Ahead Today

G3: US retail sales, PPI, initial jobless claims, industrial production; eurozone Q1 GDP and industrial production

Asia: Trade data from Indonesia and India, Philippines overseas remittances

Market Highlights

Trade tensions appear to have further eased, with China suspending export curbs on rare earths and other goods for military use targeting 28 US entities for 90 days. China will also pause a trade and investment ban against 17 US companies.

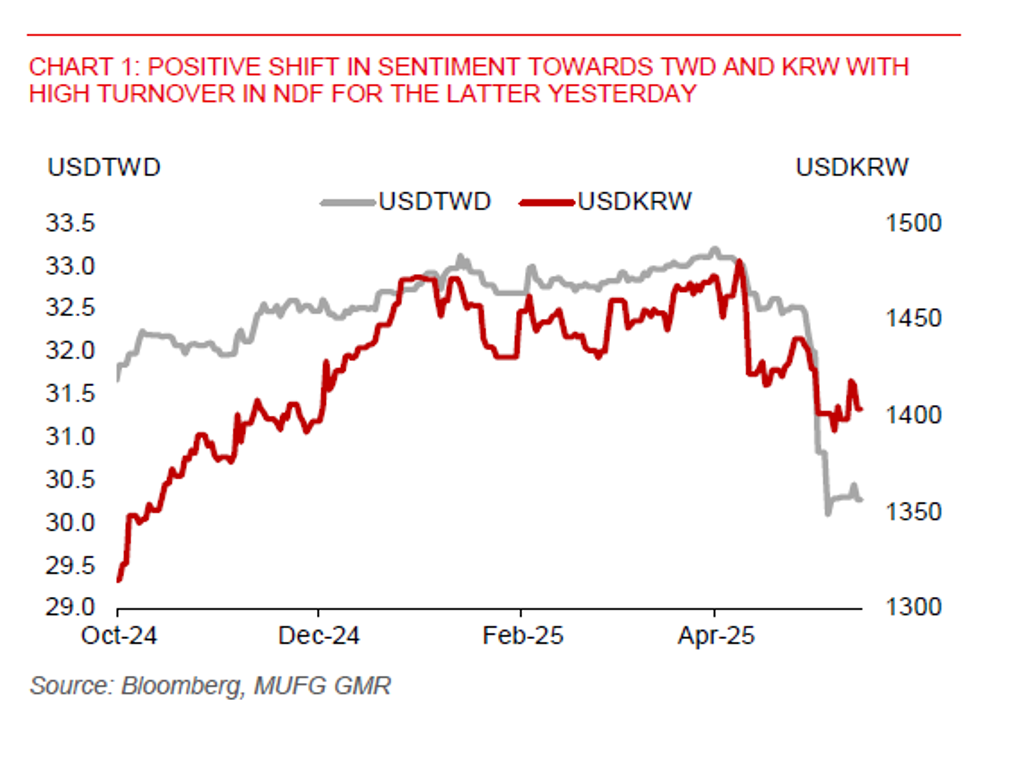

Meanwhile, news reports suggest US officials are not pushing for a weaker US dollar in trade negotiations. US Treasury Secretary Scott Bessent has sought to dispel market concerns that the US is seeking a weaker US dollar. He has been reiterating since February that a strong US dollar policy remains intact. Nonetheless, markets have remained jittery. Headline news yesterday on US and Korea reportedly having talks about FX policy on 5 May have possibly led to the Korean won gaining sharply by more than 1% against the US dollar before partially paring back those gains. And earlier this month, the Taiwan dollar recorded its biggest one-day gain of 3.7% versus the US dollar. The broad US dollar index (DXY) fell by as much as 0.6% at one point yesterday before ending flat during the session.

The key highlight today is US retail sales. Bloomberg consensus expects core retail sales (ex-auto and gas) to slow to 0.3%mom in April from a 0.8% increase in March, while the headline number could show flat growth, dragged down by lower auto sales and gas prices.

Regional FX

There are several notable gains in Asian currencies versus the US dollar in Wednesday’s session, following news that US and South Korea have discussed about FX policy. Japan’s finance minister Kato has also reportedly said that he would seek an opportunity to discuss FX matters with Bessent at an upcoming G7 meeting in Canada. KRW led gains in the region with a 0.9% appreciation, while MYR (+0.8%), TWD (+0.6%), and JPY (+0.5%) also strengthened. However, modest losses were seen in the CNH (-0.2%) and IDR (-0.2%)

China’s new CNY loans fell 61%yoy to CNY285bn in April, below market consensus. The aggregate financing, a broad measure of credit, rose CNY1.2tn, but also falling short of market consensus. Further monetary policy easing may still be on the cards to help support domestic demand.