Ahead Today

G3: US Empire Manufacturing

Asia: China monthly data

Market Highlights

Brent Oil prices rose to as much as US$78/bbl as hostilities between Israel and Iran continued for the fourth day, with safe-haven assets such as gold prices picking up, coupled with some modest Asian FX weakness against the Dollar as markets opened.

Moving forward, the key for markets on Israel-Iran tensions will depend on at least three things. First, whether there are actual physical disruptions to global oil supplies including out of Iran. On this front, the good news thus far is that the oil and gas facilities struck in Iran seem to be concentrated more on Iran’s domestic supplies and distribution, rather than for the export market. These include a natural gas processing facility coupled with an oil depot in Iran. Second, whether the Strait of Hormuz is disrupted – a key chokepoint where a third of all seaborne oil and gas supplies go through. This would likely be the most extreme action that Iran could take, and would have a meaningful impact to global oil supplies, and in a way which current OPEC+ spare capacity is unlikely to completely offset, and could well see oil prices spike meaningfully above US$100/bbl. Third, the involvement of the US on the conflict. On that, US President Trump kept that possibility open, even as he mentioned that it’s possible Israel and Iran could reach an agreement to end their conflict, though the two sides may need to continue fighting before they’re ready to broker a peace deal.

Regional FX

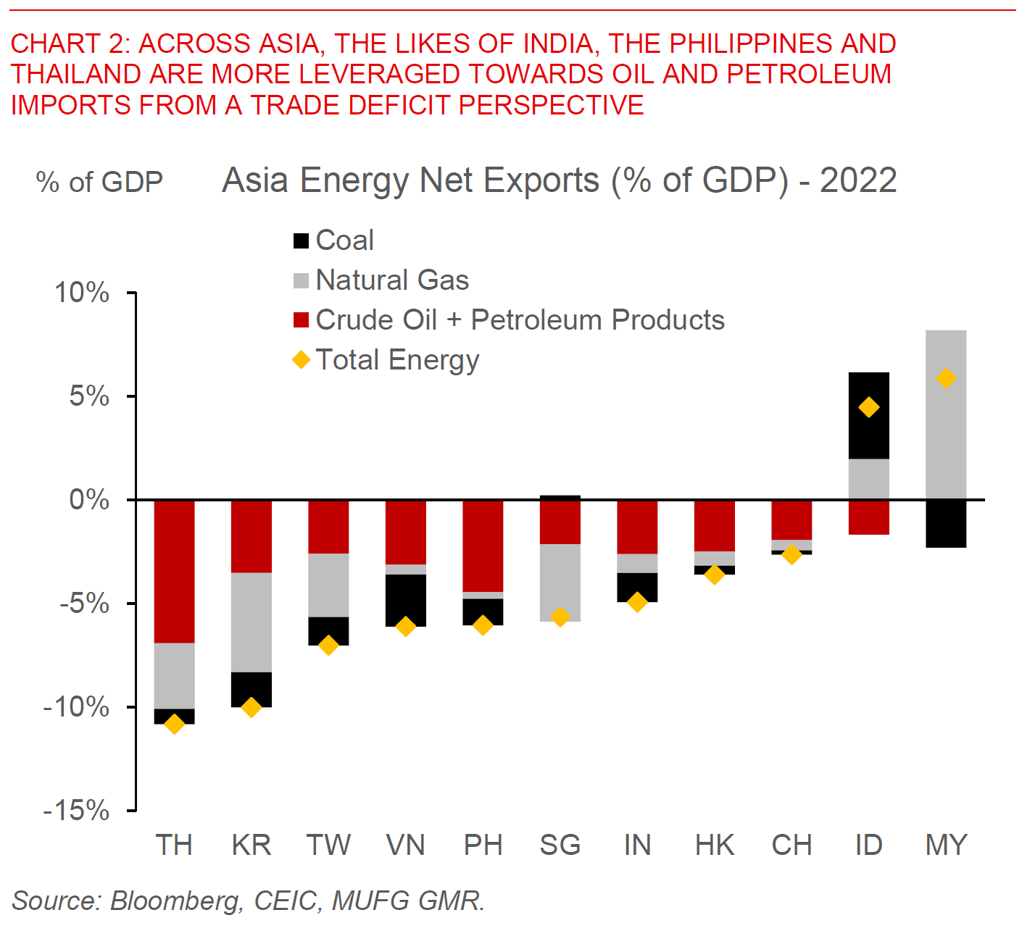

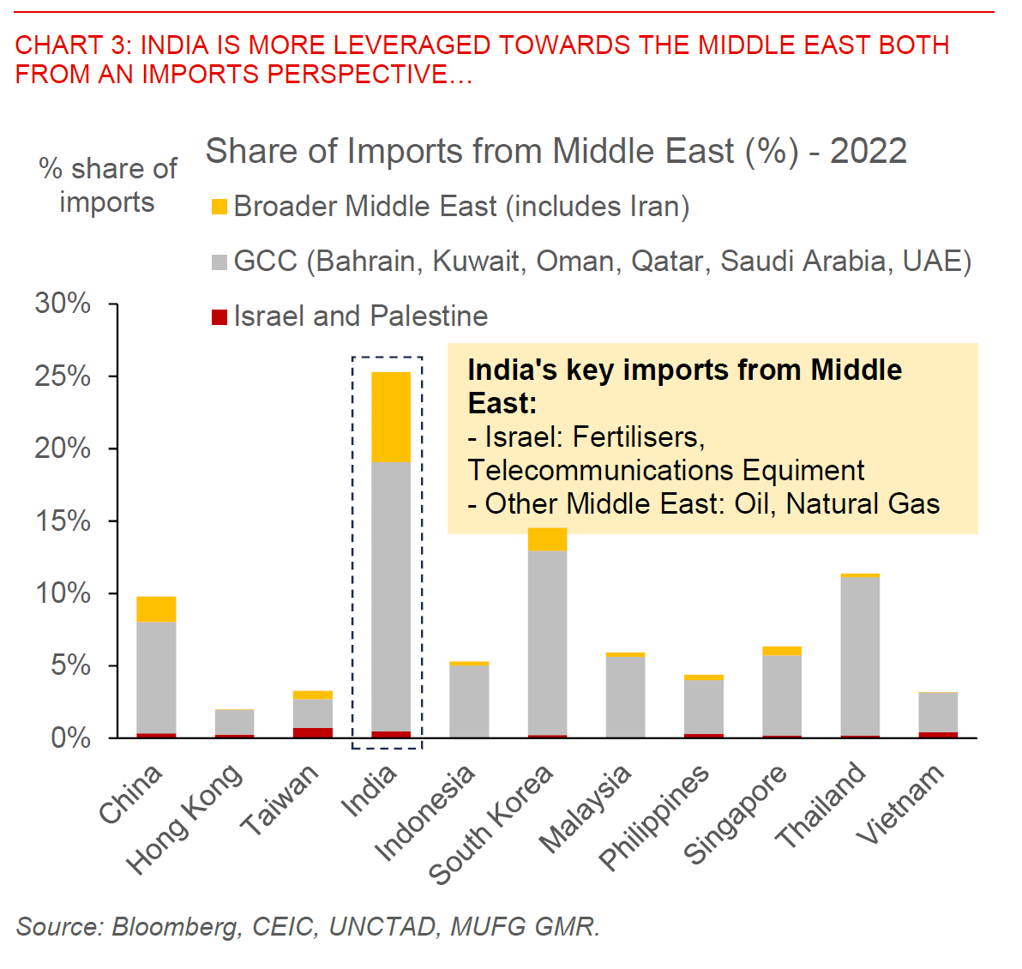

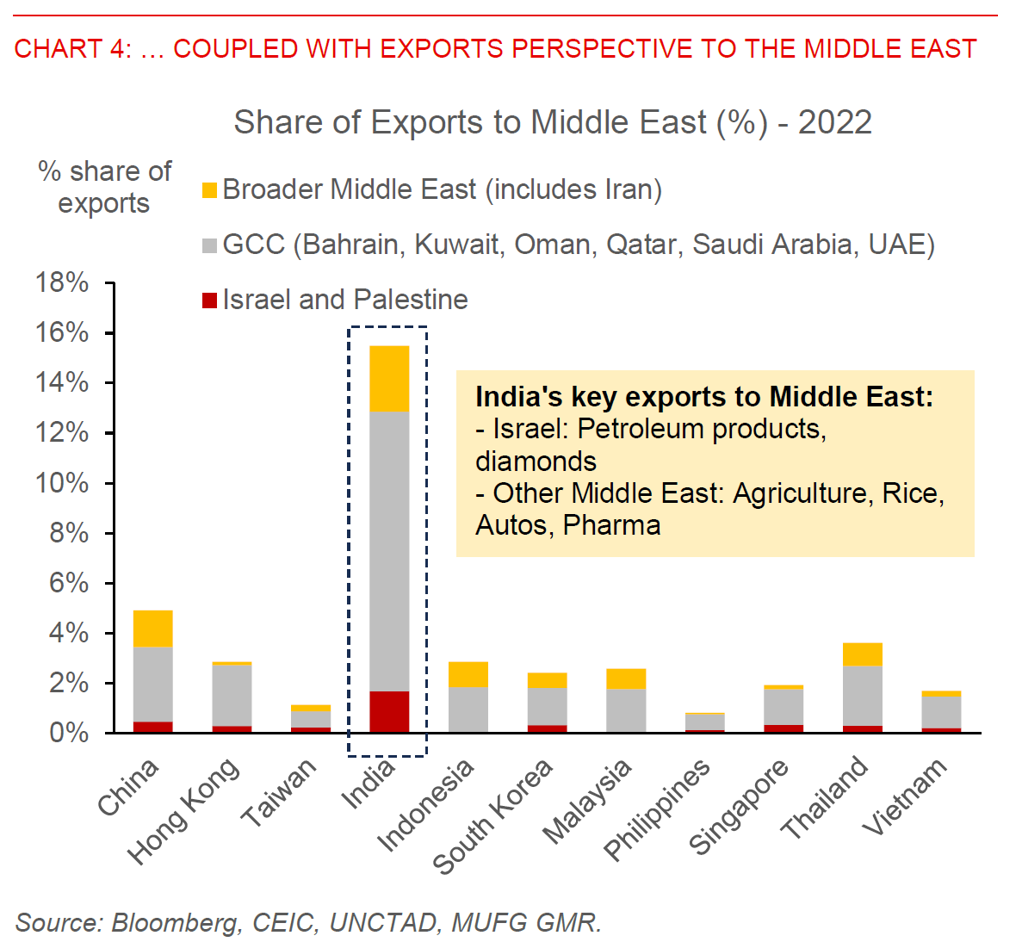

From Asia’s perspective, we had Asian currencies generally on the backfoot and weaker against the Dollar, with the likes of INR, PHP and KRW underperforming the region heading into the weekend. The dispersion of outcomes makes sense to our minds with the geopolitical conflict, given that India, the Philippines, and South Korea are meaningful net oil importers, while for Asia overall higher oil prices could add to both inflation and trade deficits more generally. In addition, India is also on a relative perspective more leveraged to the Middle East, with the region making up 25% of India’s imports. Israel is also an important supplier of electronics and fertilisers, and a market of end-demand for diamonds and petroleum products, although we note India’s imports of oil from Iran has already come down over time since 2018.

