Ahead Today

G3: US 1Q GDP, US Initial Jobless Claims

Asia: Bank of Korea

Market Highlights

The US Court of International Trade has blocked President Trump’s Liberation Day Tariffs implemented under the International Emergency Economic Powers Act (IEEPA). It ruled that the global tariffs exceeded Trump’s authority under the emergency law, while also ruled that the tariffs hitting the likes of Mexico and Canada on drug trafficking were illegal as they do not address the trafficking problem. The Trump administration has filed a notice of appeal with the US Trade Court, where it is very likely to go not just to the Court of Appeal but likely up to the US Supreme Court.

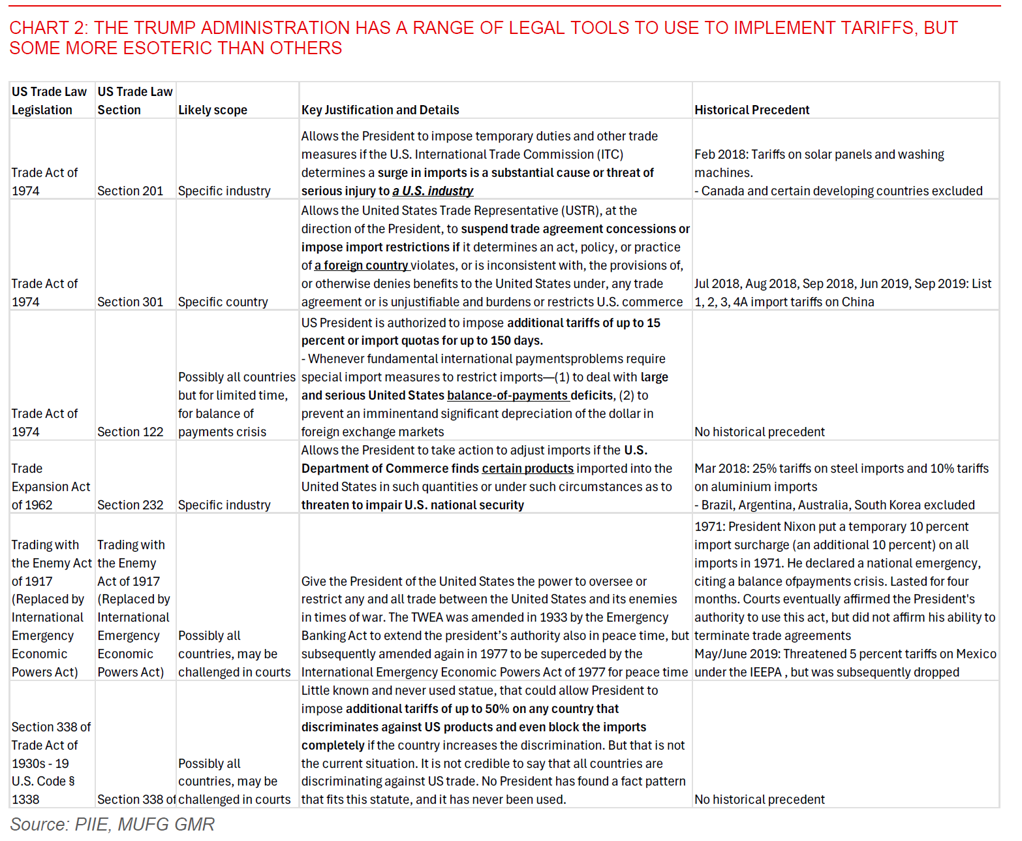

There were massive moves in markets on the back of this news, with the Dollar strengthening, risk sentiment improving, while safe haven assets such as gold and JPY underperforming. Asian currencies were also generally weaker against the Dollar mirroring the global DXY shifts, but not as weak as the likes of JPY. Meanwhile, markets priced out some Fed fund rate cuts with the front end of the US rates curve selling off and some slight flattening pressures on the US yield curve.

