Ahead Today

G3: US Non-Farm Payrolls

Asia: Taiwan Exports, Philippines Bank Lending

Market Highlights

It was a day of comments from the Trifecta of global central banks – the Fed, the ECB and BOJ. In particular, Fed Chair Powell suggested the central bank is getting close to the confidence it needs to start lowering rates in his semi-annual testimony to Congress, but also emphasized the central bank needs more evidence on inflation moving towards its target of 2%. Across the Atlantic, President Christine Lagarde signalled that the ECB may be in a position to lower interest rates in June, when they will likely get more information on wages to decide on the path of rates.

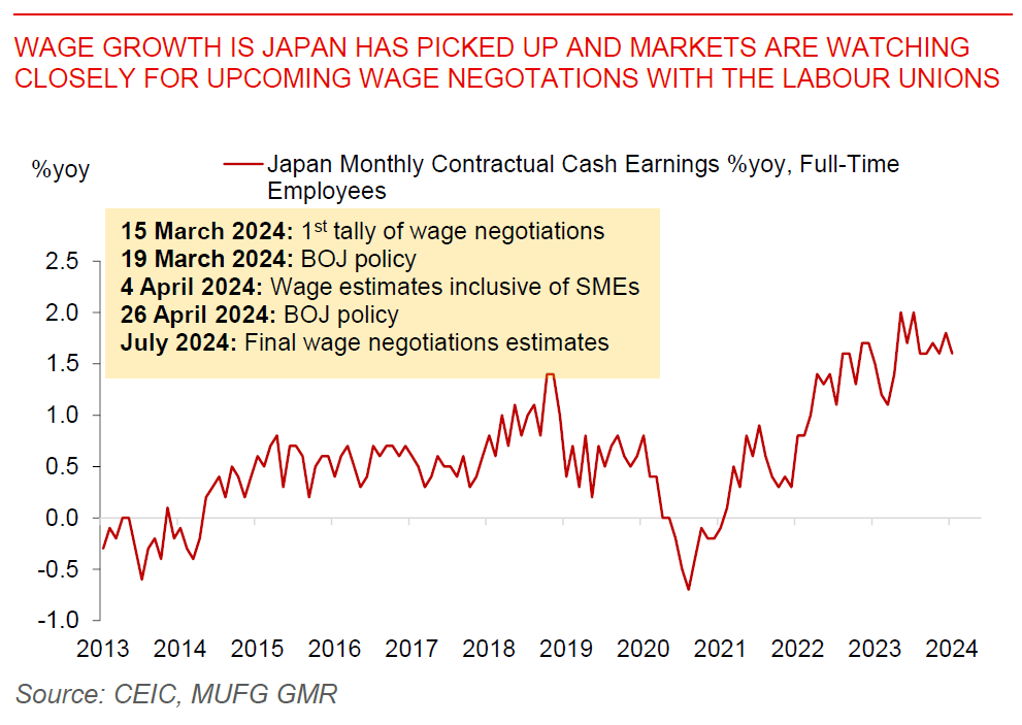

Bank of Japan Board member Junko Nakagawa – who is viewed as a more dovish member of the BOJ – said that officials are getting more confident over the strength of wage growth, and that there are clear shifts in businesses’ behaviour for setting wages. On the back of these comments, Rengo, the Japanese Trade Union Confederation, released data showing an average pay hike demand of 5.85%, the highest in 30 years, and stronger than the 4.5% demand seen last year. The actual preliminary results of the wage negotiations will be out on 15 March, and ahead of the Bank of Japan meeting on 19 March, and the OIS markets have now built in a 70% probability of rate hike in the March meeting, from just 41% earlier this week.

The combination of these moves resulted in sharp market volatility, first in USDJPY declining close to 2 big figures to 147.64, and next with EURUSD also rising 0.5% to 1.0954. US 10-year yields fell to 4.08%, while US and European equity markets soared by more than 1%. Nonetheless, there is certainly a key event risk later with the non-farm payrolls data out today.

Regional FX

Asian FX markets traded stronger against the Dollar on the back of the broader market moves, with KRW (+0.5%) and MYR (+0.48%) outperforming. China’s exports grew by a stronger than expected 7.1%yoy (vs consensus of 1.9%yoy), providing some evidence of global growth improvement and also in line with the export data we are seeing across the region such as in Korea, Taiwan and Vietnam. Meanwhile, Bank Negara Malaysia kept policy rates on hold at 3%, kept a balanced tone, while also saying that the ringgit is currently undervalued given Malaysia’s economic fundamentals and growth prospects. We continue to expect BNM to keep rates on hold through 2024.