Ahead Today

G3: US Personal Income, US Personal Spending, US University of Michigan Sentiment

Asia: Singapore industrial production, Thailand manufacturing production

Market Highlights

The US Dollar strengthened, US Treasury yields rose across the curve, and risk sentiment weakened somewhat, driven by a mix of better US macro data released overnight. In addition, there were also other uncertainties and risks, such as from announcement of additional sectoral tariffs on the likes of pharmaceuticals and kitchen cabinets, together with geopolitical risks from Russia’s alleged incursion of airspace coupled with a looming government shutdown at the end of the month.

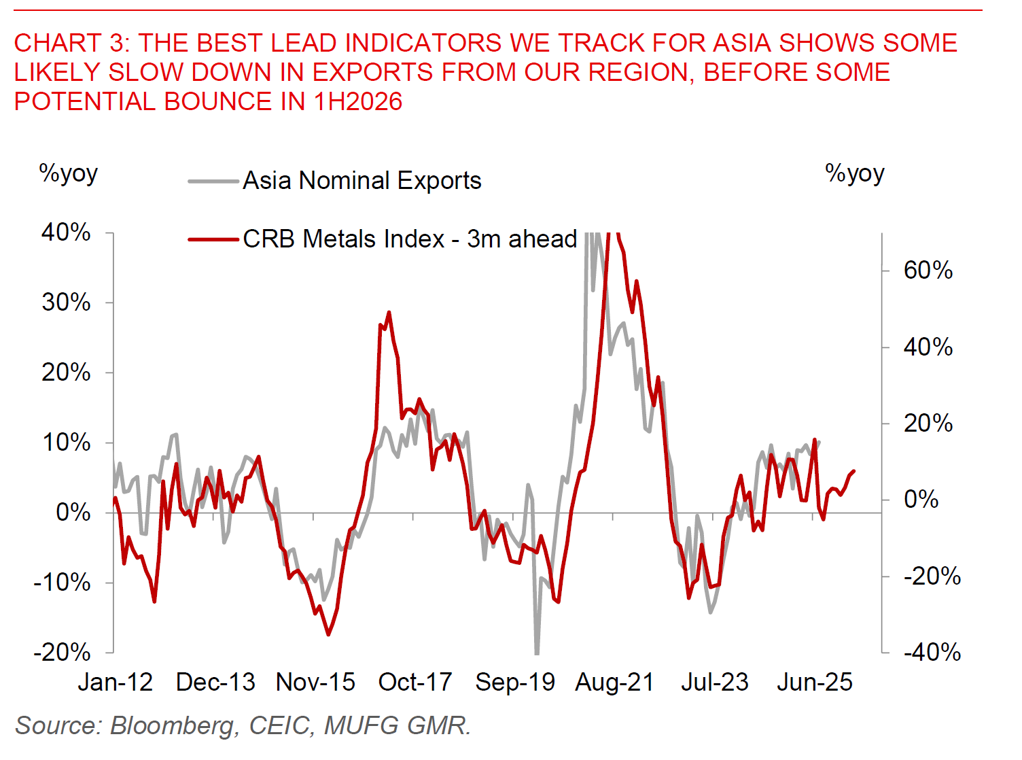

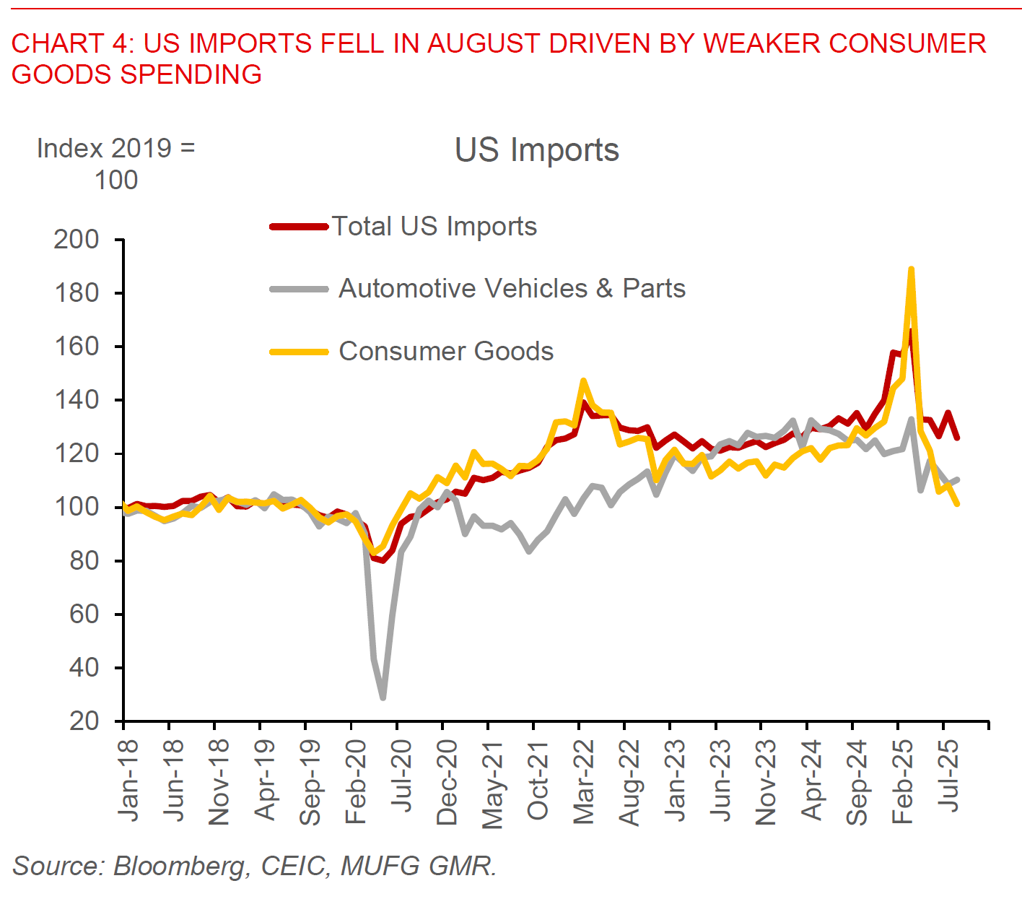

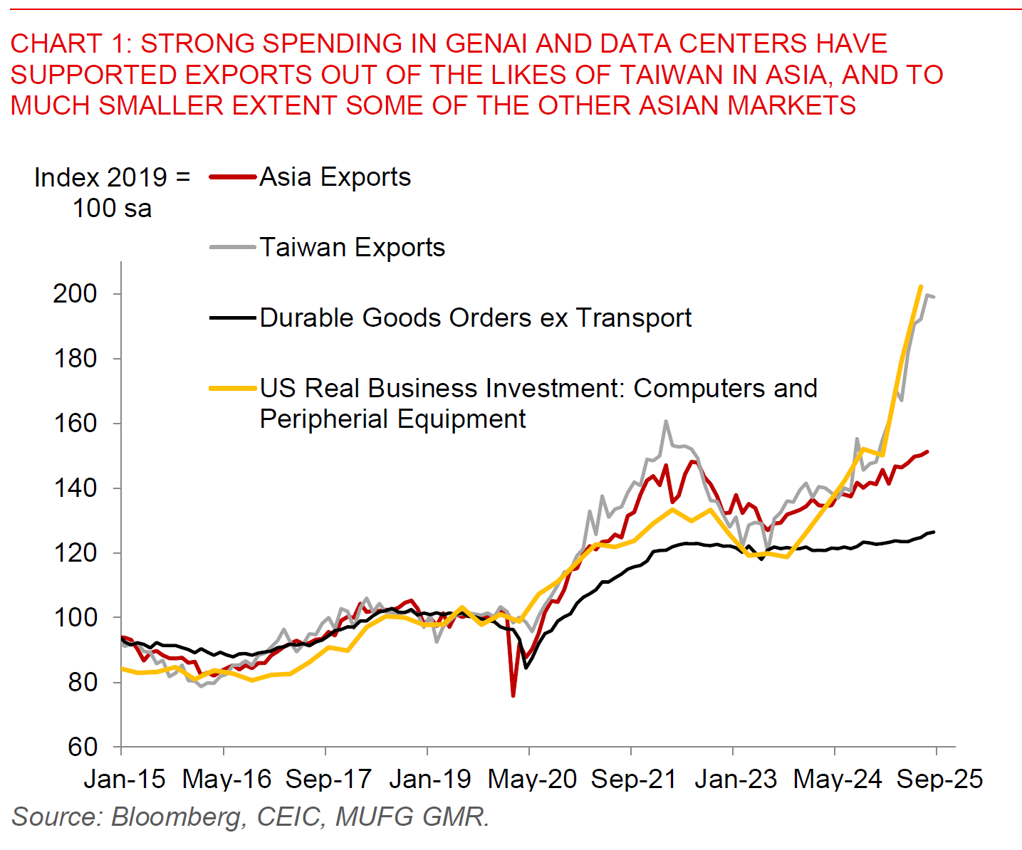

First, better than expected US macro data. 2nd quarter GDP in the US was revised up to 3.8% annualized, from 3.3% in the initial estimate, with personal consumption in particular estimated to rise 2.5% (from 1.6% in the preliminary estimate). Business investment rose by 7.3%, driven by higher spending on data centers, computer related equipment such as GPUs, coupled with stronger software spending. Of course, these numbers are backward-looking and also distorted by front-loading to some extent ahead of tariffs. The more timely indicators for August provide for a more mixed picture, with US durable goods orders ex transportation rising a stronger than expected 0.4%, while US goods imports fell 7% driven by softer consumer goods and also likely gold-related imports. Net-net, for Asia, the best lead indicators we track for Asia exports shows that exports are likely to slowdown modestly in the coming months, but interestingly are tentatively pointing towards a potential pickup in activity as we head into 2026.

