Ahead Today

G3: Eurozone CPI

Asia: China monthly macro data, Thailand GDP

Market Highlights

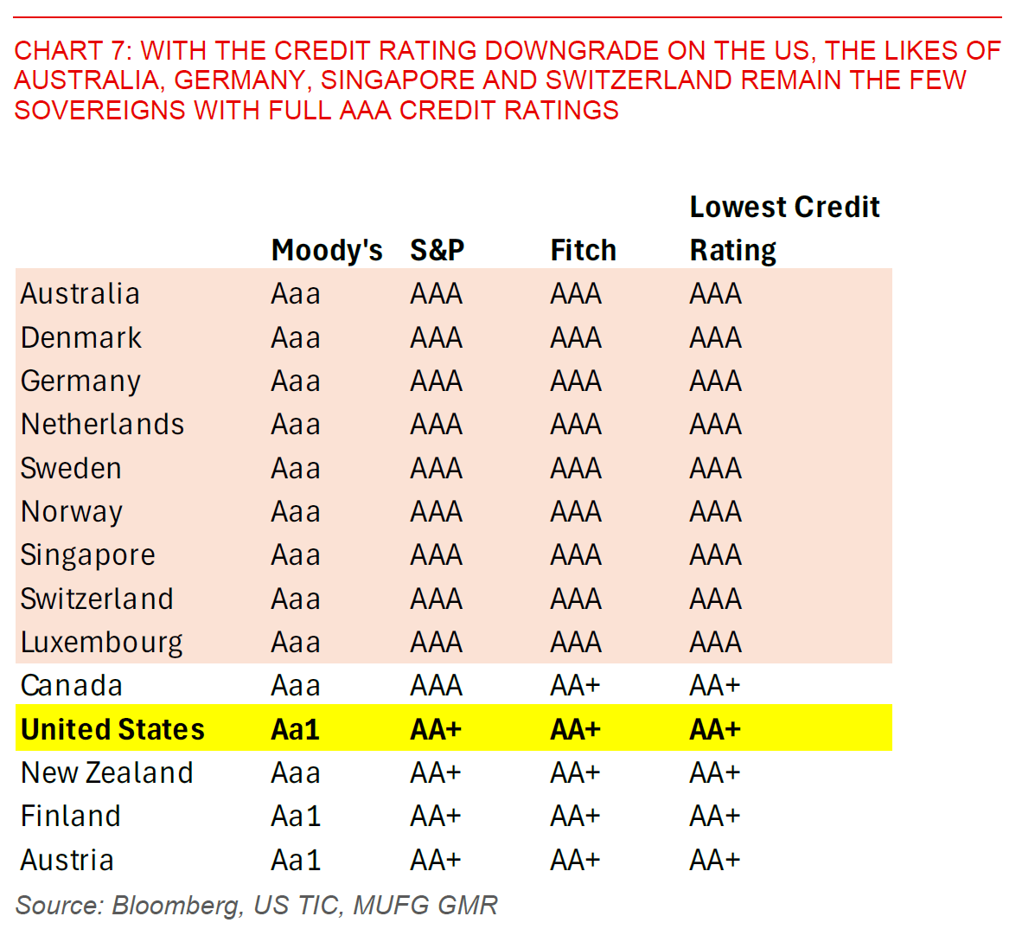

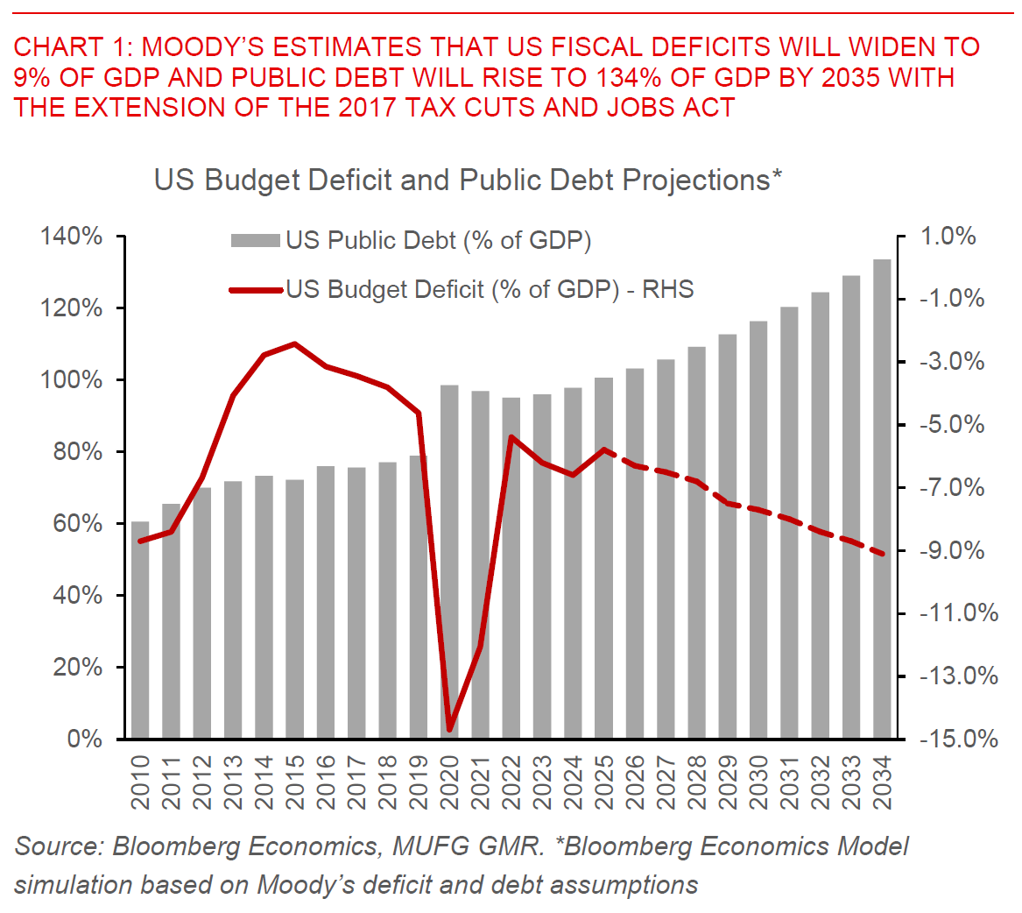

The US was stripped of its last remaining AAA credit rating by Moody’s Ratings just as US markets closed last Friday, joining S&P and Fitch in placing the US one-notch below the top grade. Moody’s highlighted limited budget flexibility and persistently large fiscal deficits driving the US government’s debt and interest burden higher as a key justification for the ratings change. In particular, Moody’s estimates US fiscal deficits will widen to nearly 9% of GDP by 2035 with the extension of the 2017 Tax Cuts and Jobs Act, up from 7.4% in 2024. With that, US public debt is also expected to rise to 134% of GDP by 2035 compared with 98% in 2024.

While it is true that Moody’s ratings change is long overdue given it was the last agency to downgrade the US, it certainly serves to confirm existing concerns of markets and policymakers around the unsustainability of the US fiscal trajectory. With the current draft of the Trump 2.0 tax cuts potentially adding US$3.8trillion to debt levels (see US fiscal outlook), and possibly even higher assuming temporary tax provisions are made permanent (see CRFB – Adding up the House Reconciliation Bill), we think the market’s focus will likely shift more towards the US fiscal outlook in coming months.

