Ahead Today

G3: US manufacturing PMI, ISM survey

Asia: China Caixin Manufacturing PMI, Indonesia inflation

Market Highlights

In a speech by Fed Chair Powell last Friday, he reiterated that there is no rush for rate cuts. He added that the latest inflation data is “pretty much in line with their expectations”. Core PCE inflation rose 0.3%mom (2.8%yoy) in February, from 0.5%mom (2.9%yoy) in January. Meanwhile, the US economy remains resilient, with initial jobless claims steadying at 210k in the week ending 23 March. The University of Michigan sentiment survey showed consumer confidence picked up in March. And US Q4 2023 GDP was revised up by 0.2ppt to 3.4%qoq annualized. US manufacturing PMI will be out later today, and we expect it to show factory activity expanded in March for the fourth straight month.

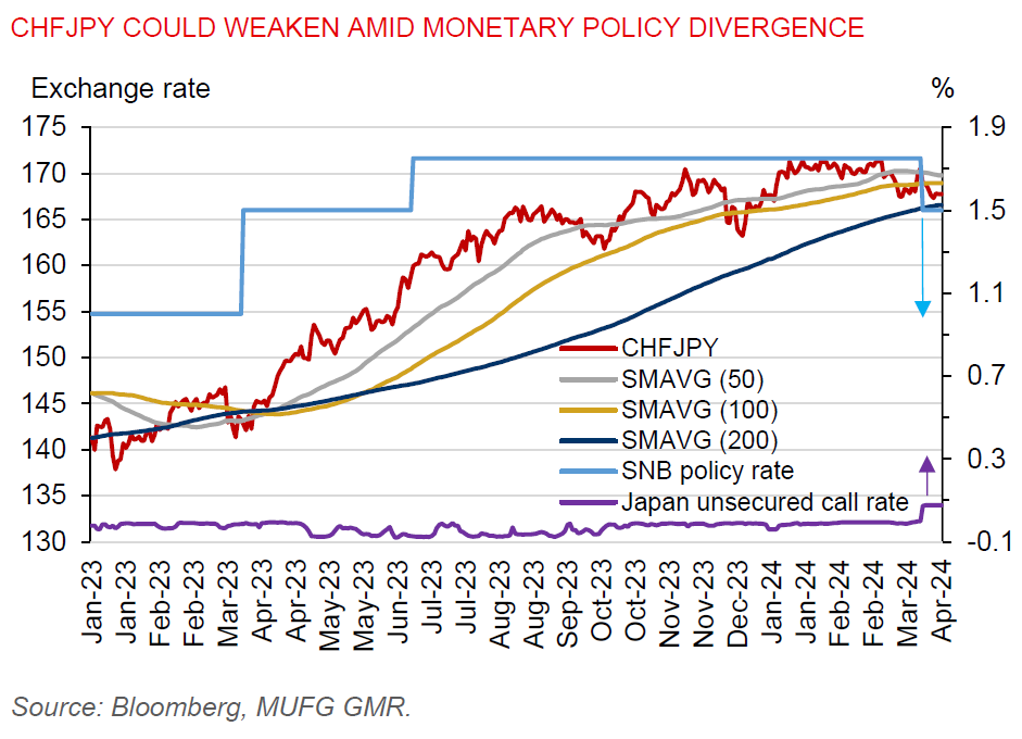

The Swiss Franc-yen pair could weaken and break the 200-day moving average. The Swiss National Bank cut interest rates by 25bp in March to 1.5%, and markets are pricing for 2 more 25bps cut this year. Meanwhile, the BOJ has exited its negative interest rate policy, and markets are pricing for another 20bps rate hike this year. There’s scope for markets to shift short exposures from the yen to the Swiss Franc to fund carry trades.

Meanwhile, US 10-year yields remained elevated at 4.2%, the US dollar index stayed firm at 104.5, while Brent prices were at US$87.5/barrel.

Regional FX

USD/Asia pair broadly held on to its gains in a short trading week last week, with KRW (-0.7%) and IDR (-0.5%) underperforming other regional currencies. Offshore Chinese yuan has retreated from its recent low point of 7.2761 versus the US dollar to trade at 7.2572, following a slightly stronger daily onshore yuan fixing. China’s factory activity expanded for the first time in March since September 2023, with the manufacturing PMI rising to 50.8 (>50 indicates expansion). This may be a sign that China’s economy is stabilizing. South Korea’s exports rose 3.1%yoy in March (missing Bloomberg consensus for 4.2% growth), though sequential momentum appeared to be slowing.