Ahead Today

G3: US mortgage applications, Germany CPI

Asia: BoT policy rate decision

Market Highlights

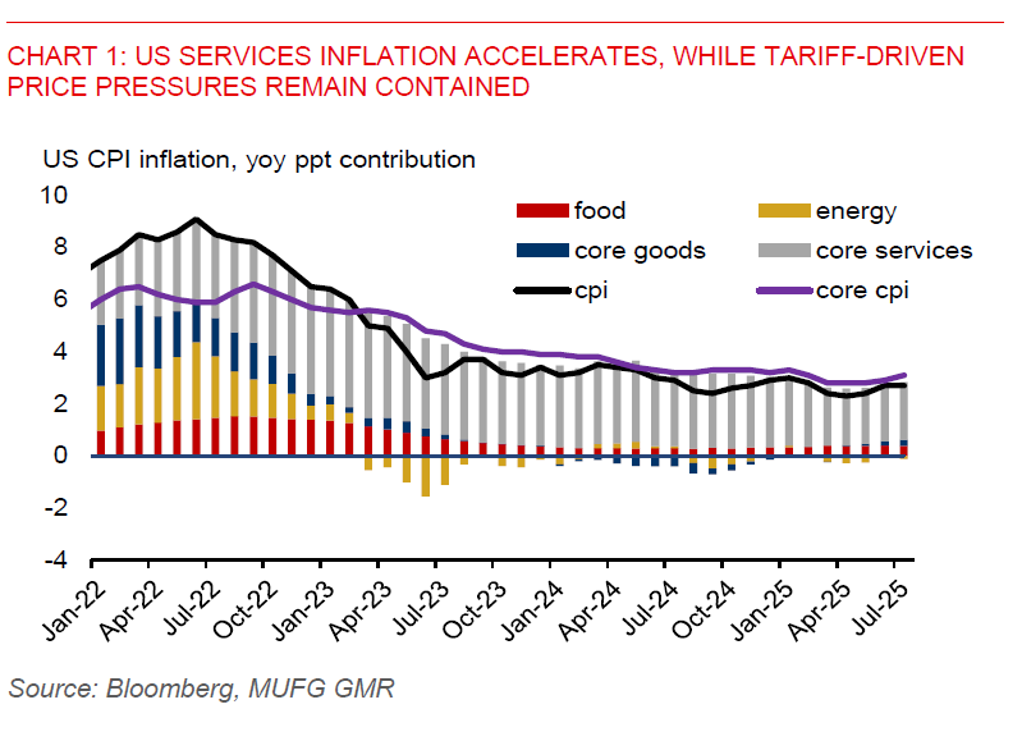

US headline CPI remained at 2.7%yoy in July, while core CPI accelerated to 3.1%yoy from 2.9% previously. On a month-on-month basis, headline inflation increased by 0.2%, down from 0.3% in June and in line with market expectations. Core CPI rose 0.3%mom, up from 0.2% in June, also in line with Bloomberg consensus forecasts. The uptick in US core inflation was primarily driven by a pickup in services prices, notably airline fares, while tariff-related inflation remained contained. Core services excluding energy rose 0.4%mom, compared to 0.3% in June, with airline fares surging by 4%mom. Meanwhile, core goods inflation held steady at 0.2%mom. New vehicle prices were flat versus a 0.4% decline in June, while used car prices rose 0.5%, reversing -0.7%mom in June.

Despite the uptick in core inflation, modest tariff effects on inflation have reinforced market expectations for the Fed to resume rate cuts as early as September. Front-end US Treasury yields edged lower, and the DXY US dollar index declined by 0.5%.

Political pressure on the Fed has also intensified. President Trump has reiterated calls for rate cuts and is reportedly considering allowing a lawsuit against Fed Chair Powell to proceed over alleged cost overruns in the renovation of the Fed’s headquarters. In a further challenge to institutional independence, Trump’s nominee to lead the Bureau of Labor Statistics (BLS) has proposed suspending the monthly nonfarm payroll report in favour of quarterly releases for now, given data collection issues. This follows Trump’s dismissal of the previous BLS head over sharp revisions to June’s payroll data. These developments could add to market uncertainty, keeping the USD under downward pressure.

Regional FX

The US dollar has weakened following the July US CPI report, as contained tariff-related inflation has reinforced market expectations for Fed rate cuts later this year. Against this backdrop, and with the extension of the US-China tariff truce for another 90 days, Asian FX is likely to remain broadly supported. The broad downtrend in the daily USDCNY fixing also suggests the PBOC aims to keep CNY depreciation expectations contained.

In Thailand, we expect the Bank of Thailand (BoT) to cut its policy rate by 25bps to 1.50% today, as headline inflation remains in negative territory. The terminal rate in this easing cycle could reach around 1%, with trade headwinds set to weigh on growth. Thai commercial bank loan growth was flat in Q2. The Thai King has endorsed Vitai—an advocate for rate cuts—as the new BoT governor. Vitai was previously president of the Government Savings Bank.