Ahead Today

G3: US Non-Farm Payrolls

Asia: Singapore Retail Sales

Market Highlights

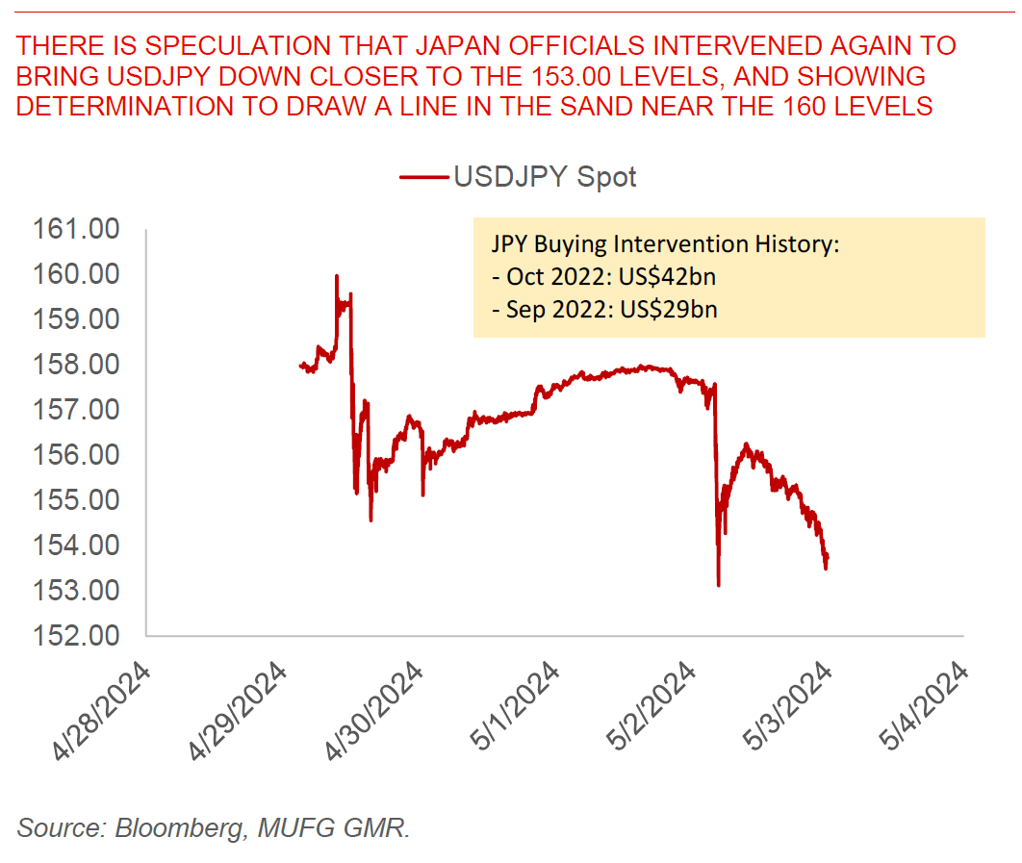

USDJPY fell sharply from 158.00 closer to 153.00, in what seemed like another potential episode of FX intervention by Japan officials. There was no official confirmation by authorities, but news reports and analysis were suggesting that the Bank of Japan possibly sold around US$23bn, and this comes on the heels of suspected intervention earlier this week to the tune of around US$30bn. To put these numbers in perspective, Japan sold around US$42bn over 4 days in October 2022, and around US$29bn in September 2022, and the suspected intervention may have been slightly larger thus far.

Japan’s Ministry of Finance’s possible determination to draw a line in the sand at the 160 level has also helped Asian currencies to an extent, with currencies such as KRW, THB TWD and SGD gaining the most thus far. Moving forward, we think that a more sustained turn in USDJPY would require a change in economic fundamentals, and today’s US non-farm payrolls could be important in this regard. Several surveys such as the NFIB Small Business Index and the PMIs have been pointing to weaker hiring conditions so far, and it’ll be important to see if this gets validated in the hard data.

Regional FX

Regional FX

Beyond the Japanese Yen, the other big market development is out of China. Chinese offshore equities (but less so A shares) have been one of the best performing equity markets over the past month. The latest data on Northbound inflows are not out yet given the holidays onshore in China, but for what it’s worth we saw US$3.4bn since last Friday. This has also spilled over into USDCNH to some extent, declining closer to 7.205. China’s economic fundamentals are still relatively soft, but there are some emerging green shoots such as in the Politburo’s recent reference to digest unsold housing inventory, together with strong domestic tourism numbers in the latest holiday period. On that front, we are also seeing some better than expected GDP numbers especially from North Asian economies, including in Hong Kong where the economy grew 2.7%yoy, together with Korea and Taiwan which have benefited thus far from the AI chip boom.