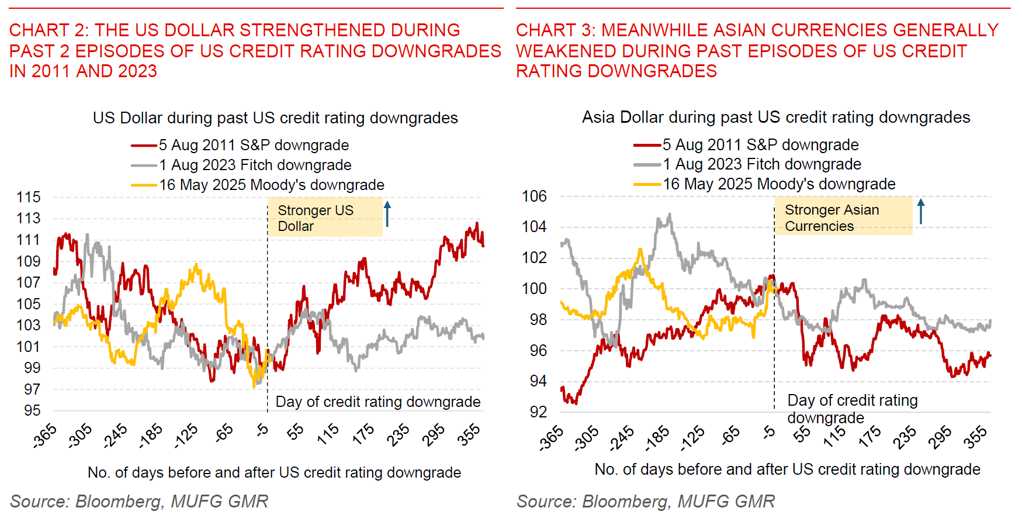

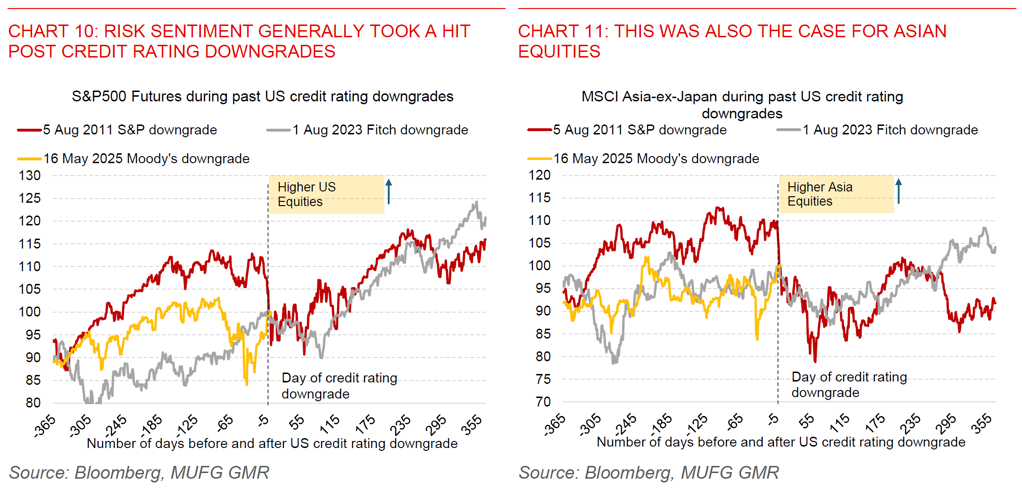

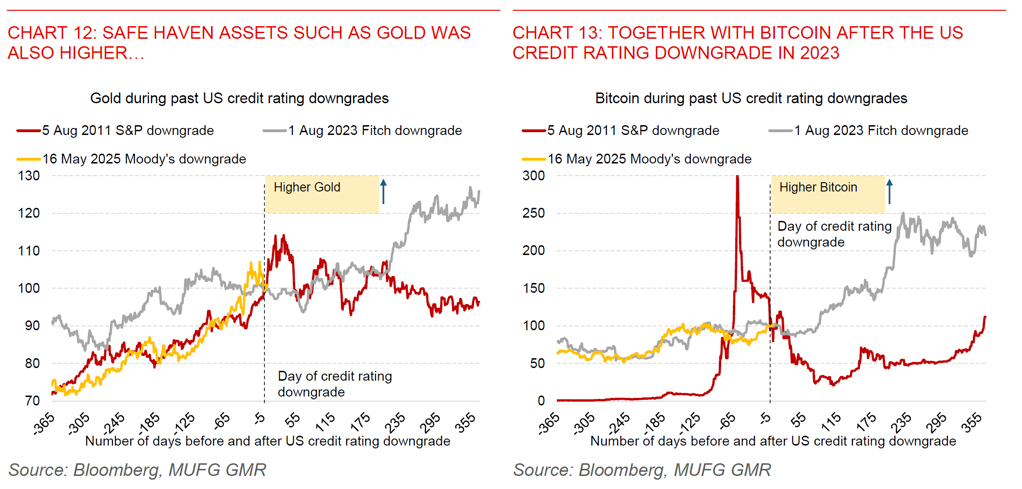

Previous episodes of US credit rating downgrades led to the Dollar strengthening and Asian currencies weakening, with weaker equity market risk sentiment including in Asia and some increases in safe haven assets such as gold. The first downgrade by S&P in 2011 was also notable in that it led to a sharp rally in US Treasuries due to the flight to safety effect, a spike in volatility, coupled with significant underperformance in current account deficit EM currencies such as INR and IDR.

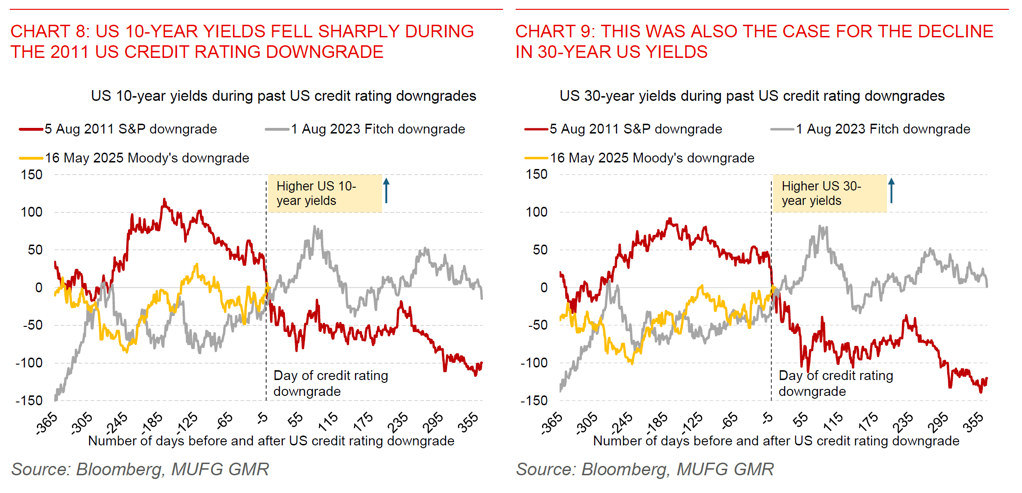

This time around, we think the Dollar could weaken while Asian currencies strengthen given the focus on US fiscal sustainability (all things equal and putting tariffs aside), even as the initial market shock is likely to be much smaller relative to 2011. We would also expect US longer-end yields to rise and remain sticky, until and unless the US tax bill provides a meaningful and credible path towards fiscal consolidation in the US.

While the full impact to markets including to Asia remains to be seen, as Asia opened on the back of the credit rating downgrade, the Dollar weakened by 0.3% with EUR and JPY up by 0.3%, Asian currencies were somewhat stronger with SGD strengthening by 0.2%, while S&P futures were down by 0.6%. US 10-year and 30-year yields last traded around 5bps higher to 4.46% and 4.95% from just before US markets closed, while gold and Bitcoin both rose by more than 1%.