Ahead Today

G3: US S&P Manufacturing PMI, Eurozone PMI, US Existing Home Sales

Asia: US S&P Manufacturing PMI, Eurozone PMI, US Existing Home Sales

Market Highlights

Over the weekend, the US military struck Iran’s three main nuclear sites, bringing the Israel-Iran conflict to a potentially more dangerous phase. US President Trump threatened a further military response if Iran retaliated, while Iran’s foreign minister said that Iran reserves all options to defend its sovereignty, interest, and people.

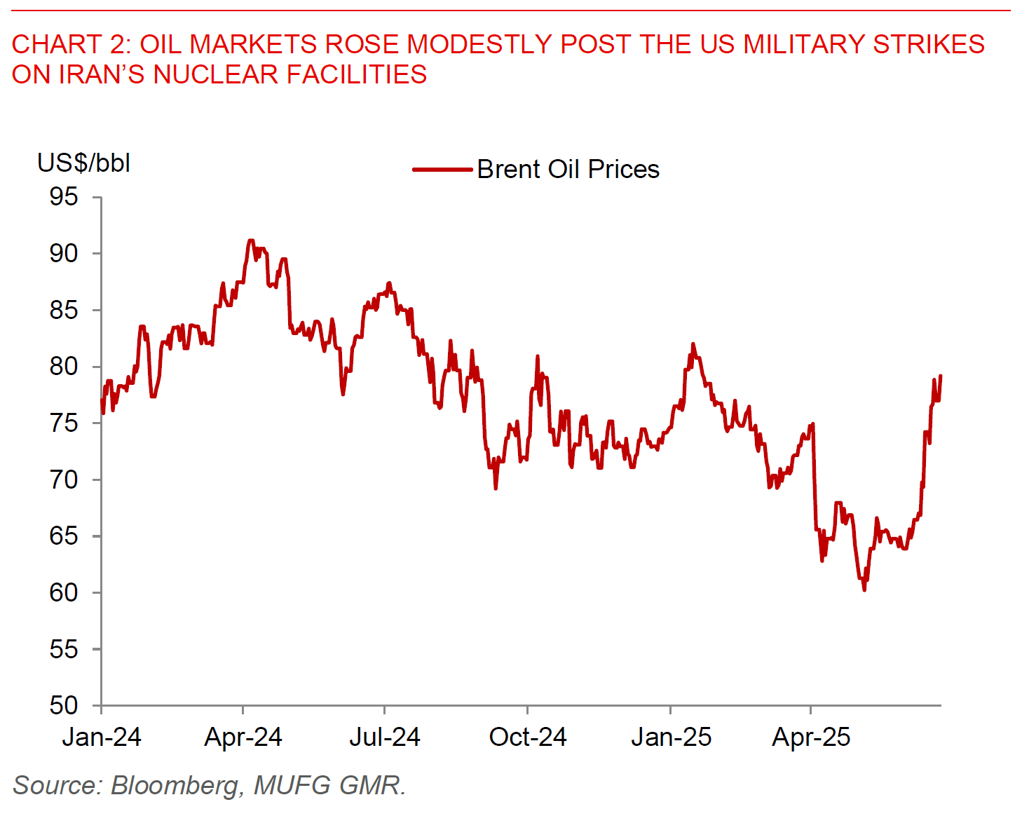

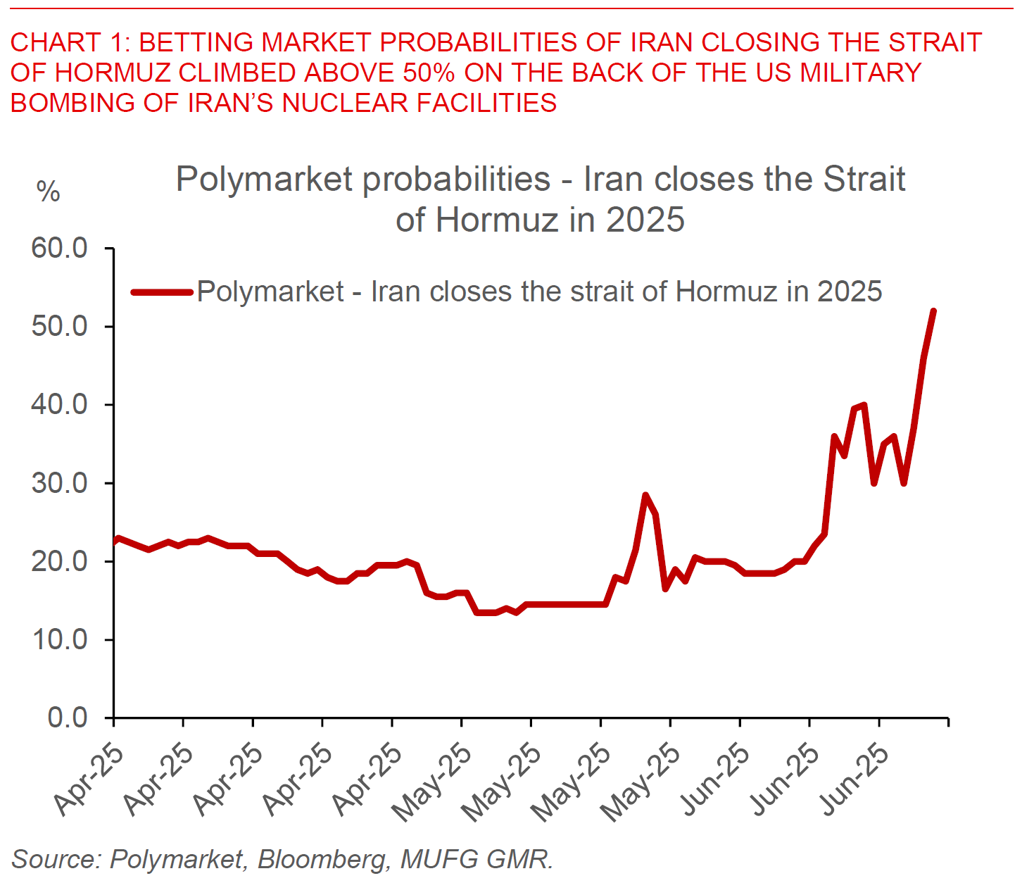

The next steps for markets will depend on how and to what extent Iran responds, and with that the extent of physical oil supply disruption. The left tail risk here is a full closure of the Strait of Hormuz – a key chokepoint where a fifth of all oil and gas production goes through. For what it’s worth, betting market probabilities on a Strait of Hormuz closure by Iran climbed above 50%, an event that if fulfilled will no doubt easily send oil prices spiralling above US$100/bbl. Nonetheless, it’s important to stress that there are many shades of grey in terms of scenarios, and to our minds, managed escalation is probably more likely, with Iran possibly responding through a variety of means but certainly falling short of meaningful disruption of global oil supplies.

Regional FX