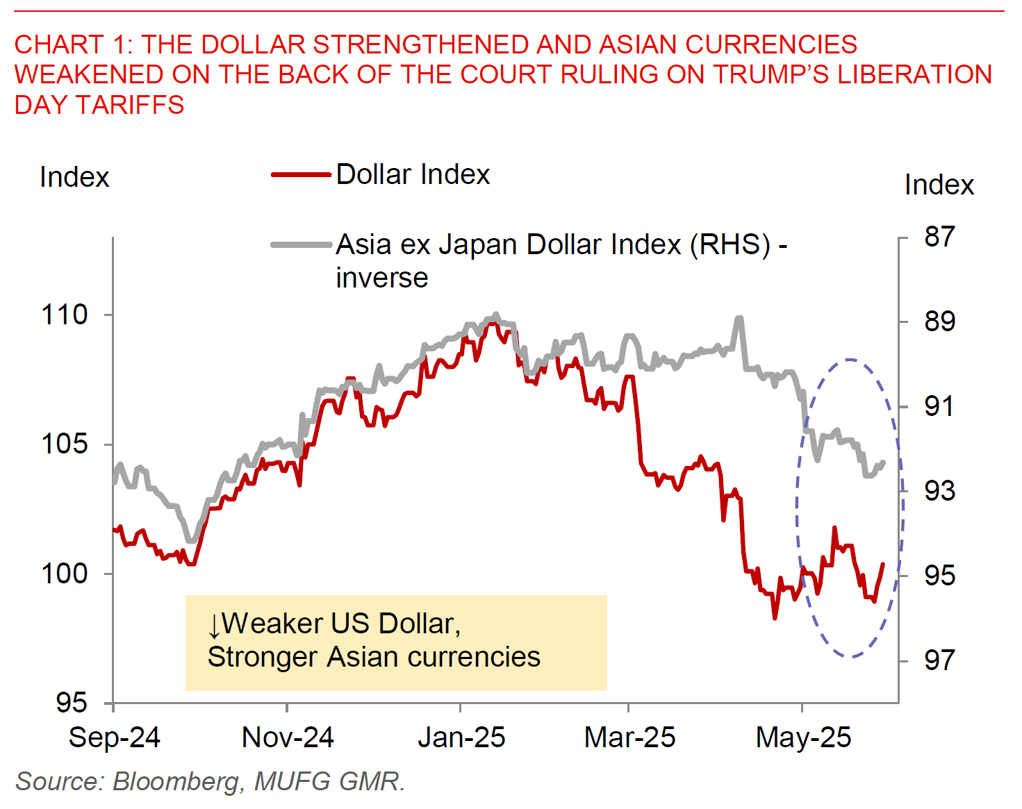

As with markets, the question is always what next. First, we think tariffs will likely still be in force during the appeals process, with the Trump administration likely to take the appeals process all the way up to the Supreme Court. Second, this also means that there will likely be a meaningful period of legal uncertainty, and the length of which is unclear. Third, beyond the IEEPA, Trump does have some additional legal authority that he could use to implement his tariffs, although with pros and cons for each. For instance, with the Section 232 and 301 tariffs, this would require an investigation by the US Trade Representative, but the upside is that the legal authority and precedent is much clearer. There are some other more esoteric legal rules such as Section 338 of the 1930 Trade Act which has never been used before historically, but would allow additional tariffs of up to 50% on any country that discriminates against US products. How to justify discrimination is another potential legal quagmire, and all of which will likely lead as such to extended period of uncertainty.

Our best sense right now for Asia FX markets is that the knee jerk reaction seen today in Asian currencies weakening and Dollar strengthening may not last. The crucial reasons are that the tariffs on Asia are likely to stay amidst the legal battle, coupled with the legal uncertainty also potentially crimping US growth and investment plans further. Nonetheless, these are early days and we’ll have to see how the appeal process develops from here.