Ahead Today

G3: Germany factory orders, France industrial production

Asia: Philippines CPI, Singapore retail sales, Thailand foreign reserves

Market Highlights

The US dollar gained by 0.4% in yesterday’s session, briefly supported by stronger than expected US jobs data and an unwinding of some dovish bets. Nonfarm payrolls rose by 147,000 in June, surpassing market expectations of 106,000 and improving from an upwardly revised 144,000 in May. The unemployment rate also edged down to 4.1% from 4.2%, beating market expectations for a rise to 4.3%. This decline was driven by job gains, while the labour force participation rate remained steady at 62.3%. Average hourly earnings increased by 0.2%mom, representing a 3.7%yoy rise, which was still robust but slightly below the 3.8%yoy recorded in May.

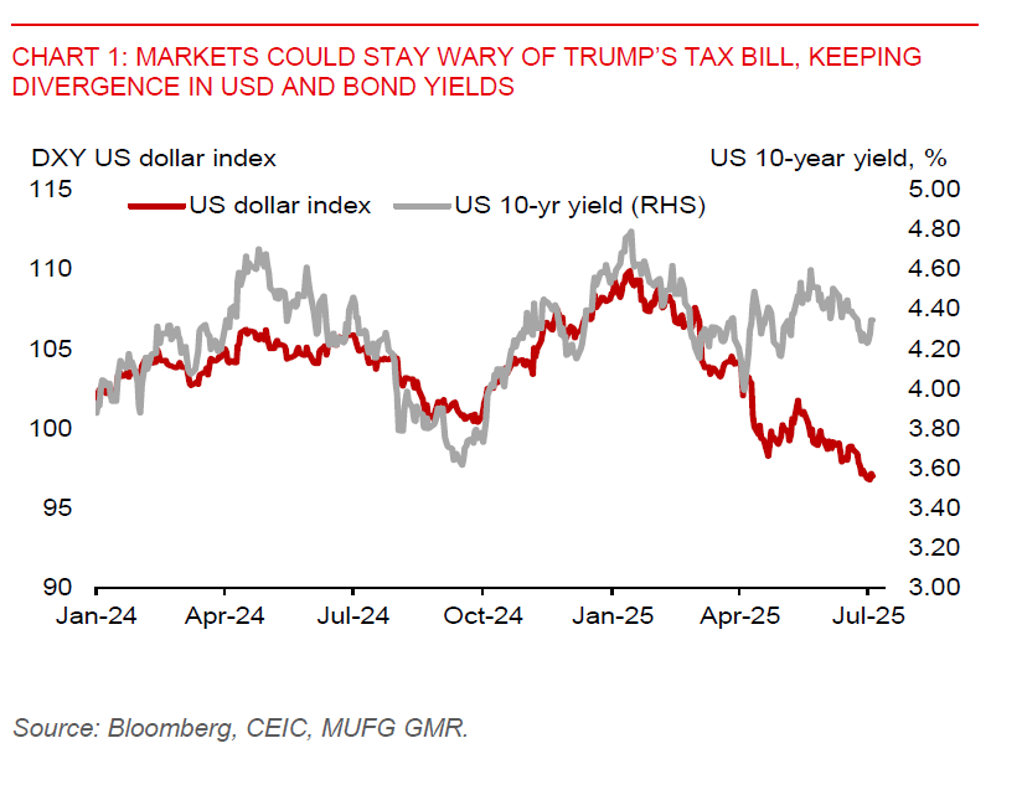

However, markets could stay wary about an unsustainable rise in the federal debt. Trump secured the passage of Trump’s one big beautiful bill worth $3.4 trillion, which was approved by the House with a 218-214 vote, so he will be able to sign the bill today. This could continue to weigh on the USD and long-term Treasuries. The fiscal package will extend tax cuts, scale back Medicaid, phase out clean-energy tax breaks, and remove a $7,500 consumer tax credit for electric vehicles after 30 September.

Meanwhile, US Treasury Secretary Scott Bessent has downplayed concerns that the US dollar’s decline will threaten its reserve currency status, asserting that CNY and euro won’t replace the US dollar as the world reserve currency. He has also said that the EURUSD at 1.2000-level would be “too strong”.

Regional FX

Asian currencies may face renewed volatility as markets turn their attention to tariff related developments. Notably, the KRW – often used as a proxy hedge for global risk sentiment - fell 0.6% against the US dollar in yesterday’s session. The risk of higher US reciprocal tariff looms on 9 July, with a breakthrough in US-Korea trade talks remaining slim for now. The South Korean government plans to request for an extension of the tariff pause. Meanwhile, the South Korean parliament amended a law aimed at protecting the rights of minority shareholders, as part of measures to help boost the equity market.

Meanwhile, with the HKD remaining at the weak end of the 7.75-7.85 trading band, HKMA’s intervention efforts will have to persist. Funding costs are still low, keeping the carry trade attractive.