The market response for what it’s worth as Asia opened was reasonably modest, with Brent oil prices rising above US$79/bbl on Monday morning from US$77/bbl last Friday. Meanwhile, the US dollar was stronger by 0.35%, with Asian currencies generally weaker. The South Korean won and Thai Baht underperformed, weakening by 0.6%, while the Indian Rupee 1 month NDF softened by 0.3%. Meanwhile, the likes of CNH and to some extent SGD were more resilient. While we do not know how exactly the Israel-Iran conflict will play out from here, we just published a report providing a sensitivity analysis to help provide a gauge on potential winners and losers across our region if oil prices were to rise further (see Asia: The impact of oil price shock on Asia FX – a scenario analysis). Our analysis shows that PHP, KRW and THB are more vulnerable in Asia from an FX perspective to further sharp spikes in oil prices. INR is also relatively more vulnerable with a current account deficit closer to 2% of GDP together with relatively higher economic linkages to the Middle East. Meanwhile, the likes of MYR, IDR and TWD should be more resilient. We think the impact on CNY is likely to be minimal. While we will likely adjust our FX forecasts for the likes of INR and PHP weaker given this external shock, given how FX levels in both currencies have already moved weaker, the risks for both currencies could be more two-sided now even as we continue to acknowledge the significant uncertainty in the next steps of the Israel-Iran war.