Ahead Today

G3: Japan leading index

Asia: Thailand trade, Singapore industrial production, and Hong Kong exports

Market Highlights

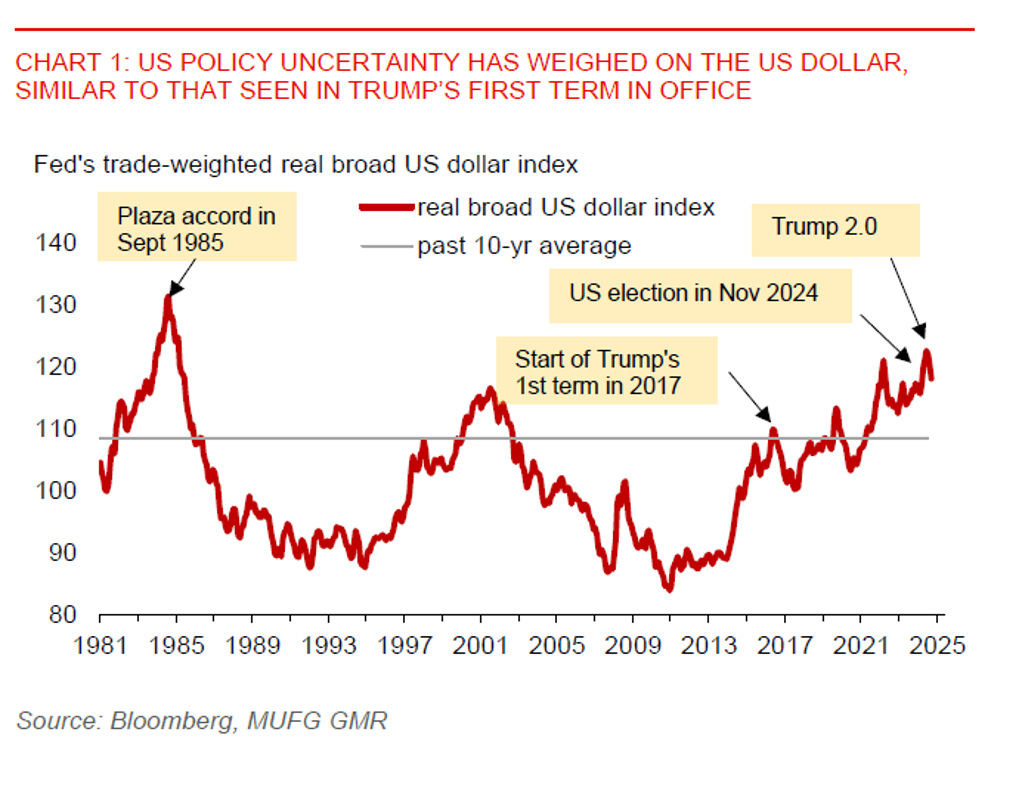

There may be some reprieve for the US dollar to start the trading week, with Trump agreeing to delay the 50% EU tariff till 9 July. Last Friday, US President Trump took to social media to announce a straight 50% tariff on the EU. He thinks that it’s very hard to deal with the EU, with trade discussions not making any meaningful progress. Tariffs are seen as a threat to the US economy, with the “sell US” trade re-appearing following that tariff announcement. The broad US dollar index (DXY) fell 0.8% last Friday, with EURUSD gaining 0.7%, while US stocks fell.

Reaction in the Treasury market has been muted. Long-end yields have remained at elevated levels, with markets requiring a higher risk premium for holding US long-term bonds. This has mainly been over concerns about a worsening fiscal outlook in the US. The US Congress is getting closer to passing Trump’s signature tax bill, which could sharply widen US trade deficits by trillions of dollars. Moody’s has recently downgraded US sovereign credit rating by 1 notch to Aa1, warning of the risk that the federal deficit could rise to nearly 9% of GDP a decade later, from 6.4% in 2024, driven by higher debt interest payments and low revenue collections. Notably, the US 10-year term premium has reached levels not seen since a decade ago.

Regional FX

Asian currencies have continued to find support in a weaker US dollar. Broad gains were seen in Asian currencies last Friday, with KRW (1.2%), MYR (+1%) and THB (+0.8%) leading gains against the US dollar in the Asia region. US trade and fiscal policy risks have continued to pose cyclical headwinds to the US dollar. Markets have also seemingly perceived that President Trump is looking for a weaker US dollar versus several Asian currencies as part of bilateral trade negotiations. So, any signs of FX discussion with the US could still be an upside risk to Asian currencies in the near term.

Meanwhile, Singapore’s inflation has remained subdued. Headline CPI inflation held steady at 0.9%yoy in April, with healthcare inflation at 2.5%yoy, food at 1.4%yoy, and private transport at 1.3%yoy. However, core inflation picked up modestly to 0.7%yoy from 0.5%yoy in March. We expect inflation will likely remain subdued, with a likely trade induced hit to global demand posing a disinflationary drag on prices of commodities and manufactured goods. And while SGD has strengthened against the US dollar so far this year, it could still face renewed weakness when there’s a visible tariff impact on its export performance in H2.