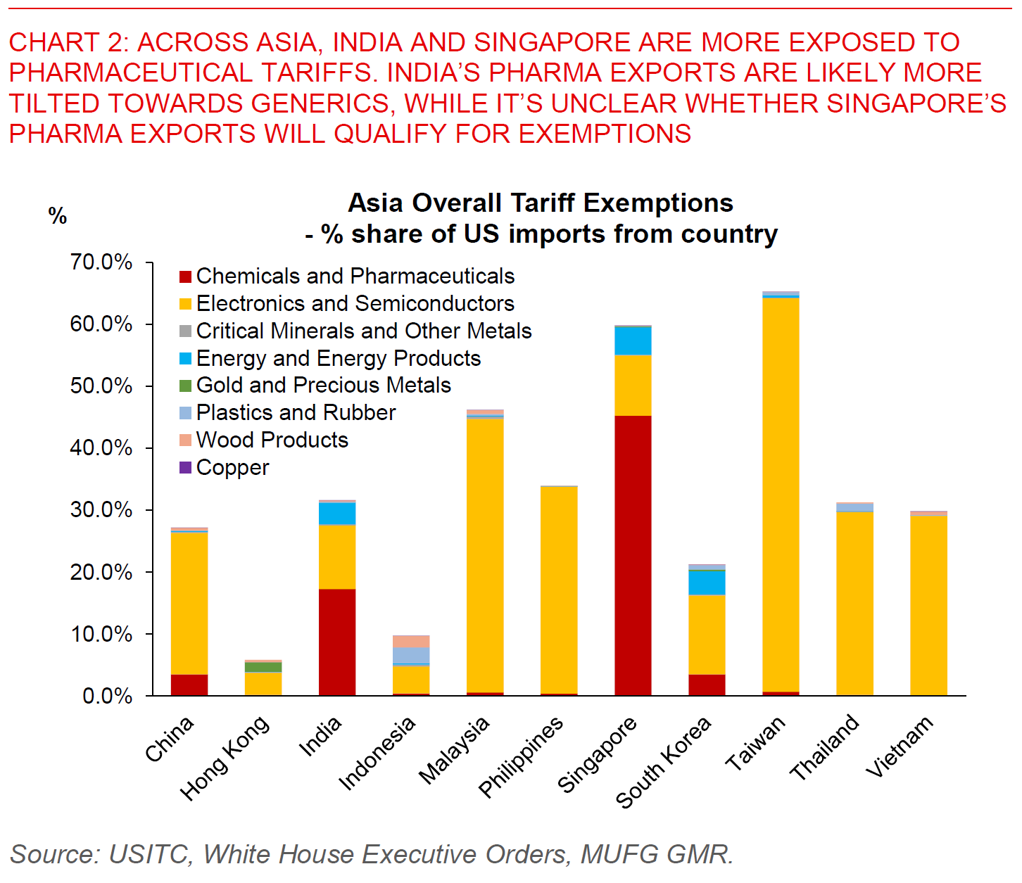

Second, additional sectoral tariffs including on pharmaceuticals. President Trump announced that he will be imposing a 100% tariff on any branded or patented Pharmaceutical product, starting from 1 October. Nonetheless, akin to previous announcement on potential exemptions on semiconductor tariffs, he said that there will be no tariffs on these pharmaceutical products if construction has started. In addition, he also announced a 25% tariffs on heavy trucks, 50% tariffs on kitchen cabinets and bathroom vanities, as well as 30% tariff on upholstered furniture.

Looking at Asia specifically, it is still unclear how branded or patented pharmaceutical products will be defined, but our working assumption is that this will not incorporate generic drugs and pharmaceutical shipped by the likes of India to the US. As such, India could be spared from these announcements – perhaps for now. Across Asia, Singapore stands out as being far more exposed with 40% of its exports to the US currently enjoyed exemptions in the pharmaceutical sector, and with its products likely skewing more towards the higher end. A quick search of some of the more significant FDI into Singapore by pharma companies shows that many of the big names with investments in Singapore including Pfizer, GSK, MSD, Roche and Sanofi seem to have plans for investment in the United States. While that could be a saving grace, the implementation and impact for the likes of Singapore and India are still highly unclear at this moment on the pharma sector.

Lastly, other additional risks such as on geopolitics. According to Bloomberg News, European diplomats warned Russia that Nato is ready to respond to further violations of its airspace with full force, including by shooting down Russia planes. This was reportedly at a tense meeting between British, French and German envoys addressing concerns about an incursion by Russia fighter jets over Estonia last week