Ahead Today

G3: Germany industrial production, US Fed 1-year inflation expectations

Asia: Philippines BSP policy rate

Market Highlights

US non-farm payrolls released on Friday was strong in several respects. The headline number rose by 303k, up from 275k the previous month, the unemployment rate ticked down to 3.8%, while average weekly hours worked rose by a touch to 34.4 from 34.3. Meanwhile, employment change measured in the household survey was less weak, although a gap remains between that measure and payrolls. The good news on labour supply is a further rise in the labour force participation rate to 62.7% from 62.5%. With forward looking indicators indicating continued moderation in wage growth over 2024, the rise in labour supply is another positive in that regard.

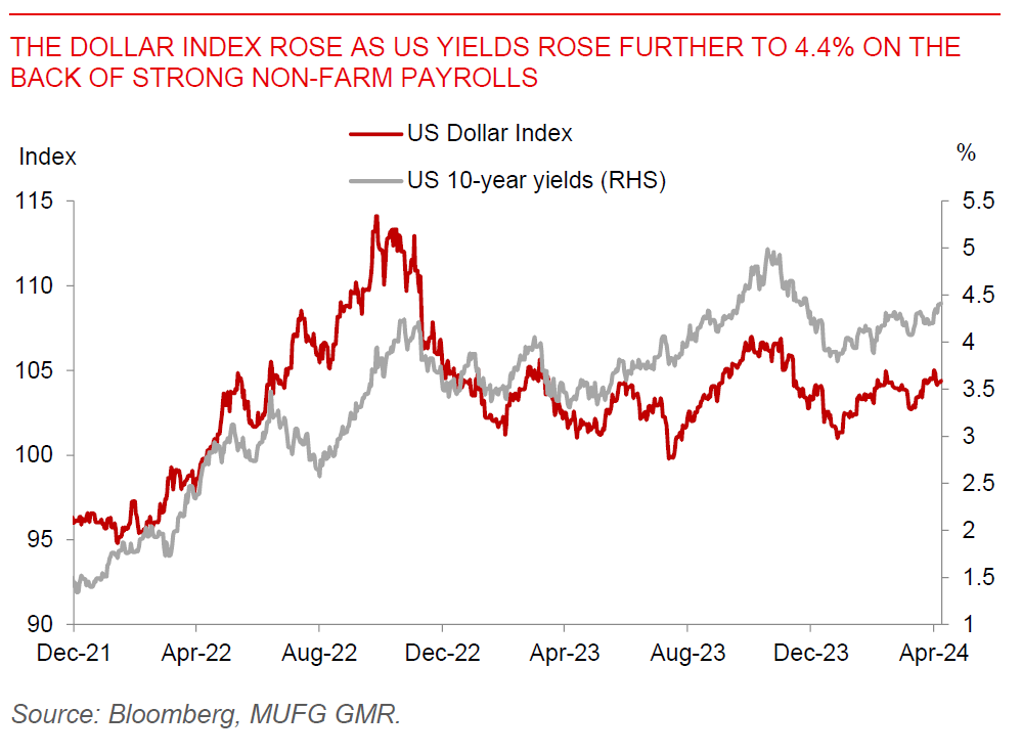

With the NFP print, US 10-year yields surged to 4.4% with markets now pricing in around 63bps of rate cuts in 2024. More importantly, risk assets took the NFP number quite well, with the S&P500 rising more than 1%, ultimately leading to a stronger US Dollar by around 0.2%.

With the Dollar still strong coupled with the rise in oil prices, some countries are feeling uncomfortable by the extent of currency depreciation. Japan is a key example. Bank of Japan governor Ueda signalled a chance of an interest rate increase in 2H2024 by highlighting the possibility inflation momentum will strength. The comments led to some short-term strengthening in JPY, but ultimately Dollar strength dominated.

Regional FX

Asian FX markets traded weaker against the Dollar as the USD strengthened post NFP, with USDCNH at 7.25, USDSGD at 1.3498, and USDKRW at 1354. US Treasury Secretary Janet Yellen and China’s He Lifeng agreed to talks on “balanced growth” to address what the US sees as China’s growing overcapacity. The initial comments on China’s purported overcapacity were not taken too well, but ultimately ended on a cordial note. Today, markets will focus on the onshore USDCNY fix, in part because USDCNY is already trading at the top side of the policy band, while PBOC seems to be also concerned about generating excessive currency depreciation expectations. Meanwhile, RBI announced its monetary policy decision. The decision was not too much of a surprise, with RBI keeping its key policy rate on hold at 6.50%, with an unchanged policy stance of withdrawal of accommodation.