Ahead Today

G3: US mortgage applications, Germany CPI

Asia: India wholesale prices

Market Highlights

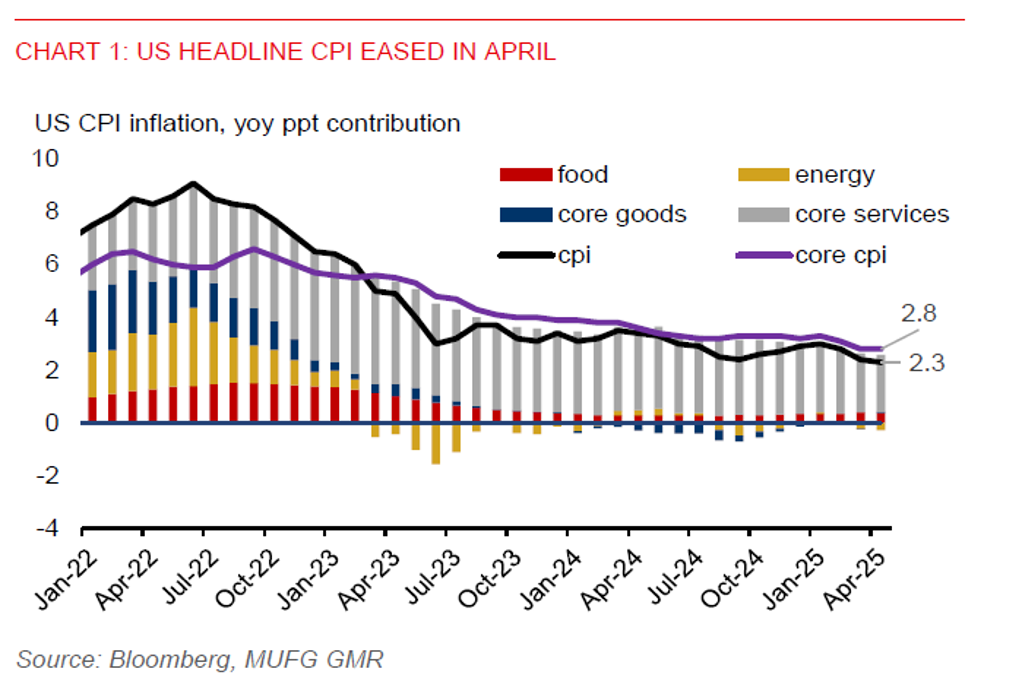

President Trump’s import tariffs are widely expected to push up inflation in the US. But the impact on US inflation from tariffs has largely not shown up in the April CPI report. Companies may still be working through the large inventories that were stocked up ahead of tariffs, allowing them to not raise prices yet. And with the US temporarily lowering tariffs on most goods from China to 30% for the next 90 days, from 145% previously, it likely suggests a milder pickup in US inflation in the coming months.

US CPI inflation slowed to 2.3%yoy in April, from 2.4%yoy in March. This was lower than market expectation of 2.4%yoy. Core CPI inflation (ex-food and energy) was unchanged at 2.8%yoy in April. Lower food, energy, and core services inflation had contributed to a further moderation in the year-on-year headline inflation. And on a sequential basis, US headline CPI rose 0.2%mom, from -0.1%mom, below Bloomberg consensus of +0.3%mom. Core CPI also rose 0.2%mom, from +0.1%mom, below Bloomberg consensus of +0.3%mom.

The swap market now priced in only about 53bps of easing this year, implying 2 Fed rate cuts, with the first rate cut fully priced in for September. However, the 2-year US treasury bond pared back its gains, after yields fell by as much as 6bps at one point yesterday.

Regional FX

Asian currencies broadly weakened against the US dollar in Tuesday’s session, with THB (-0.6%), PHP (-0.6%), and TWD (-0.5%) leading losses in the region. However, the SGD gained 0.4% versus the US dollar, on the back of a 0.8% decline in the broad US dollar index (DXY). The drop in DXY follows from a 1.4% gain in the prior day.

India has surprisingly planned to suspend trade concessions on some US goods to retaliate against US tariffs on steel and aluminium imports, despite being in trade talks with the US. This could suggest that India’s trade talks with the US may have hit a snag. So, while other Asian countries have also been engaging with the US on trade, the road ahead may still be bumpy. And there’s still a risk that the region could face a higher tariff rate than today following the end of the 90-day reciprocal tariff pause on 9 July.

Meanwhile, India CPI rose 3.2%yoy in April, marking the slowest pace of increase since mid-2019, staying below the RBI’s 4% target. This implies room for the RBI to continue its policy easing. Meanwhile, markets may have taken off some geopolitical risk premium on the rupee following the ceasefire with Pakistan, with rupee volatility easing.