Ahead Today

G3: US mortgage applications, eurozone consumer confidence

Asia: Singapore CPI, Taiwan industrial production

Market Highlights

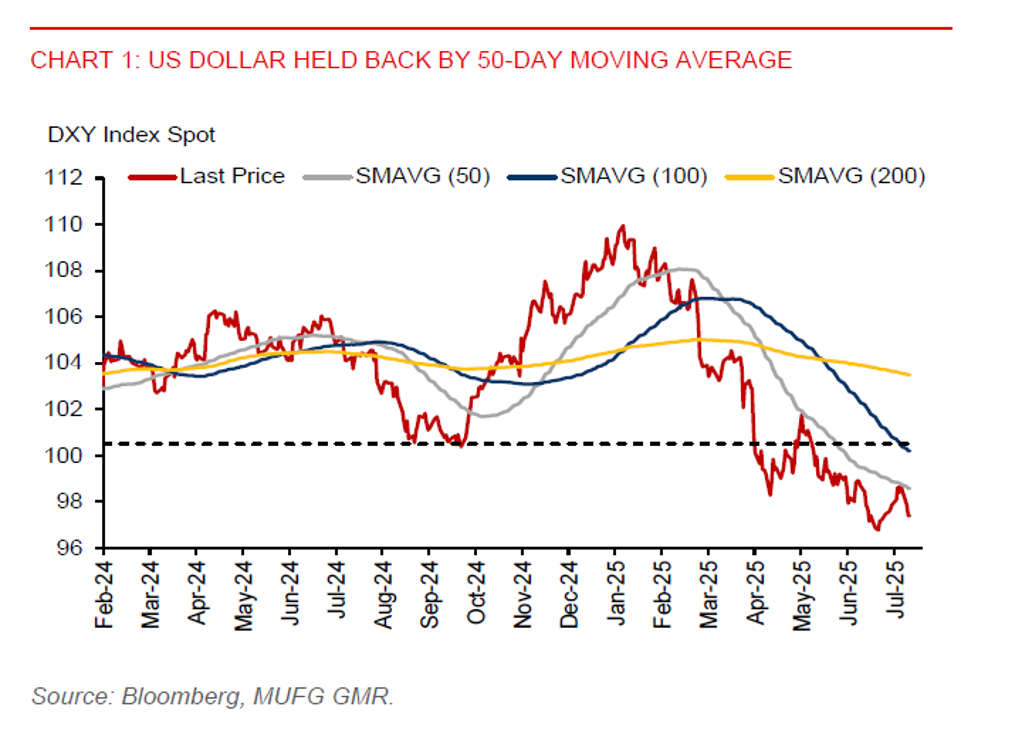

The recent rise in the US dollar index (DXY) has been relatively modest, and the US dollar could continue to trend broadly lower amid ongoing policy uncertainty. DXY fell 0.4% yesterday, following a 0.6% decline on Monday, underscoring the US dollar’s vulnerability.

Political pressure on the Fed remains a concern. President Trump has previously floated the idea of removing Fed Chair Powell, raising questions about the Fed’s autonomy. While US Treasury Secretary Scott Bessent recently stated that there is currently no reason for Powell to step down, this inconsistent messaging from the Trump administration only adds to the uncertainty. Coupled with market expectations for Fed rate cuts in the coming months, the US dollar’s appeal has been undercut. That said, markets appear to remain skeptical about Powell’s removal. Prediction market Polymarket currently indicates 81% probability that Powell will stay in his role this year.

On trade, the scheduled rollout of reciprocal tariff on 1 August looms large. In the absence of new US trade deals, there’s a risk that tariff levels could revert to the steeper rates announced during US Liberation Day in April. This uncertainty is weighing on the US dollar. Trump has reportedly said that smaller countries will be assigned a blanket tariff rate of between 10%-15%.

For Japan, a trade deal with the US has been reached. The US will lower the tariff rate on Japanese imports to 15%, while Japan will invest $550 billion in the US. NHK also reported that the US will set tariffs at 15% on Japanese auto imports too. This will help to lessen the negative impact of tariffs on Japan's broader economy, particularly at a time when the ruling coalition government has recently lost its majority in the upper house election. Market expectations for a potential BoJ rate hike in response to the trade deal could lend support to the Japanese yen, although near-term political uncertainty may temper investor sentiment.

Regional FX

There remains limited impetus for markets to price in tariff risks on Asian currencies at this stage. As seen previously with the Trump administration, the rollout of reciprocal tariffs has already been delayed with a 90-day pause since April, and the upcoming 1 August deadline may prove similarly flexible. US Treasury Secretary Bessent is scheduled to meet China officials for a third round of trade talks, likely aimed at postponing the 12 August tariff rollout deadline on China. Against this backdrop of USD weakness, Asian currencies will broadly be supported, though country-specific factors could shape their relative performance.

Thai baht – resilient despite political headwinds

For the Thai baht, it has remained resilient against the US dollar, despite political troubles. There could also be market optimism regarding a US trade deal that could lower the 36% reciprocal tariff rate. Thailand has proposed to increase the purchase of US products and boost investments in US, while 90% of US goods will have duty-free access to the Thai market. Meanwhile, the Thai cabinet has endorsed the appointment of Vitai – a rate-cut advocate - as the new Bank of Thailand governor. He was previously the president of the Government Savings Bank. We expect 2 more rate cuts in H2, but that may not necessarily drag on THB significantly, especially if the Fed also cut rates twice as what markets currently anticipate.

Malaysian ringgit – consolidation amid resilient macro fundamentals

While there will be near-term pressure on the ringgit due to tariff uncertainty, Malaysia’s economic fundamentals remain supportive. Demand for its local government bonds remain healthy, inflation was subdued at 1.1%yoy in June, tourist arrivals rose 20%yoy in January-May period, while the government is seeking lower US tariff rate of around 20%, aligning more closely with the region.