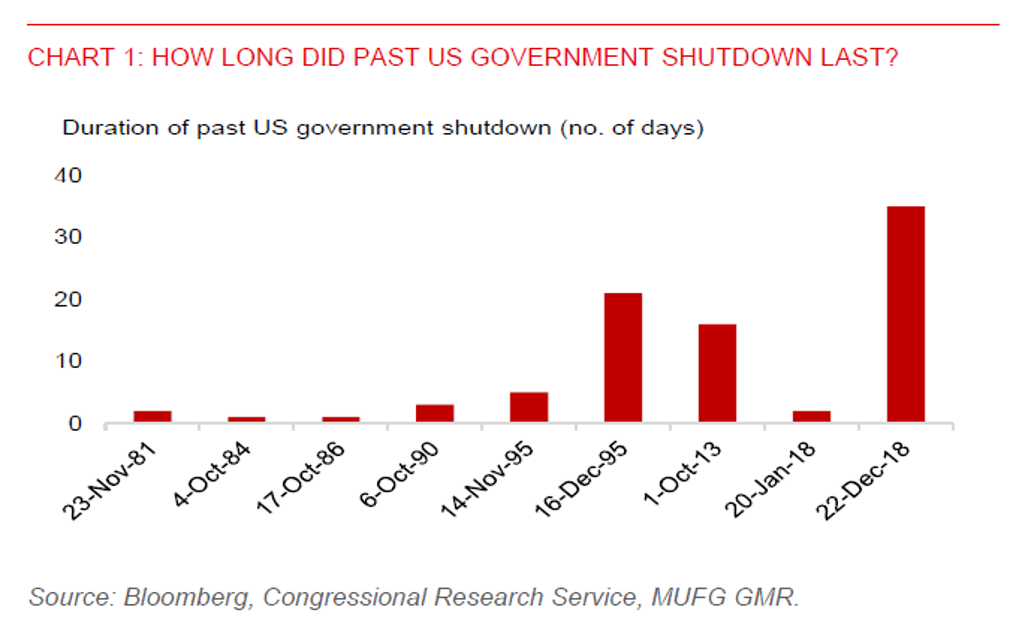

Meanwhile, gaps in federal funding have triggered a partial US government shutdown. The Trump administration is reportedly planning to lay off some federal workers, adding to uncertainty. The duration of the shutdown remains unclear, and the threat of mass layoffs could weigh on USD sentiment. The nonfarm payroll data, scheduled to be released this Friday, may be delayed. The last US government shutdown was during Trump’s first term in office, when it lasted for 35 days, the longest in four decades.

The Japanese yen extended its gains against the US dollar, appreciating by 0.6% yesterday and 1.6% over the past three days. The move likely reflects market reaction to the partial US government shutdown, which has modestly weighed on the US dollar. Other Asian currencies posted modest gains against the US dollar following the onset of the US government shutdown.

USDIDR has also pulled back in recent days, supported by USD weakness and a slight easing of sovereign risk. However, headline CPI rose 2.65%yoy in September, mainly driven by a 6.4%yoy rise in volatile food inflation. Core inflation and administered price inflation were relatively steady at 2.2%yoy and 1.1%yoy, respectively. Rising headline inflation and weak market sentiment suggest a continued downside bias for IDR.