Ahead Today

G3: FOMC meeting, Germany factory order

Asia: Taiwan CPI

Market Highlights

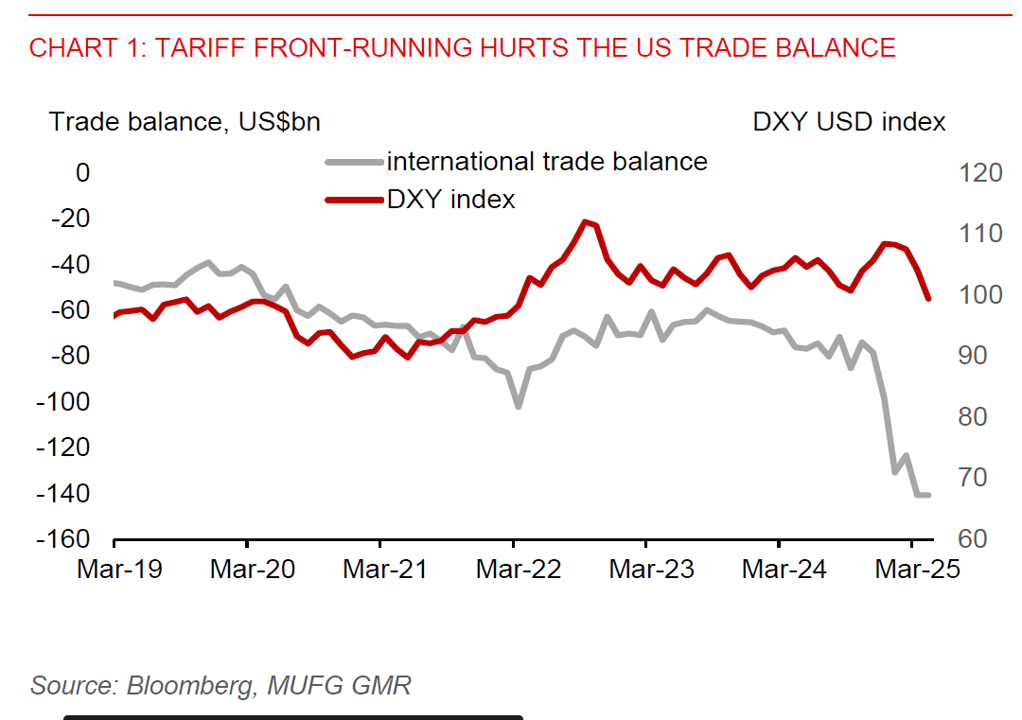

US international trade balance was -$140.5bn in March, larger than Bloomberg consensus of -$137.2bn and widening from -$123.2bn in February. This was historically the largest monthly trade deficit due to the front-running of tariffs. Indeed, US goods imports jumped by a further $17.8bn to $344.3bn in March. This was primarily led by pharmaceutical imports, while capital equipment, computer accessories, and motor vehicles had also increased.

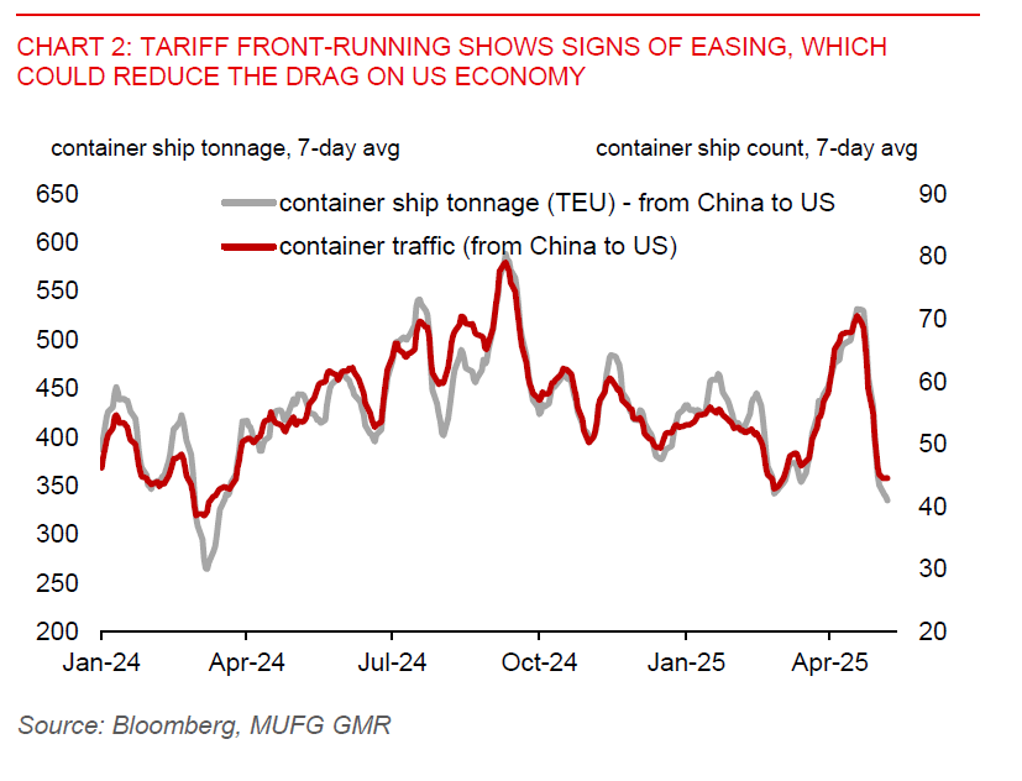

However, the import surge from tariff front-running may have eased, given that container ships departing from China to US have fallen back since mid-April following the surge in Q1. The import jump was a key reason for US GDP to fall 0.3%qoq annualized in Q1. So, as trade deficit starts to narrow in April/May, it should help reduce the drag on US economic growth in Q2.

The key highlight for today is the FOMC meeting. We think the Fed could stand pat while adopting a neutral to somewhat hawkish tone. Policymakers could reiterate that uncertainty around the economic outlook has increased, while maintaining a wait-and-see approach. Recent surveys suggest the US services activity is still holding up, but inflationary pressures are building. This may keep the Fed cautious about delivering a dovish signal.

Regional FX

The broad US dollar index extended its decline by another 0.6%, but several Asian currencies retraced some of their recent gains versus the US dollar. This was led by the ringgit (-0.7%) and TWD (-0.5%) following their sharp appreciation, especially in the latter. However, the Thai baht bucked the regional trend by gaining 1.2% to trade below the 33.000-level yesterday. Falling oil prices and a rebound in gold prices have likely contributed to the Thai baht’s outperformance.

Recent gains in several ASEAN currencies may not be durable, though, given a still challenging macro backdrop. Factory activity across Asia has weakened in April compared to the prior month, except for Philippines and India. Tariff front-running has also appeared to ease. While China has reportedly agreed to engage with the US on trade, the road ahead is likely a bumpy one. And if the Fed delivers a somewhat hawkish tone at the FOMC meeting, it could provide support for the US dollar.

Meanwhile, CPI data from Thailand and Philippines show subdued price pressures, bolstering the case for more rate cuts. Thailand’s headline CPI fell 0.2%yoy in April from +0.8%yoy in March. Philippine headline inflation also slowed to 1.4%yoy in April from 1.8%yoy in March.