Ahead Today

G3: Japan industrial production and tertiary industry index

Asia: China trade, India wholesale prices and CPI

Market Highlights

The US dollar continues to find support from recent tariff announcements from President Trump. USDJPY has risen by about 2% last week, reaching above the 147.00-level. Over the weekend, President Trump announced a 30% tariff on EU goods, effective on 1 August, unless the EU offers improved trade terms. This could be part of Trump’s negotiation tactics, leaving a two-week window of opportunity for potential further trade negotiations and tariff adjustments.

In response, the EU is reportedly considering countermeasures and may coordinate its actions with other tariff-hit economies. It remains uncertain whether this will escalate into a new round of tit-for-tat measures between EU and US, or lead to a de-escalation. Additionally, Trump announced a 30% tariff on Mexico starting 1 August, although USMCA compliant goods are exempted.

Separately, the Trump administration is reportedly exploring if the renovation at the Fed’s headquarters could serve as a justifiable reason to remove Fed Chair Jerome Powell. While the legal grounds for such a move remain unclear, it underscores mounting political pressure on the Fed to implement aggressive rate cuts.

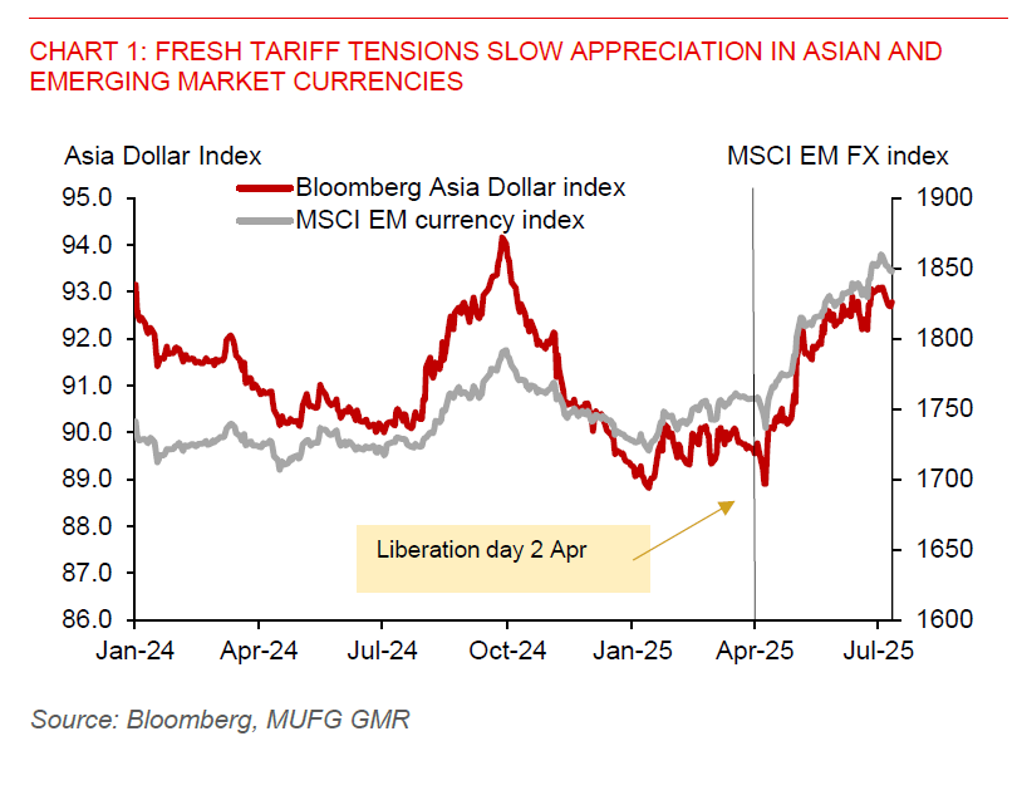

Regional FX

Asian currencies face some near-term pressure following fresh tariff threats from President Trump. However, market expectations of lower fed funds rates and concerns over rising fiscal sustainability in the US may help contain US dollar strength. This could provide some support to Asian FX over the medium term, particularly if bilateral trade talks with US lead to some tariff concessions. That said, the risk remains that Trump could proceed with the recently announced reciprocal tariff rates on trading partners, which would cloud the outlook for global growth and regional currencies.

