Ahead Today

G3: Germany industrial production

Asia: China Exports and Imports

Market Highlights

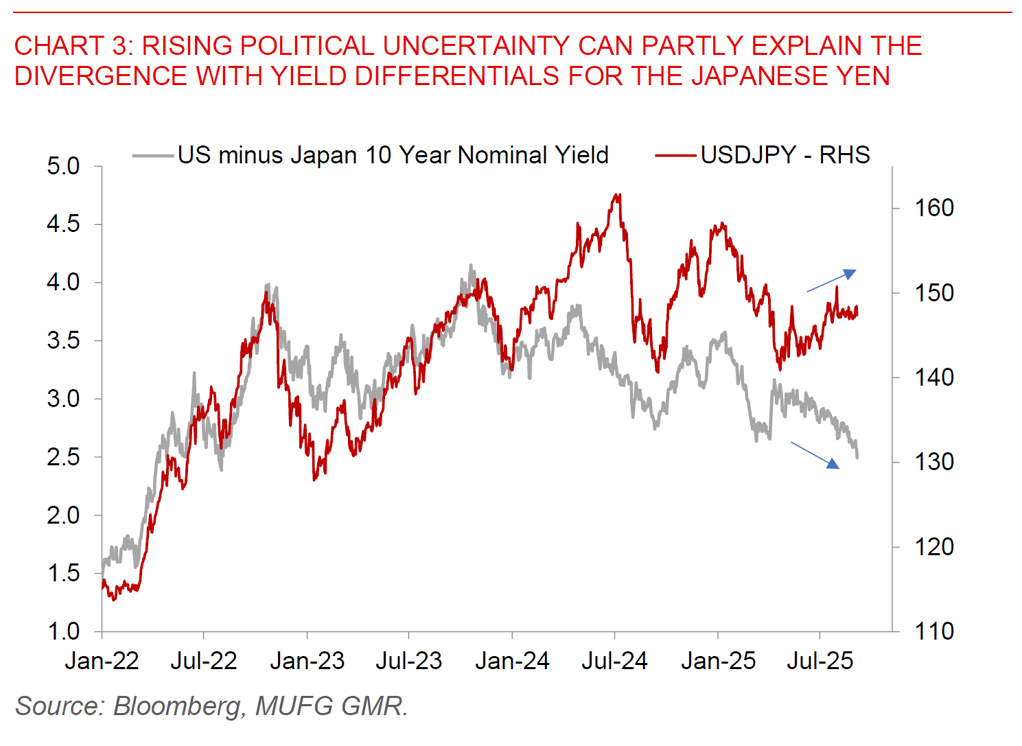

A combination of weak US labour market data coupled with rising political uncertainty in Japan dominated global markets as we started the week in Asia. In particular, US non-farm payrolls rose just 22,000 in August, meaningfully disappointing consensus expectations for a 77k rise, with downward revisions resulting in a contraction for June’s non-farm payrolls. Outside of some specific services sectors such as education, health and leisure, most other sectors including tariff-sensitive ones such as manufacturing saw negative employment growth, with the unemployment rate ticking up to 4.3% from 4.2% previously, led by rising unemployment among youths. It’s important to point out the multitude of other factors at play as well, including tighter immigration policies lowering labour supply (and not just demand), potentially some impact from AI affecting younger and entry-level workers, and perhaps a more unequal distribution of economic gains amidst the surge in the technology capex cycle. Nonetheless, the magnitude of these downside surprises likely go beyond what these factors may explain, and as such raises the risk of much sharper slowdown in the US labour market and economic activity moving forward absent policy support.

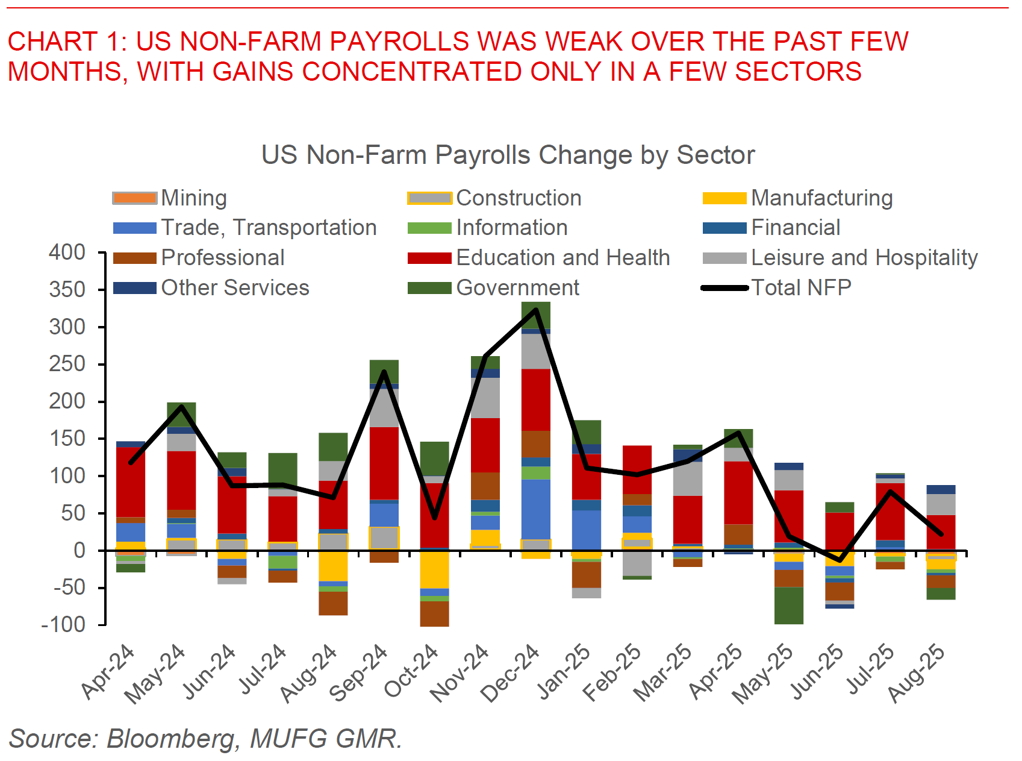

The market responded accordingly, with the Fed Fund futures market now pricing for the Fed to cut rates below 3% by end-2026, with a 25bps cut in September more than fully priced (in other words an outside chance of a 50bps Fed rate cut in the September meeting).

