Ahead Today

G3: Germany PMI, Eurozone PMI, US PMI

Asia: HSBC India PMI, Malaysia CPI, Indonesia Current Account

Market Highlights

There seem to be three major and fascinating global macro shifts underway, and in some ways embedded in recent developments and price action.

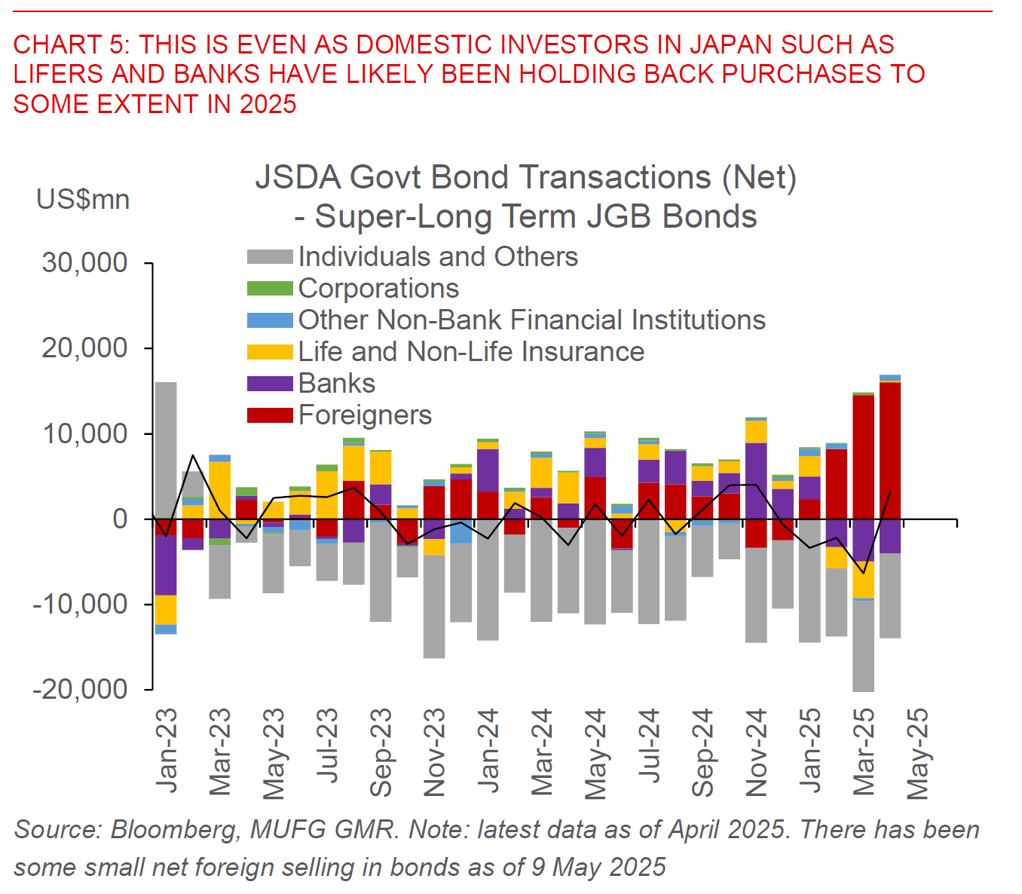

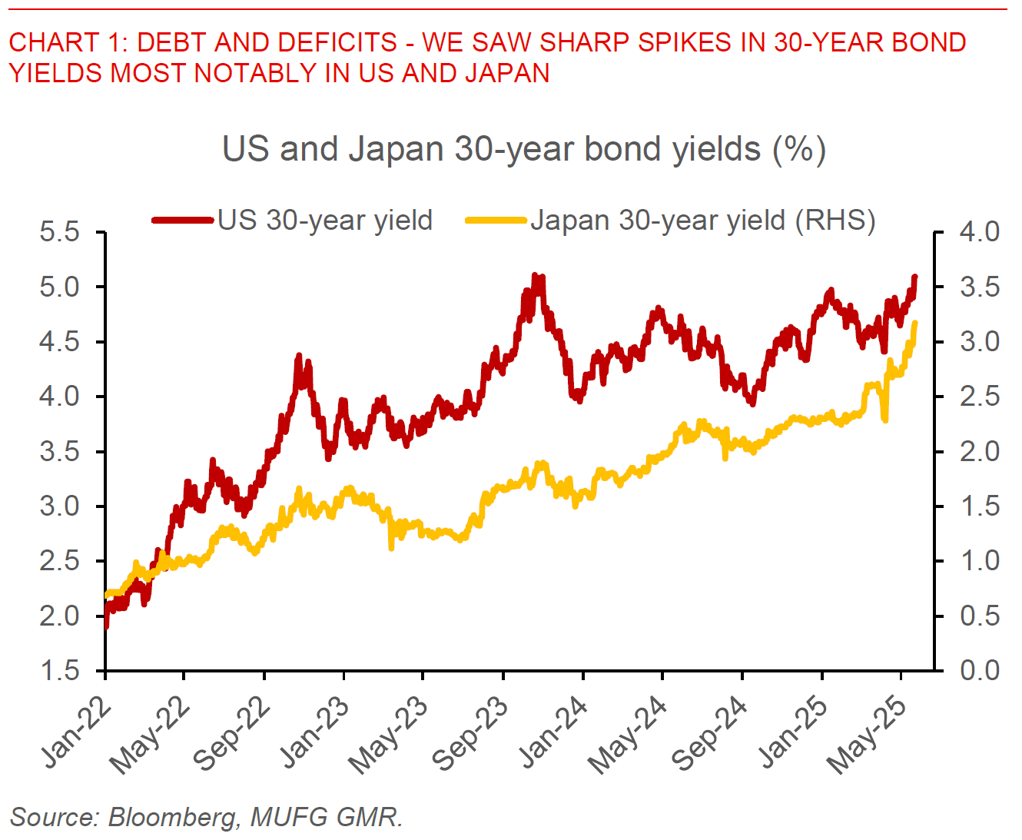

First, increasing concerns about debt and deficits, most prominently in the US but certainly not confined to it, and coming on the back of the recent Moody’s credit rating downgrade (see Till debt do us part). This was seen in the relatively poor US Treasury 20-year auction yesterday, resulting in US 30-year yields rising sharply by more than 12bps to 5.1%. Just as prominently Japan’s 