Ahead Today

G3: Japan Rengo Wage estimates, US Industrial Production, US University of Michigan Sentiment

Asia: PBOC MLF rate, Indonesia Trade Balance, India Trade Balance, China New Home Prices

Market Highlights

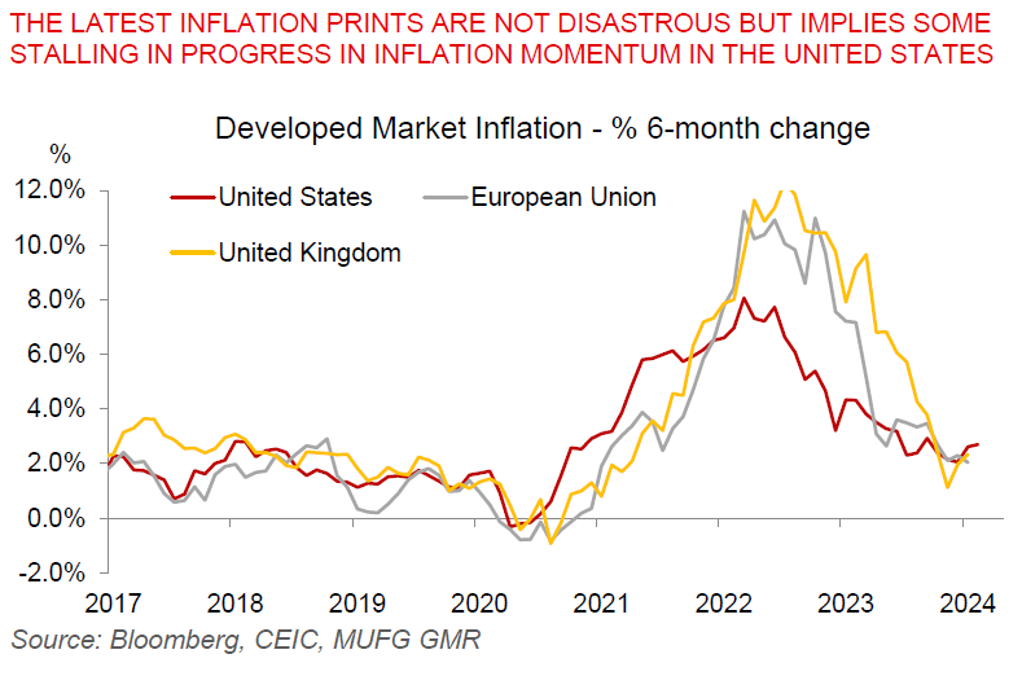

US yields jumped as a hotter than expected Feb PPI print led to markets paring back odds of the Fed cutting rates in June. PPI rose 0.6%mom on a headline basis, and 0.3% mom in the core figure. With PPI feeding into some components of PCE inflation – the indicator the Fed targets - the best estimates of headline PCE is likely around 0.4% and for core PCE in February at around 0.3-0.34%, coupled with an upward revision to the January PCE inflation estimate.

These numbers are not disastrous for the Fed, but neither does it bolster calls for rate cuts anytime soon. The Fed will update its dot plot and its economic projections in its next meeting in March, and it’ll be interesting to see what message the Fed decides to send to markets then about the path forward.

Overall, US 10 year-yields jumped up to 4.29%, the S&P500 fell 0.29%, while the Dollar rose sharply by 0.5%, with EURUSD declining to 1.088. Looking ahead, markets will focus on the 1st estimates of Japan’s labour union wage estimates released by Rengo, together with the University of Michigan sentiment surveys.

Regional FX

Asian FX markets traded weaker against the Dollar, with KRW (-0.5%) and SGD (-0.3%) underperforming. We will have China’s decision on the 1-year medium-term lending rate today, where consensus is expecting no change at 2.5%. We believe that the PBOC will lower its MLF rates through 2024 to help lower bank funding costs and support NIMs. Looking ahead, we will also have Indonesia’s trade balance for February, which is expected to print at US$2.3bn, roughly unchanged from US$2bn seen the previous month.