Ahead Today

G3: US ISM PMI, US initial jobless claims, Eurozone PMI, Bank of England Bank Rate

Asia: Caixin China PMI, Indonesia CPI

Market Highlights

The Federal Reserve held rates and kept the pace of quantitative tightening at US$95bn a month. It adopted an even-handed approach to the future policy path, seeing risks to achieving inflation employment goals moving better into balance. It has also signaled openness in making any adjustment to policy rates, suggesting the possibility of rate cuts. But Fed chair Powell gives the clearest indication as yet that rate cuts won’t be in March. The Fed is still not confident that inflation is moving “sustainably” to 2%, while “economic activity has been expanding at a solid pace”. There isn’t an updated dot plot accompanying this meeting.

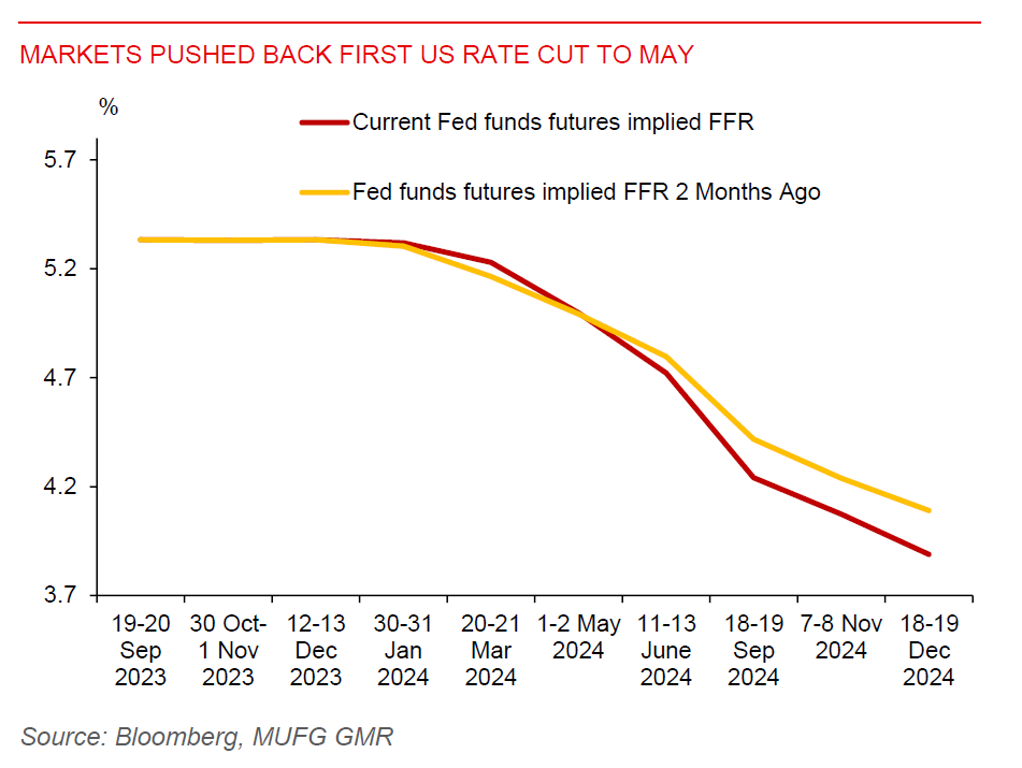

The futures market is still pricing in 144bps of rate cuts in 2024, only slightly lower than the day before, but pushed back timing of a rate cut to May. Market reaction has been relatively muted.

Meanwhile, ADP employment data came in weaker than expected, at 107k in January, down from 158k in December. EU-harmonised CPI in Germany moderated to 3.1%yoy in January from 3.8% in December, continuing the disinflation trend in the euro area. And we will have the BOE meeting later today.

Regional FX

Asian FX held steady against the US Dollar following the Fed policy decision. USDCNH and USDSGD were relatively steady at 7.18 and 1.34 respectively. China’s factory activity contracted for the fourth straight month in January, driven by shrinking new orders. Philippines 4Q GDP surprised on the upside at 5.6%yoy and 2.1%qoqsa, following 3.8%qoqsa growth in Q3. Singapore’s Q4 unemployment rate steadied at 2%, reflecting still a tight labor market, though signs of cooling are emerging. And in a sign of a tech recovery, Taiwan’s Q4 GDP rose 5.1%yoy, beating consensus for 4.1% growth. Meanwhile, the pickup in Hong Kong’s 4Q GDP (+4.3%yoy) missed market estimates of 4.7%, reflecting China’s slowing growth and higher interest rates. South Korea’s exports grew 18%yoy in January, a sign of better global growth prospects ahead.