Market Highlights

Markets continued its sugar high from this week’s Fed meeting, when Chair Powell hinted that the Fed may be done hiking. The S&P500 posted its best day since April, 10-year Treasury yields fell further to 4.69%, while the US Dollar fell by 0.7%. To be clear, Chair Powell emphasised that tighter financial conditions would need to be “persistent” to weigh on future rate actions, and the market moves over the past two days were certainly not in that direction. Overall, the US economy showed resilience and rebalancing at least so far, with data overnight highlighting stronger productivity growth, lower unit labour costs, and still decent durable goods orders.

The Bank of England kept rates on hold as expected, with BOE governor Bailey saying there was no discussion on cutting rates on the MPC.

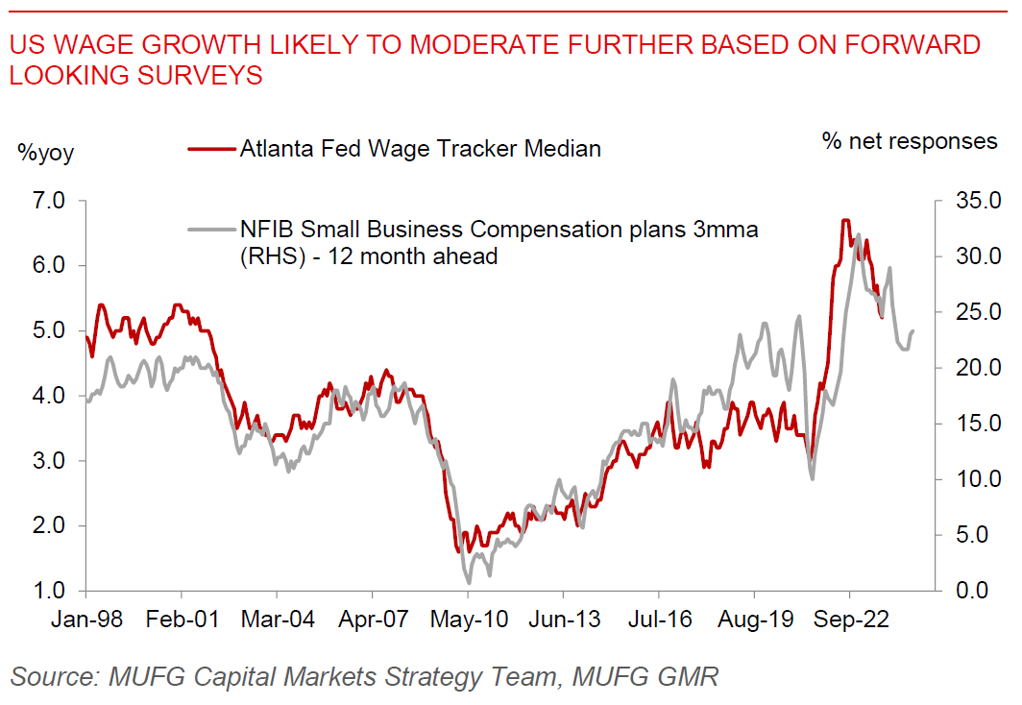

The key event today is the non-farm payrolls, where consensus is penciling a moderation to 180k from 336k, with a slightly uptick in wage growth to 0.3% mom.

Regional FX

Most Asian currencies were stronger against the Dollar, following the broader dollar sell-off. THB (+0.67%), KRW (+0.57%) and PHP (+0.41%) outperformed. Malaysia’s central bank kept its OPR rate unchanged again, and signalled it may extend the pause amidst a weaker ringgit and higher US rates. In particular BNM said that expectations for higher for longer interest rate have contributed to a persistently strong US Dollar, but that these developments are not expected to derail Malaysia’s growth prospects. Looking ahead, we will have China’s Caixin Services and India’s Services PMIs, together with Singapore’s retail sales estimates.