Ahead Today

G3: US Personal Income and Spending, US Core PCE, US Employment Cost Index

Asia: India Economic Survey, India Budget FY2025/26

Market Highlights

President Trump renewed his pledge to follow through on his threat to impose 25% tariffs on imports from Canada and Mexico on February 1, citing the flow of fentanyl and large trade deficits among the reasons. Nonetheless, he was still considering whether to exempt oil imports from these tariffs, and would make a determination as soon as Friday morning Asia time. Trump also indicated he would proceed with tariffs on China due to the issue of drugs and fentanyl, although it was not clear whether this is tied to 1 Feb. With both Mexico and Canada pledging to retaliate to any trade levies it would notably raise the risk of tit-for-tat tariffs and weigh on global growth and trade.

India will announce its Budget for FY2025/26 on 1 Feb, and also its Economic Survey providing the economic backdrop later today. We expect the government to maintain a commitment to reduce the fiscal deficit to 4.5% of GDP for FY2025/26, from an estimated 4.8% of GDP in FY2024/25. We also think the budget will likely focus on boosting consumption with possible income tax cuts, higher welfare spending for rural areas, support for employment, and also greater spending on the agriculture sector, with the trade-off being slower growth rates in capital expenditure allocation. If this is right, we continue to expect the RBI to cut rates in its policy meeting on 7 Feb (see INR – Let it go? A weaker outlook for 2025).

Regional FX

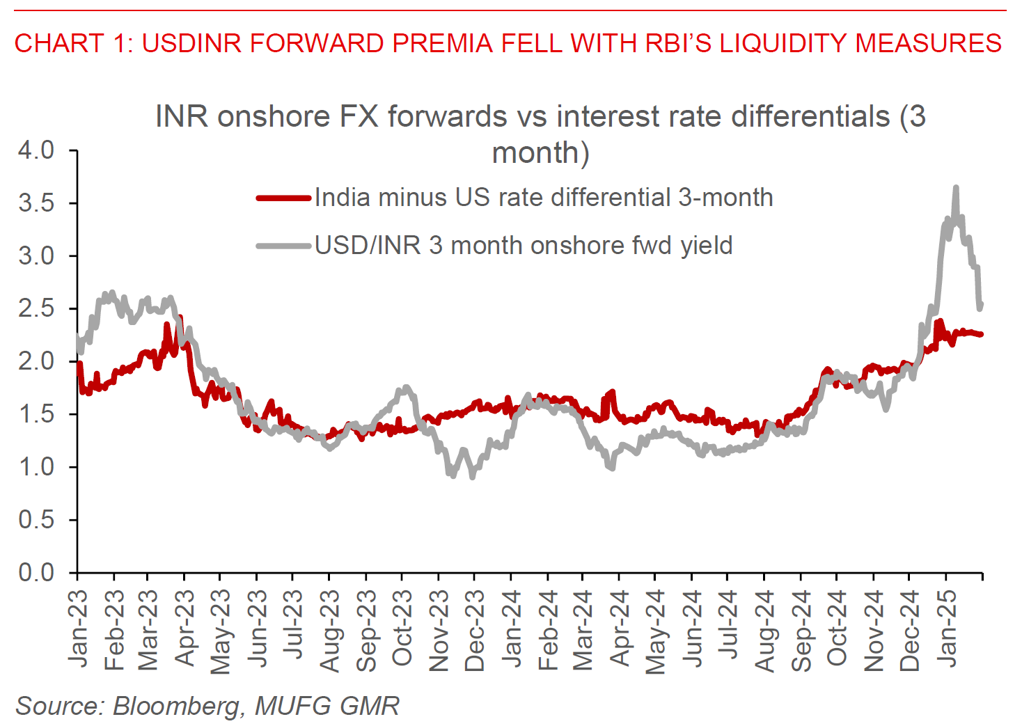

Asian currencies were generally weaker on the back of announcements around possible tariffs by Trump on 1 Feb. Apart from India’s Budget, RBI this week has pushed through several INR liquidity injection measures totaling INR1.6trn to address the liquidity deficit in the banking system, and among other measures announced a US$5bn FX buy/sell swap. With these measures, onshore forward premia for USD/INR fell across the curve, but generally still remained above what’s implied by interest rate differentials for shorter tenors, indicating continued risk premia placed by markets on INR depreciation. We think that the focus for RBI is likely to pivot towards supporting growth, and as such continue to expect the RBI to cut rates by 25bps in its upcoming policy meeting on 7 Feb assuming the government maintains its commitment to fiscal consolidation. The flip side of that is we think RBI will likely intervene less aggressively to cap USD/INR moving forward, and allow INR to weaken in a reasonable fashion through 2025. We forecast USD/INR at 86.80 in 1Q2025 (calendar year) and 88.50 by 4Q2025 (calendar year).

Philippines 4Q2024 GDP was weaker than expected at 5.2%yoy (versus consensus of 5.5%yoy), with full year growth disappointing at 5.6%. We think part of this weakness was likely due to typhoon and weather related disruptions, and hence expect at least part of this to reverse into 1Q2025. Overall, the details suggest that investment activity softened, while private consumption has not yet shown an improvement and was still growing below 5%yoy. With softer growth and still manageable inflation, we think the path of least resistance is for the BSP to cut rates gradually through 2025 and we forecast another 75bps of rate cuts through this year. We continue to think that PHP has some space to outperform the rest of Asian currencies in the context of tariff increases given its more domestic oriented nature. Weaker growth can also help support PHP by helping to narrow the current account deficit, notwithstanding softer portfolio inflows. We forecast USD/PHP at 59.70 in 1Q2025 and 58.80 in 4Q2025, implying outperformance against the likes of CNY and KRW.