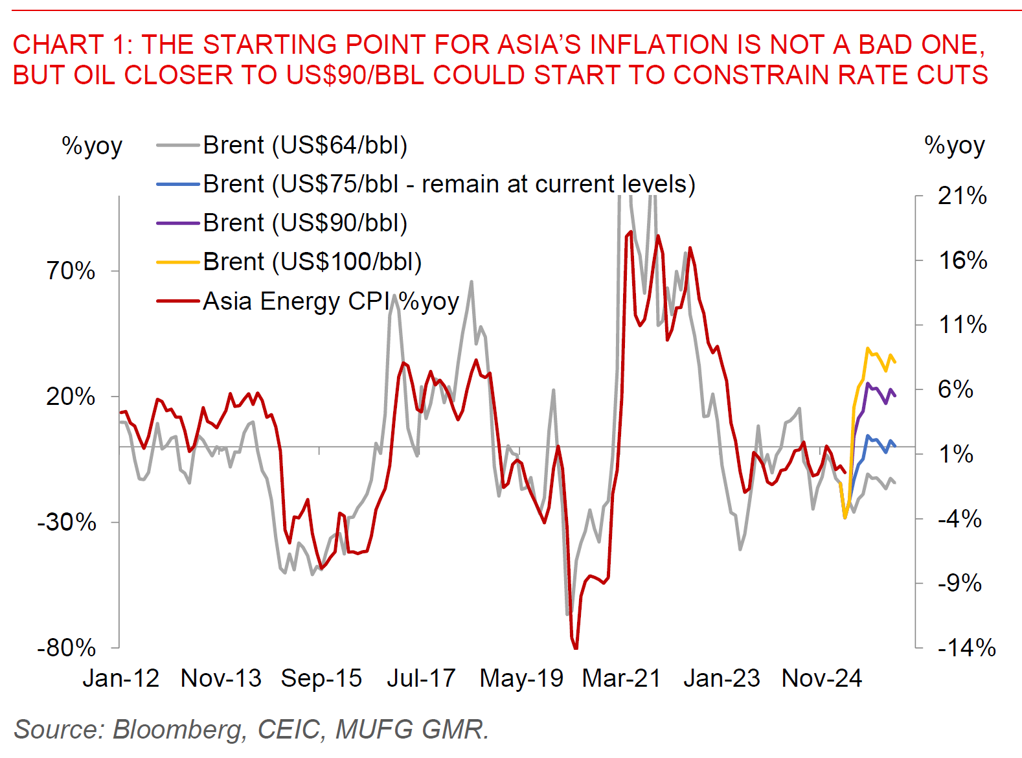

The good news for Asia is that the starting point for inflation and trade deficits is not a bad one, with headline inflation generally heading lower before the geopolitical tensions and oil price spikes. Our implicit base case is that there will not be meaningful supply disruptions to global oil supplies, with the risk to the oil market contained more to geopolitical risk premia. If this is right, oil prices could hover around US$70-80/bbl in the near-term, but should moderate over time towards the US$60-70/bbl levels over the medium-term as OPEC+ spare capacity and excess oil supplies eventually dominate. As such, we see these geopolitical tensions as probably delaying the path of rate cuts across Asian central banks, including from the likes of India, the Philippines, and perhaps South Korea, but should not change the ultimate destination. Nonetheless, the left tail risks are quite meaningful here, and we would be watchful for the risks in the near-term on the Israel-Iran conflict.