Ahead Today

G3: US Non-Farm Payrolls

Asia: RBI Policy, Taiwan Exports

Market Highlights

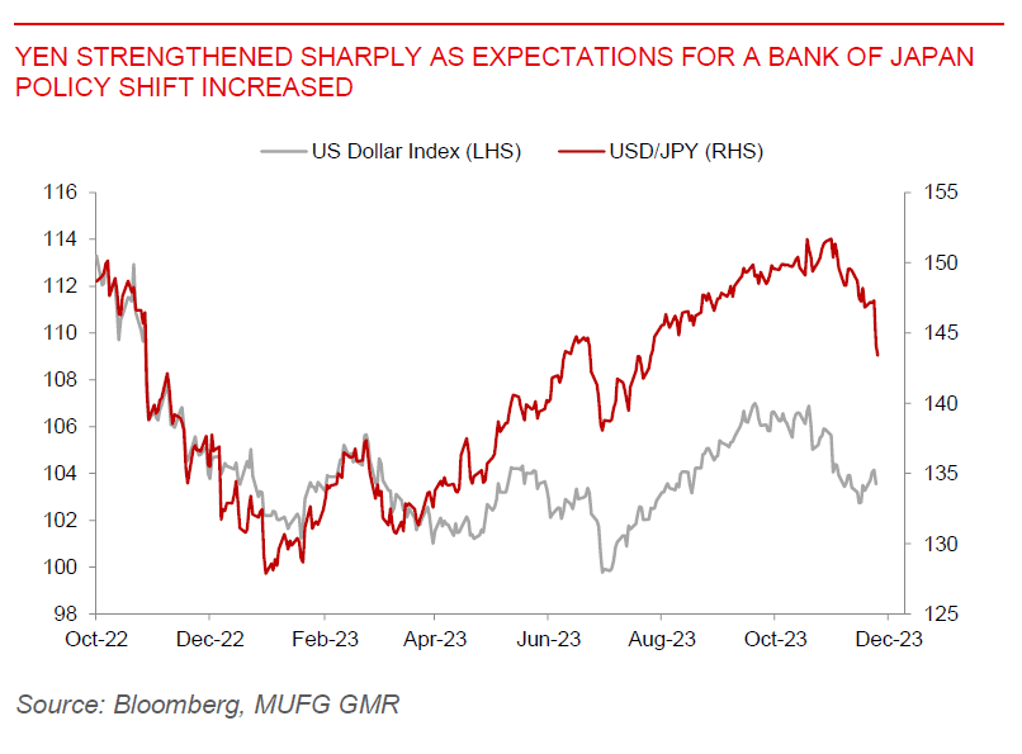

The Japanese Yen strengthened sharply by more than 2% to 144.1, at one point reaching 142, as markets priced in an increasing probability that the Bank of Japan will remove its negative interest rate policy as soon as this month’s meeting. In his testimony to parliament, Bank of Japan Governor Kazuo Ueda said that handling monetary policy “will get tougher from year-end and through next year”, while saying that BOJ will work to “properly communicate and conduct appropriate policy”. Meanwhile Governor Ueda discussed the state of Japan’s economy with Prime Minister Fumio Kishida, but declined to discuss the details.

Markets will focus on US non-farm payrolls and labour market data out later today. The consensus is expecting some small bounce in payrolls and earnings, but any signs of further rebalancing of the US labour market could reinforce expectations of Fed rate cuts in 2024.

Overall, US 10-year yields remain contained at 4.15%, risk assets such as S&P500 was up by 0.8%, while the Dollar was weaker by 0.6% led by JPY strength.

Regional FX

Asian FX pairs were generally stronger against the Dollar on the back of USD weakness and JPY strength, with KRW strengthening by 0.9% in particular. China’s exports improved by more than expected to 0.5%yoy from -6.4%yoy previously, and in line with some regional improvement in exports. Meanwhile, China’s imports were weak at -0.6%yoy, highlighting continued concerns about the strength of domestic demand. We will have the Reserve Bank of India’s policy decision today. We expect RBI to keep rates on hold at 6.5%, but maintain a hawkish tone and to signal a bias towards keeping liquidity conditions tight. Meanwhile, Taiwan releases its exports for November, which will be interesting to see if regional improvement in exports continues.