Last week, the TWD and KRW underperformed among major Asian currencies, each depreciating by around 1% against the US dollar. The ringgit followed with a 0.7% decline, while the US dollar posted broad-based gains across other regional currency, reflecting continued near-term strength.

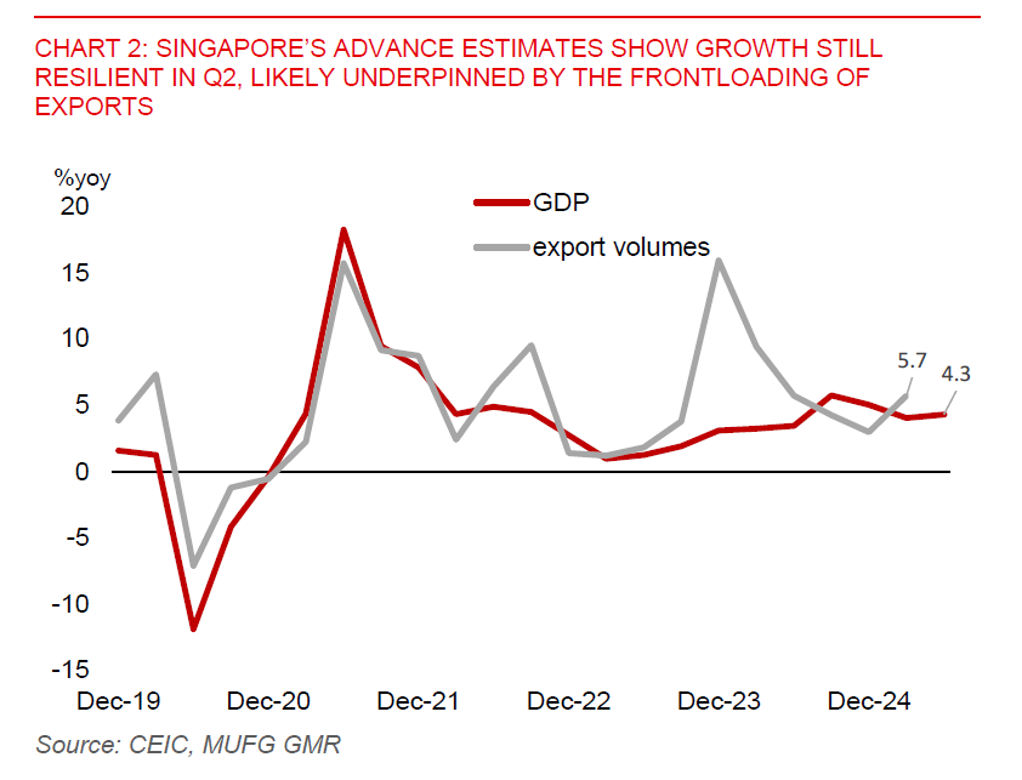

In Singapore, USDSGD has risen by 0.5% to the 1.2800-level last week, moving in tandem with broad-based US dollar strength. However, stronger-than-expected Q2 GDP data could lend support to SGD. The advance GDP estimate showed that GDP rebounded to 1.4%qoq sa in Q2, reversing the upwardly revised 0.5% contraction in Q1 and beating market consensus of a 0.8%qoq increase. As a result, Singapore avoided a technical recession. The rebound was primarily driven by a rise in construction activity (+4.4%qoq) and the frontloading of exports and production. On a year-on-year basis, GDP rose 4.3% in Q2, following an upwardly revised 4.1% in Q1. Looking ahead, the second half of the year may prove more challenging, with potential payback in export growth following earlier frontloading, and the risk of higher tariffs on Singapore’s trading partners from 1 August. These factors could have negative spillover effects on Singapore’s trade-reliant economy, particularly given its role as a transshipment hub.