Ahead Today

G3: US Existing Home Sales, UK Retail Sales, US Uni Mich Inflation expectations

Asia: Malaysia trade, Malaysia GDP, Philippines BOP

Market Highlights

US initial jobless claims came in lower than expected at 187k, the lowest since September 2022, while continuing jobless claims also fell to 1806k, indicating a still resilient US labour market, at least so far. Meanwhile, Japan’s December National CPI was marginally higher than expected, which keeps open the possibility of a rate hike by the Bank of Japan in 1H2024. JPY has been the weakest G10 currency year-to-date as markets reassessed both the pace of US rate cuts, and also on the back of recent earthquake in Japan which likely delays policy normalization by the BOJ.

Meanwhile, the IEA now estimates that oil inventories rose by 560,000 barrels a day as US production soared, a meaningful change from their earlier expectations that the oil market would be in a deficit in 2023. Thus far, oil prices have remained quite well behaved despite risks from conflict in the Middle East.

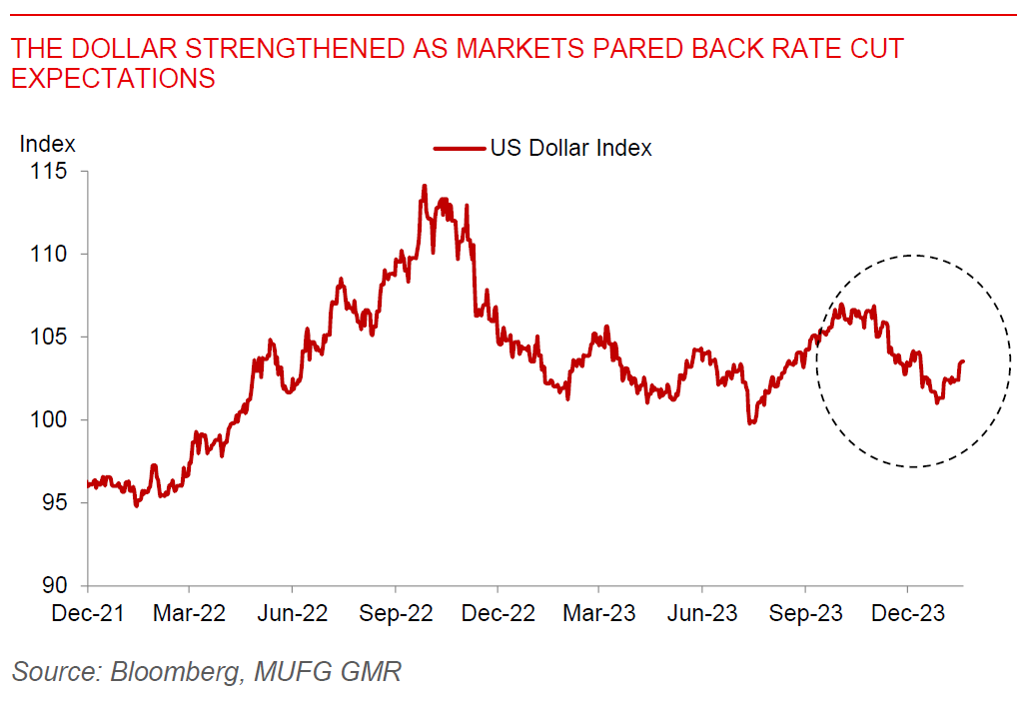

Overall, US 10-year yields rose to 4.14, the Dollar strengthened marginally, while equity market sentiment bounced back up with S&P500 rising 0.88%.

Regional FX

Asian FX were mixed against the Dollar, with KRW (+0.7%) and SGD (+0.12%) rising, while THB (-0.6%) falling against the USD. TSMC said it expects to return to solid growth this quarter, and gave itself room to raise investment spending, suggesting a recovery in the tech cycle and computing demand globally. It is now budgeting capital expenditure of $28bn to $32bn (versus $30bn in 2023), and expecting revenue to bounce back to at least 20% for 2024. It is also moving ahead with plans for plants in Japan, Arizona and Germany. Signs of a recovery in chipmaking sector have emerged more generally, with pickup in exports from Taiwan and Korea, while the Semiconductor Industry association estimated chip sales increased in November after more than a year of declines