Ahead Today

G3: US Mortgage Applications, US Inventories, Germany CPI

Asia: Singapore COE Premiums, Philippines Unemployment Rate

Market Highlights

The Dollar strengthened overnight as Fed officials emphasized the need to get CPI down to the central bank’s 2% inflation target, while also highlighting the uncertainty around the volatility in US 10-year yields. Governor Christopher Waller said that jump in US yields amounted to nothing less than an “earthquake”. Neel Kashkari echoed the 2% inflation commitment, adding there’s been no discussion of rate cuts. Meanwhile, Austan Goolsbee said that reducing inflation is the no. 1 thing, while Michelle Bowman reiterated that she expects more hikes.

Germany’s industrial production came in much weaker than expected at -1.4% mom sa, leading to some sell-off in the Euro. The Reserve Bank of Australia hiked rates by 25bps bringing the cash rate to 4.35%. However, the central bank signalled a higher hurdle to further policy tightening. This led to some AUD sell-off.

Regional FX

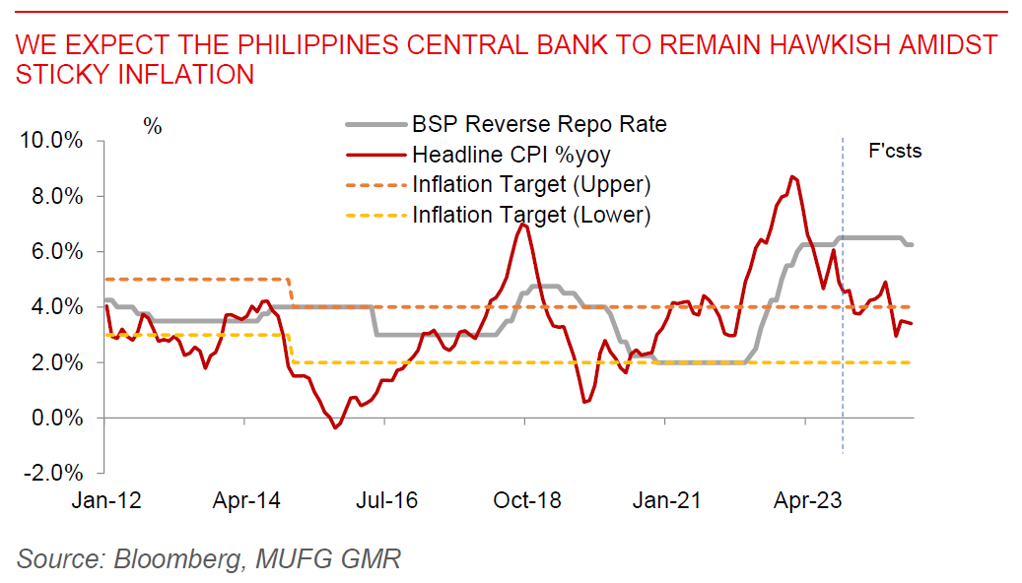

Asian currencies were mixed against the Dollar. China released trade data, with imports surprising on the upside at +3%yoy (from -6%yoy). The details suggest some pickup in goods such as soybean, textiles, leather and copper imports, indicating some possible improvements in China’s domestic demand. Meanwhile, the Philippines’ inflation print was lower than expected, helped by lower rice prices. The country’s trade deficit was also smaller than expected at US$3.5bn, helped by lower oil imports.