Ahead Today

G3:

Asia: Thailand’s 4Q GDP

Market Highlights

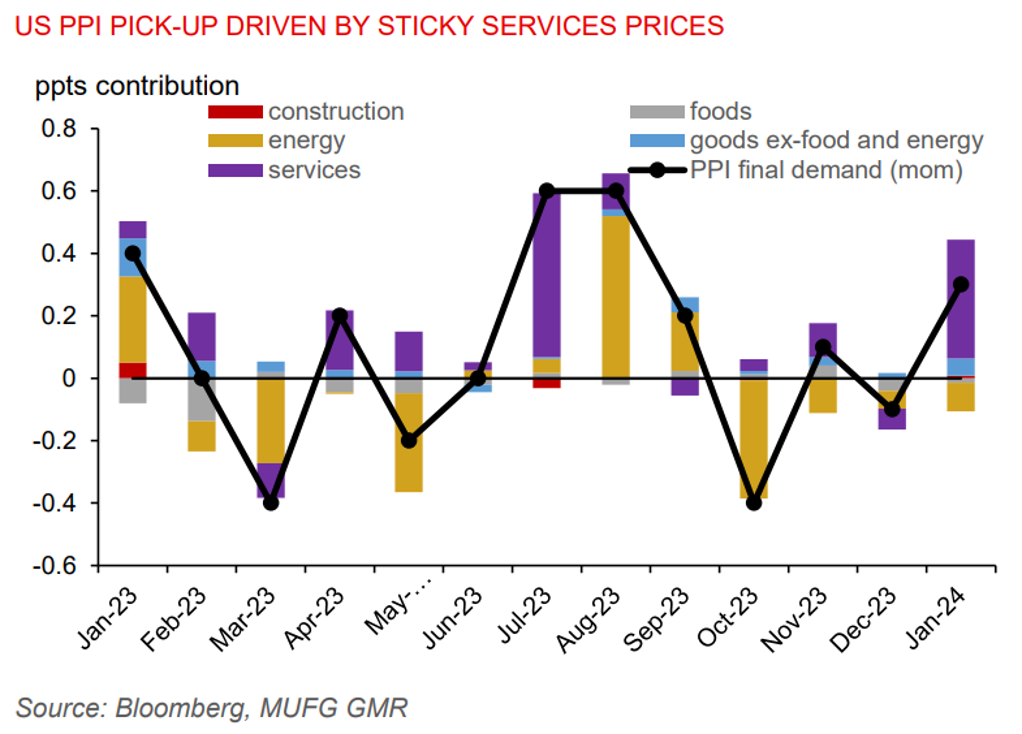

US housing starts fell by 14.8%mom in January, though this could be due to weather related factors in the Midwest that held back new starts and is not necessarily indicative of a slump in housing demand. Indeed, recent new home sales data showed sales of single-family homes were up 8% in December, from -9% in November. University of Michigan consumer sentiment rose to 79.6 in February from 79 in January, albeit slightly missing analyst estimates of 80. Meanwhile, the year-ahead inflation picked up to 3% from 2.9%. And US PPI rose 0.3%mom in January, up from -0.1% in December and higher than analyst estimates of a 0.1% rise, driven by higher services cost. These developments suggest that inflation is stickier than expected, which means the US Fed will be in no rush to cut rates. Fed’s Daly said the FOMC needs to be patient and agile with decision making, with expectations for 3 rate cuts for this year looking reasonable. The broad US dollar index was stable, while US yields moved higher.

In Japan, core machinery orders rose 2.7%mom in December, from -4.9% in November. In China, more than 61mn rail trips were made in the first 6 days during the Lunar New Year holiday, the highest compared to the past 5 years.

Regional FX

Asian FX was marginally stronger against the US dollar, with the THB (+0.4%) and TWD (+0.2%) outperforming.

In Singapore, non-oil domestic exports (NODX) rose 16.8%yoy in January, driven by non-electronic products. Electronic exports also rose 0.7%yoy, from -11.7%yoy in December. The better-than-expected export data suggests a brighter outlook for exports ahead, Deputy Prime Minister and Minister for Finance, Mr. Lawrence Wong, delivered the FY2024 budget in parliament on 16 February. The budget provides support for households and businesses in tackling the immediate problem of rising costs, while also aiming to strengthen its long-term economic competitiveness via boosting investment, innovation, productivity growth, and human capital. While the budget provides cost of living support for households, the government is also mindful of the need to maintain fiscal discipline. As such, the government plans to run a balanced budget of 0.1% of GDP surplus in FY2024, which would be a modest fiscal tightening from the 0.5% deficit in FY2023.

Malaysia’s final 4Q GDP rose 3%yoy, missing analyst estimates of 3.4%. This brings full year 2023 growth to just 3.7%, below market consensus for 3.7% growth.

In China, the PBOC left its 1-year MLF rate unchanged at 2.5%.

We will get Thailand’s 4Q GDP data later today. Market consensus is for 2.5%yoy in Q4 and 2.1% in 2023. A weaker than expected reading would spur more rate cuts bets for the Bank of Thailand.