Ahead Today

G3: Germany Current Account Balance

Asia: China Exports, India CPI

Market Highlights

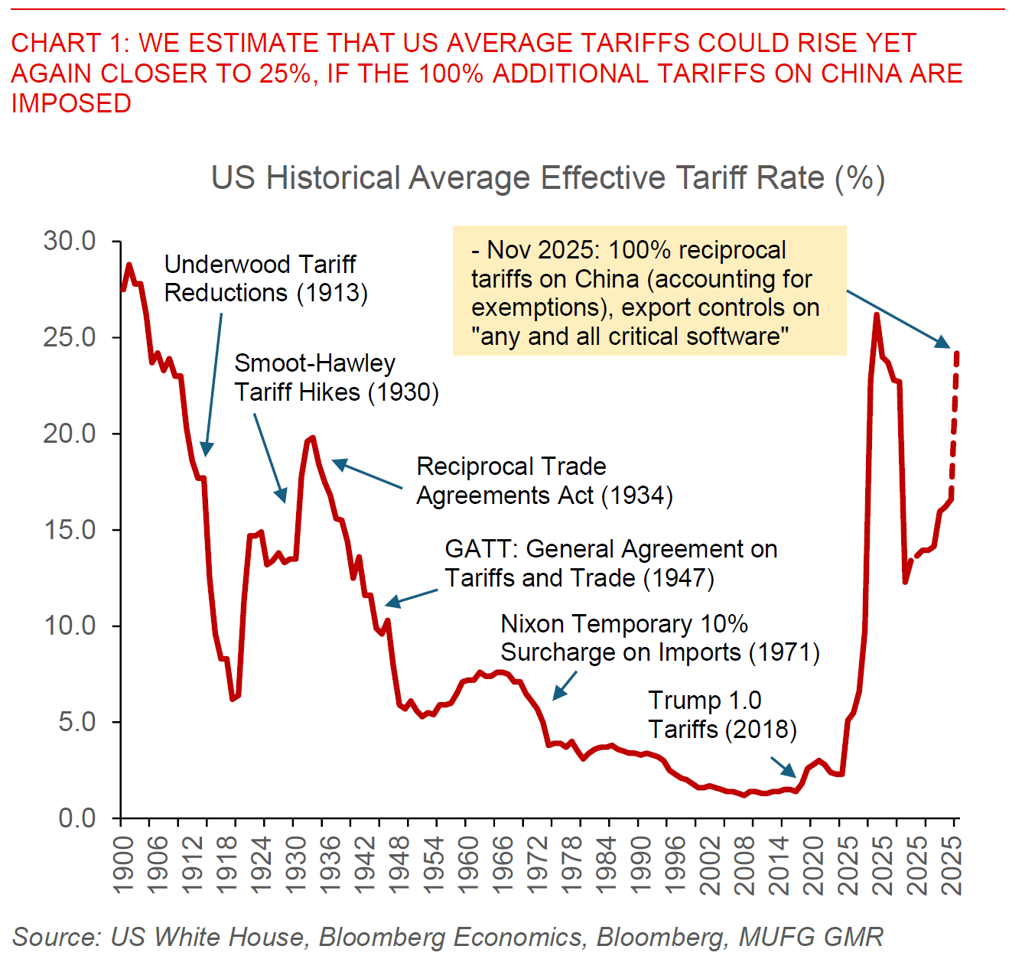

President Trump threatened to impose 100% additional tariffs on China together with export controls on “any and all critical software” over the weekend, and coming on the back of China’s expansion of export controls on critical minerals and rare earths announced on 9 October. Risk assets including the S&P500 fell sharply on the back of these developments, with accompanying US Dollar and CNH weakness, coupled with a rally in US Treasuries and safe haven assets such as gold and to some extent JPY. These market moves reversed to some extent during early morning Asia as Trump said in social media post: “don’t worry about China, it will be all fine!”