30-year yields surged by 40bps to 3.14% from a weak auction, although whether that’s primarily due to fiscal concerns or a JGB supply-demand mismatch amidst BOJ’s tapering of bond purchases is unclear.

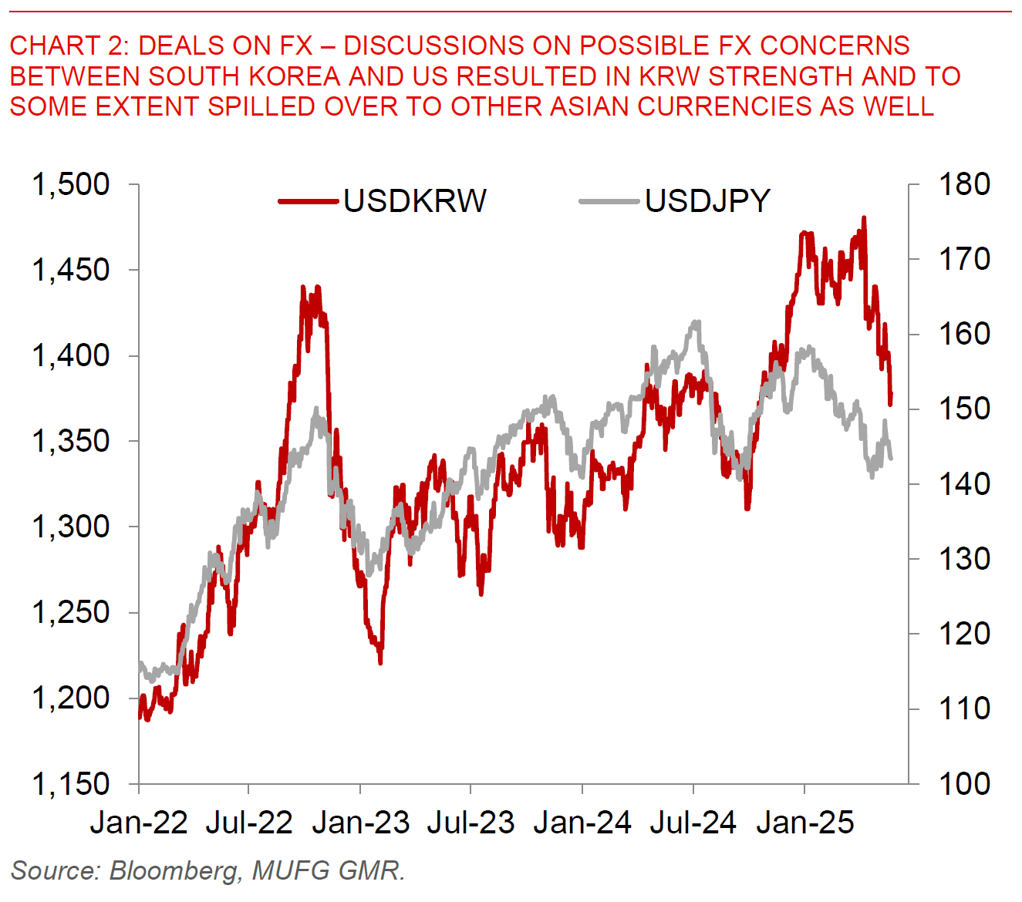

Second, possible deals on FX with the US most notably for the likes of South Korea and Japan. For South Korea, news reports suggest the US believes the fundamental cause of the trade deficit is FX, and that South Korea and the US are discussing the direction of FX in talks, but the US did not mention a specific level. With that piece of news, the South Korean won jumped to as high as 1370.75 against the Dollar, before paring back some gains, and to some extent spilled over to the likes of TWD and JPY.