All these also fed through to FX and other asset classes, with the US Dollar softening by 0.6%. In particular, EUR/USD rose above 1.17, USD/CNH fell below the 7.13 handle, while gold prices surged further above the US$3,580/ounce level. The next key catalysts to watch for this week would be the upcoming benchmark Quarterly Census of Employment and Wages (QCEW) labour market revisions on 9 Sep coupled with US CPI data on 11 Sep.

For Asia FX and rates markets, rising expectations of Fed rate cuts and with that lower US yields should be a welcome development to some extent providing some breathing space and policy room for Asian central banks. Nonetheless, the key risk for Asian currencies would also lie in a sharp US slowdown and hard-landing recession through sharply slower exports to the US, which we stress is not our base case. Our modal forecasts are as such still for Asian FX to strengthen against the dollar but underperform G10 currencies through our forecast horizon, with our preference towards outperformance for the likes of MYR and IDR, and underperformance for INR and VND reflecting both domestic factors and also the dispersion of tariff outcomes.

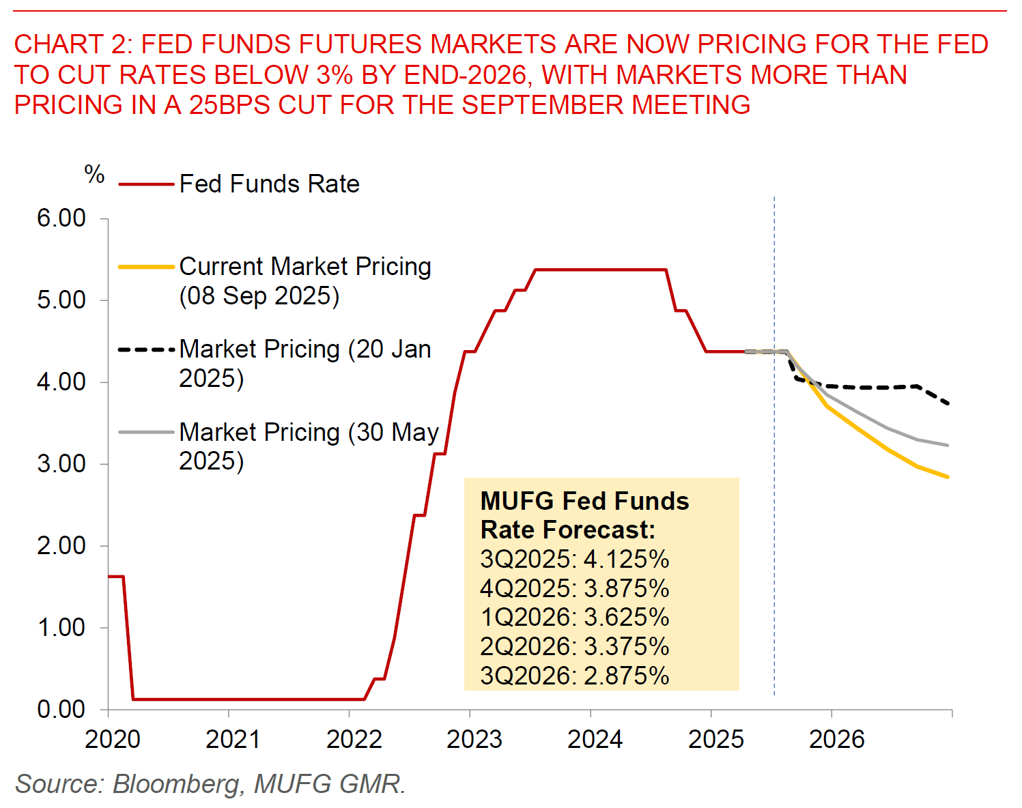

Last but not least, Japan political uncertainty is also an important risk for Asia, not least due to the anchor role the Japanese Yen plays from a currency perspective across Asia.

On that note, Japanese Prime Minister Shigeru Ishiba announced on Sunday, 7 September that he will step down. The ruling LDP was set to hold a vote on Monday on expediting a leadership election that was threatening to turn into a vote of no confidence in PM Ishiba. This will now be turned into a leadership race for the LDP over the coming weeks. While the ruling LDP party does not have a majority in the lower and upper house, the most likely scenario for now is still for the LDP to be able to elect its Prime Minister candidate through Parliament, given that the opposition is relatively fragmented for now.

Nonetheless, the key for the Japanese Yen is that uncertainty has risen up a notch for three key reasons, and as such JPY could underperform in the near-term. First, the leader taking over Prime Minister Ishiba will matter in terms of policy direction, with Sanae Takaichi seen as the most negative for JPY due to her support for loose monetary policy and stimulus, while Agriculture Minister Shinjiro Koizumi perceived as more of a reformist with appeal to a younger generation. Second, the Bank of Japan could also delay its timing of rate hikes until it gains better clarity on the policy direction, of course depending on how long the leadership election takes place. Third and lastly, there could also be a left-tail risk of a general election being called, even if this is not the base-case scenario.