Ahead Today

G3: US CPI

Asia: Malaysia IP

Market Highlights

US Treasury yields fell with the 10-year yield at 4.04% while global equities rose, helped by a softer US PPI inflation print coupled with optimism over AI driven by an extremely strong quarter by Oracle. In particular, US producer prices on a headline and core perspective both fell by 0.1%mom, much softer than consensus expectations for a 0.3%mom rise. The components which feed into the Fed’s key inflation measures for core PCE inflation were however not as soft as the headline numbers suggest. Net-net, these numbers cemented market’s expectations for a 25bps cut in the September Fed meeting, with the possibility of a 50bps cut still a high bar but dependent on the CPI inflation numbers out later today.

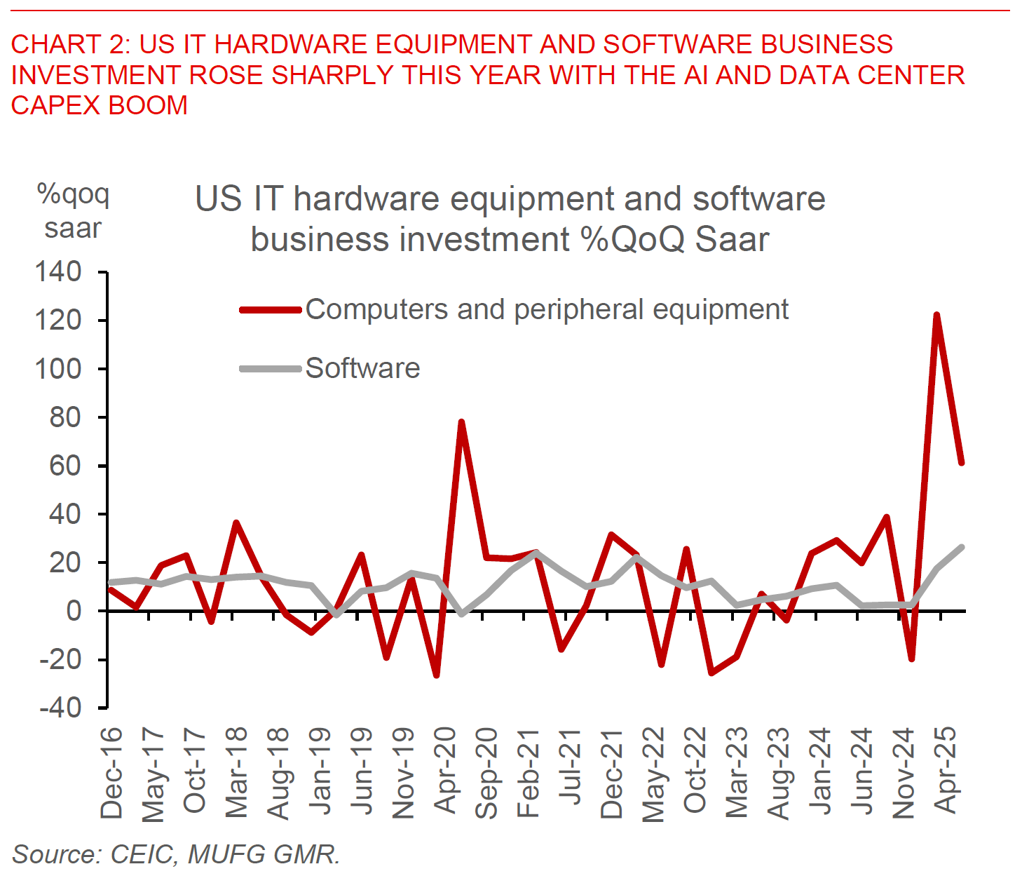

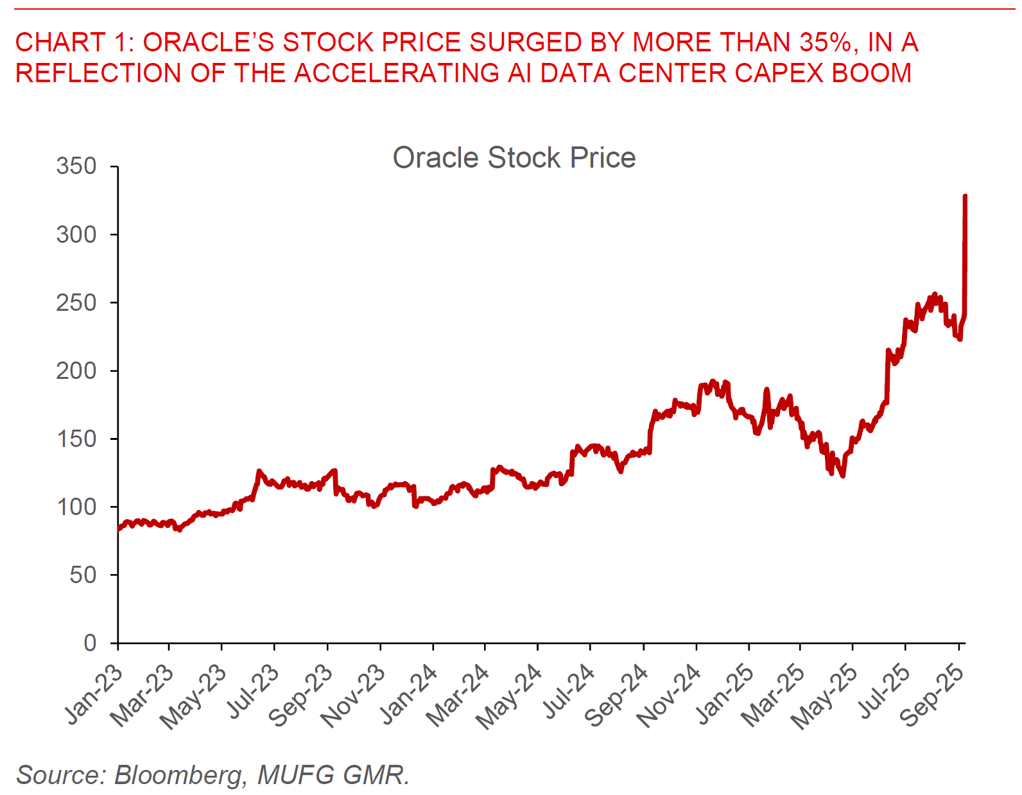

Meanwhile, in a reflection of the strong optimism around the AI and data center capex boom, Oracle’s stock price surged by more than 35% having already rallied 38% this year. Oracle announced that the company signed four multibillion-dollar contracts with three customers in the quarter, and expects to sign up several additional customers in the coming months, with the company’s cloud infrastructure business expected to expand 77% to US$18bn this fiscal year and reaching US$144bn by May 2030.

The broader macro picture we are seeing is perhaps one of an increasingly divergent US economy, with economic gains accruing to large technology companies and S&P500 and the stock markets and asset prices continuing to reach all-time highs. Meanwhile this is juxtaposed by increasing signs of a softer US labour market including for entry level and younger workers, with the tariffs impact likely also hurting the poor far more than the rich who benefit from tax cuts and the investment boom in AI - at least for now until technology percolates and diffuses more generally. From a market perspective, we think that the Fed will increasingly focus on the softer labour market and not just cut by 25bps in September, but also deliver around 100bps of cuts through the next 12 months and also bring the Fed funds rate to around 3% by end 2026.

It's of course important to point out these trends of rising income and wealth inequality are not specific to the US. To some extent the protests that we have seen across the region including Indonesia and Nepal are a reflection of widening income and wealth inequality, together with a significant generational divide perhaps driven by the recognition of low social mobility – the notion that the next generation can be better than the previous. We also see increasing headlines out of the Philippines around corruption charges on bogus flood control infrastructure projects, and this is certainly one area to watch for in terms of risk for PHP.

All these trends predate 2025 and exacerbated by the massive disruptions from COVID19 with the surge in asset prices, together with megatrends such as disruption from technology, initially the gig economy to some extent and over time perhaps increasingly AI. The domestic political disruptions we are seeing across a variety of countries are ultimately a reflection of the underlying economics and social contract, and countries that can emerge better and stronger are likely those that can promote social inclusion and mobility better, with employment and job prospects increasingly more important than headline GDP over the medium-term.