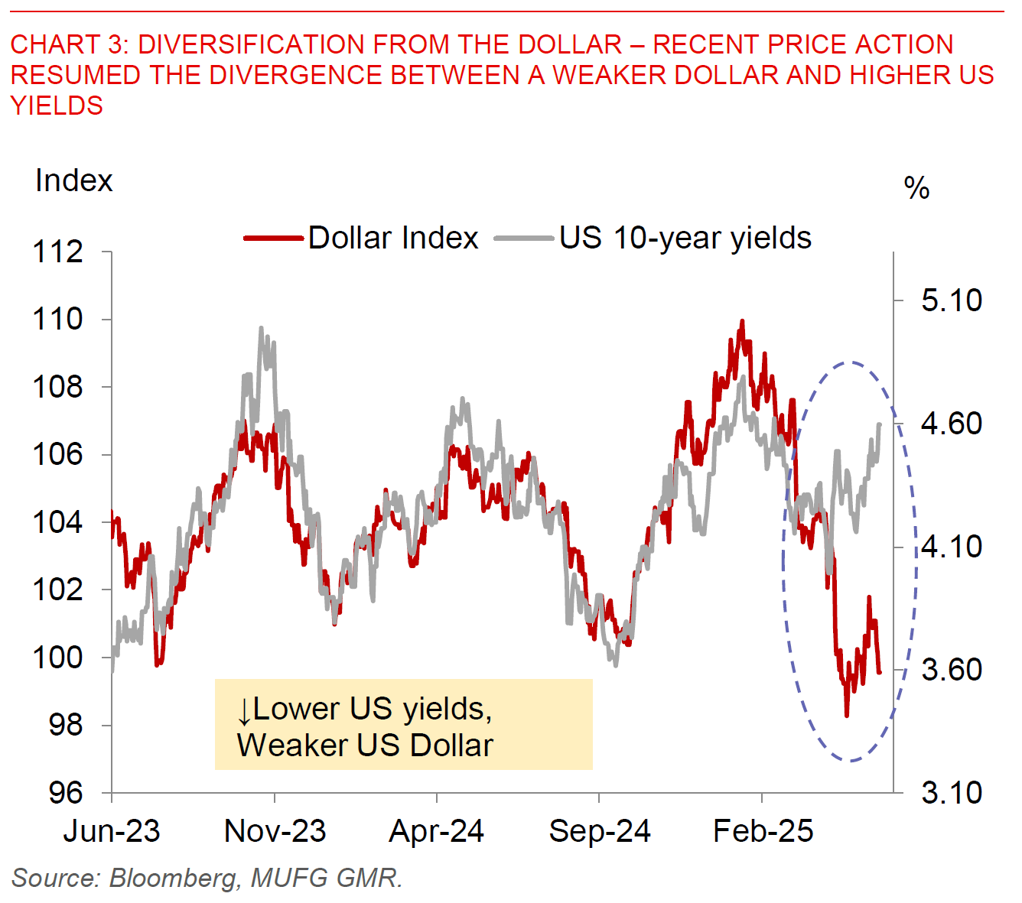

Third, diversification from the Dollar. We see this to some extent in the price action yesterday, with uncertainty on the US tax bill and trajectory of the US deficit contributing to a sell-off in both US equities and US Treasuries, but most importantly also a weaker Dollar and stronger performance in alternative safe havens such as gold and bitcoin. FX is of course importantly a relative price asset, and the best indicators (albeit still incomplete) we have suggest that there has been increasing foreign inflows into the likes of Japan, while retail investors in Taiwan and South Korea have also been modestly selling US assets, overall fitting into the broader theme of rebalancing away from US assets.

All these global macro themes do not of course mean that tariffs and trade do not matter, and we do expect Asian currencies to underperform core G10 including EUR and JPY due to weaker exports and growth prospects out of our region as tariffs increasingly bite.

Nonetheless, weaker growth and also soft inflation pressures in Asia is also one key reason for our high conviction call for Asian central banks to increasingly cut policy rates to support growth. On that front, yesterday Bank Indonesia cut its policy rate by 25bps to 5.50% in line with our expectation, with manageable Rupiah pressures providing BI policy space to cut rates (see IndonesiaPulse – Tariffs to bite, BI eases). Looking ahead, we forecast 75bps more cuts by central banks in India, the Philippines and South Korea for instance, while also 50bps more cuts by 1Q2026 by Bank Indonesia.