We highlighted to clients and our readers last week how China’s moves to expand its export controls of rare earths and other critical minerals on 9 Oct were a meaningful move, and how markets were perhaps too sanguine in their initial assessment including the potential response from the US administration (see Asia FX Talk – China significantly expands export controls on critical minerals). Of course since then, there has been a flurry of announcements and another huge round trip in markets.

We are not convinced that this trade escalation between US and China is over from this morning’s social media tweet from Trump, given the huge gulf of expectations between both US and China. As such, we think markets could remain volatile in the near-term, and in the broader context of assets priced quite closely for perfection, we think both realised and implied vol across assets could start to pickup somewhat from reasonably low levels currently. The door of course still remains open for a potential détente and a meeting between Trump and Xi later this month during the APEC Summit, but we think the probabilities are lower as we speak.

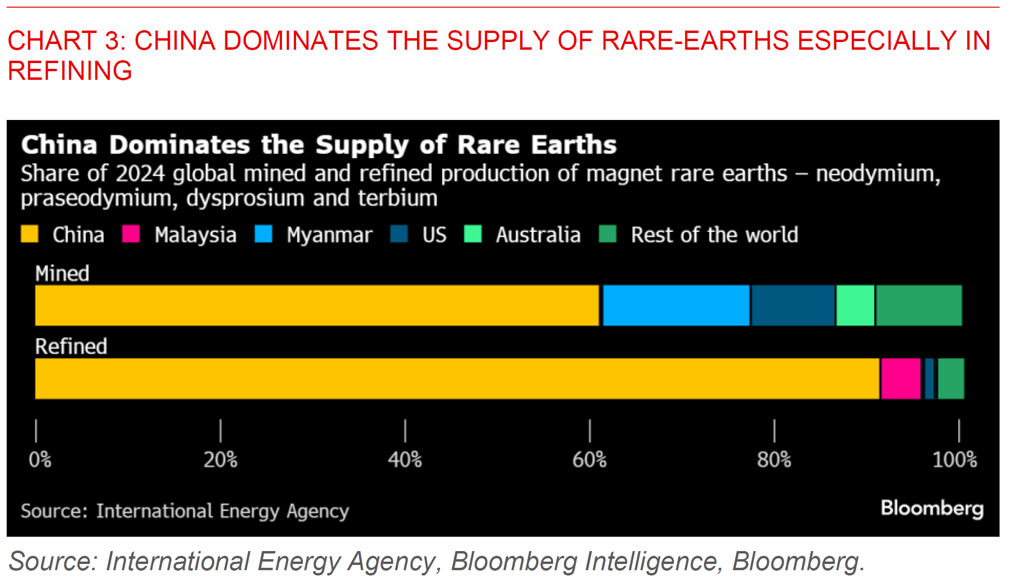

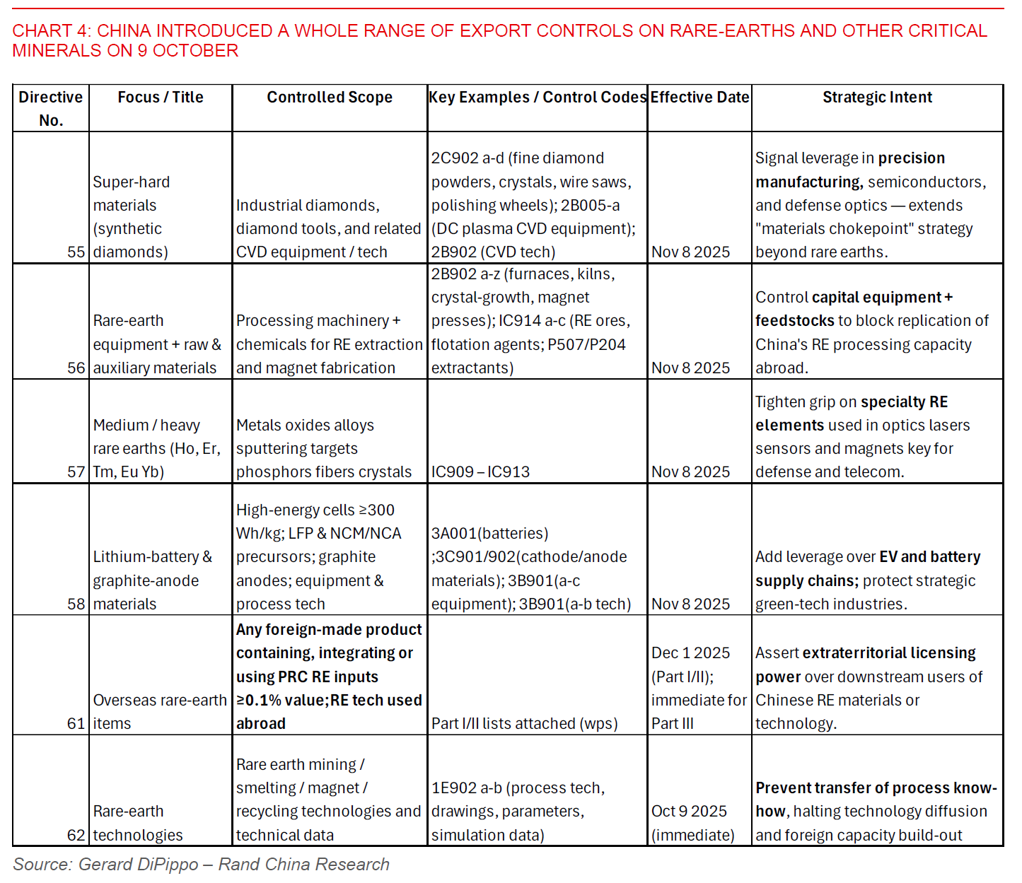

As we highlighted in our report on Friday morning, China’s expansion of export controls on rare-earths and other critical minerals on 9 October were a meaningful expansion of some of its ongoing measures to exert greater control over the critical mineral supply chain (see Asia FX Talk – China significantly expands export controls on critical minerals). These measures expanded the number of rare earths in the restrictions, included the high-end Lithium battery supply chains for the first time, included semiconductor chip production and research and development, together with other components such as superhard materials. The potentially most important development was an official move by China to assert extra-territorial jurisdiction over foreign-made products that contain or are manufactured using Chinese-origin rare-earth materials. This is reminiscent or even a mirror of the US Foreign Direct Product Rule (FDPR) used most extensively in the semiconductor supply chain. For context, China has been expanding its legal toolkit over time to better legislate its controls over critical supply chains, including through the adoption of the 2020 Export Control Law.

Of course, all these moves depend on whose perspective you look at, and our key takeaway is that the gulf in expectations between US and China remains wide.

