Ahead Today

G3: US Dallas Fed Manufacturing

Asia: India industrial production, Hong Kong trade

Market Highlights

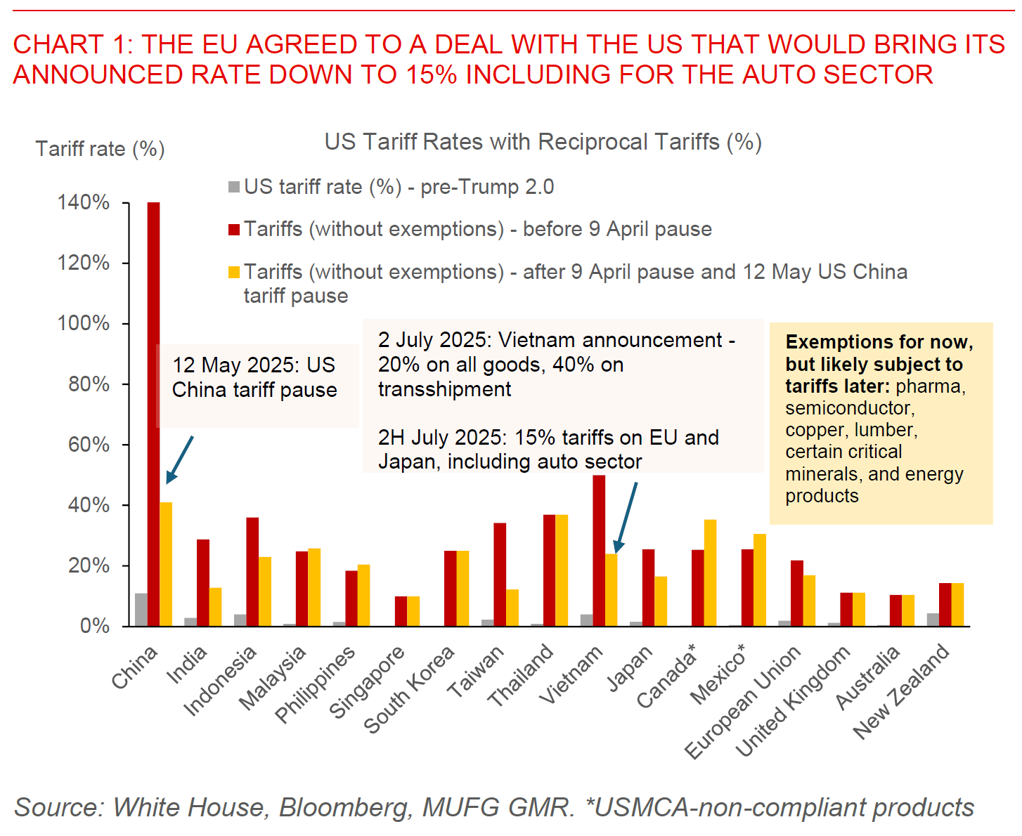

The US and European Union agreed on a trade deal over the weekend, which will see the EU face 15% on most of its exports including automobiles. In return, Trump said that the EU has agreed to purchase US$750bn in American energy products, invest US$600bn in the US on top of existing purchases, open up the EU markets at zero tariffs, and purchase “vast amounts” of military equipment. Nonetheless, as what we have seen in the other trade deals including with Japan, the lack of a formal agreement can easily lead to different interpretations. For one, European Commission President Ursula von der Leyen said that a 15% tariff rate has been agreed on pharmaceuticals, irrespective of upcoming Section 232 sectoral tariffs on the sector, with the investment commitments by the EU key as well in clinching this. This was contradicted by Trump who said that the deal would not include pharmaceuticals. Second, the EU and the US also diverged on tariffs on steel and aluminum tariffs, with the US saying metal tariffs will be cut and quota system will be put in place, but Trump saying 50% tariffs will remain in place. Meanwhile, US and China will meet in Stockholm on 28 July, with SCMP reporting that both are expected to agree to extend the truce by 90 days.

Regional Currencies

On the back of these tariff and trade deal developments, the Dollar started the week during the Asia session weaker, with some modest positive spillover to Asian currencies as well, with USD/CNH trading around the 7.165 levels. In terms of tariff and trade negotiations with other Asian countries, South Korean Finance Minister Koo Yoon Cheol and US Treasury Secretary Scott Bessent are expected to meet this week in the US, with trade ministers from both countries continuing talks until late Friday but have not yet closed a deal according to Yonhap news. Local news reports quoting South Korean government officials suggest that the South Korean government is reviewing extra investment in the US shipbuilding sector such as acquiring US shipyards and expanding shipyard facilities such as docks, and also extra investment in semiconductor in the HBM sector, coupled with possible increases in rice imports. Meanwhile, we have not yet seen concrete trade deal developments in several other Asian markets such as India, Malaysia, and Taiwan, even as it seems that negotiations and discussions are still ongoing. One key development to watch in particular for the Thai Baht is the current conflict between Thailand and Cambodia. Thailand and Cambodian leaders are set to hold talks on Monday, after US President Donald Trump used the threat of tariffs to press for a ceasefire.