Ahead Today

G3: US CPI, Germany Zew Expectations

Asia:

Market Highlights

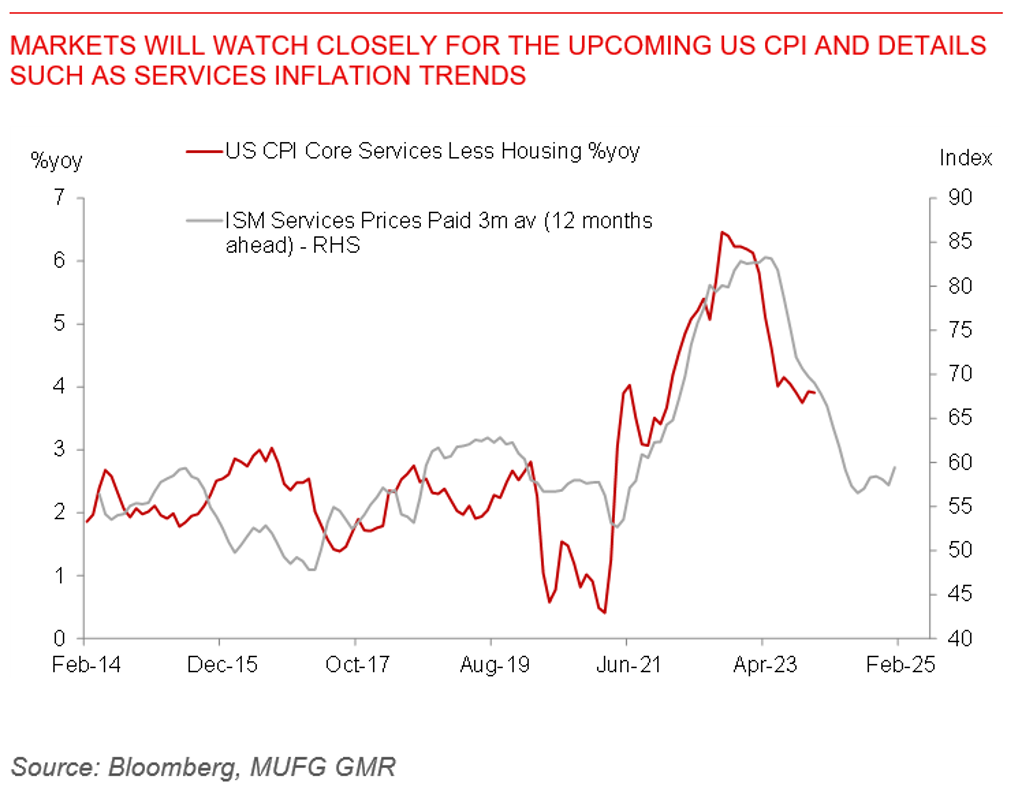

Markets will focus on US CPI out later today. Consensus is calling for a 0.2%mom rise in the headline rate, together with a 0.3%mom rise in the core estimate, with the headline figure possibly falling below the 3% handle. The known drivers for the month are somewhat mixed, with likely continued goods disinflation as indicated by used car prices, but with some uncertainty around the impact of new seasonal factors (which boosts January prints) coupled with higher weights given to the rental component.

Overall, Fed officials have been singing from the same tune by indicating a slower rate cut cycle, notwithstanding the inflation print out today. Governor Bowman – a known hawk - reiterated that it’s too soon to consider rate cuts, while Richmond Fed President Thomas Barkin said that businesses may be slow to give up pricing power.

Meanwhile, Germany’s office property values slumped by 10% in 2023, the sharpest on record, raising some concerns on the implications for the banking sector and financial stability. Higher rates and post COVID shifts have raised concerns around the impact of commercial property for regional US banks and also several banks across the world, although some of the impact may have been priced into markets, with the stock price of New York Community Bancorp rising sharply yesterday.

Regional FX

Many Asian markets are closed in the midst of Lunar New Year Holidays. India released its CPI inflation print yesterday. Headline inflation rose by slightly more than expected at 5.1%yoy (vs consensus 5%), but the core inflation print showed continued disinflation declining to 3.6%yoy, the lowest in four years. We continue to think that RBI will have the policy space to cut rates gradually from the September 2024 quarter, but see the central bank remaining hawkish for now. Meanwhile, we will have Indonesia’s elections coupled with the BSP policy meeting later this week. Markets will watch closely for whether a second round run-off is needed, and the vote share garnered by the various Presidential Candidates in Indonesia including front-runner Prabowo.