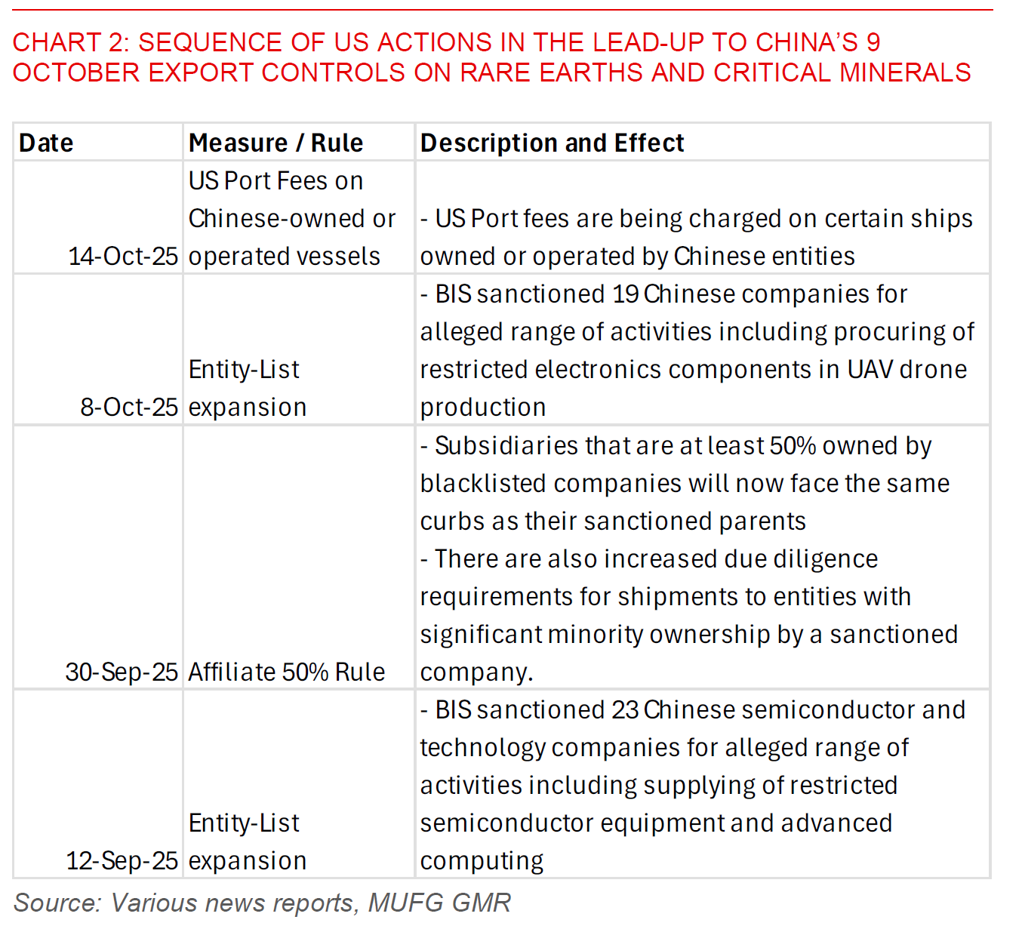

From China’s perspective, the US has been imposing additional restrictions since the Madrid talks, indicating potential bad faith policy moves even in the midst of trade negotiations. These policy moves by the US include recent changes in the affiliate rule, indicating that subsidiaries that are at least 50% owned by blacklisted companies will now face the same curbs as their sanctioned parents. The BIS has also been expanded the entity-list twice in September and October each, while US port fees on Chinese-owned or operated vessels are planned to go ahead later this week in October.

From the US’ perspective, the export controls by China on 9 October are seen as a meaningful escalation, which could among other things severely hamper the US defence industry given the critical importance of some of these materials in defence production. While China’s Ministry of Commerce emphasized (twice) in its press statement over the weekend that these measures are not an export ban, and as such legitimate activities by companies will be approved with minimal impact to global supply chains, the elephant in the room is perhaps still the US defence sector and how this might play out in trade negotiations.

Our best sense right now is that these export control measures by China are probably something the Chinese authorities were planning for a long time, given the significant comprehensiveness of the measures. Put differently, these policy changes are not something a bureaucracy can do over the course of one or two weeks.

As such, we think that beyond the potential tactical reasons for pushing out the policy – for instance gaining more leverage over Trump and also hitting back at perceived bad faith negotiations – there is far more likely a longer-term and strategic imperative for China to push out these measures.

We are as such also extremely unconvinced by some analysts especially those in the Western media and even some from the US administration who say that China has overplayed its hand in pushing out these export controls.

Key References:

China Ministry of Commerce (MOFCOM) Directives 55 to 62, Press Statements

Gerard DiPippo – Rand China Research

Global Trade Alert (9 Oct 2025) – A widening net: A short history of Chinese export controls on critical raw materials and their usage (link here)

Cory Combs – Trivium China Head of Critical Mineral and Supply Chain Research

Bloomberg Intelligence