Ahead Today

G3: US CPI, Bank of Canada rate decision

Asia: India CPI, India Industrial Production

Market Highlights

In what was yet another volatile day of tariff-related whiplash, President Trump threatened to double tariffs on Canadian steel and aluminum to 50%, after Ontario announced plans to place a 25% surcharge on electricity sent to US. Things seemed to escalate further with Ontario Premier Doug Ford threatening to raise those surcharges further, before a call between Commerce Secretary Howard Lutnick and Doug Ford led to an agreement to discuss a renewed USMCA trade agreement and temporary suspension of electricity surcharges. President Trump also backed on his threat to double tariffs to 50%.

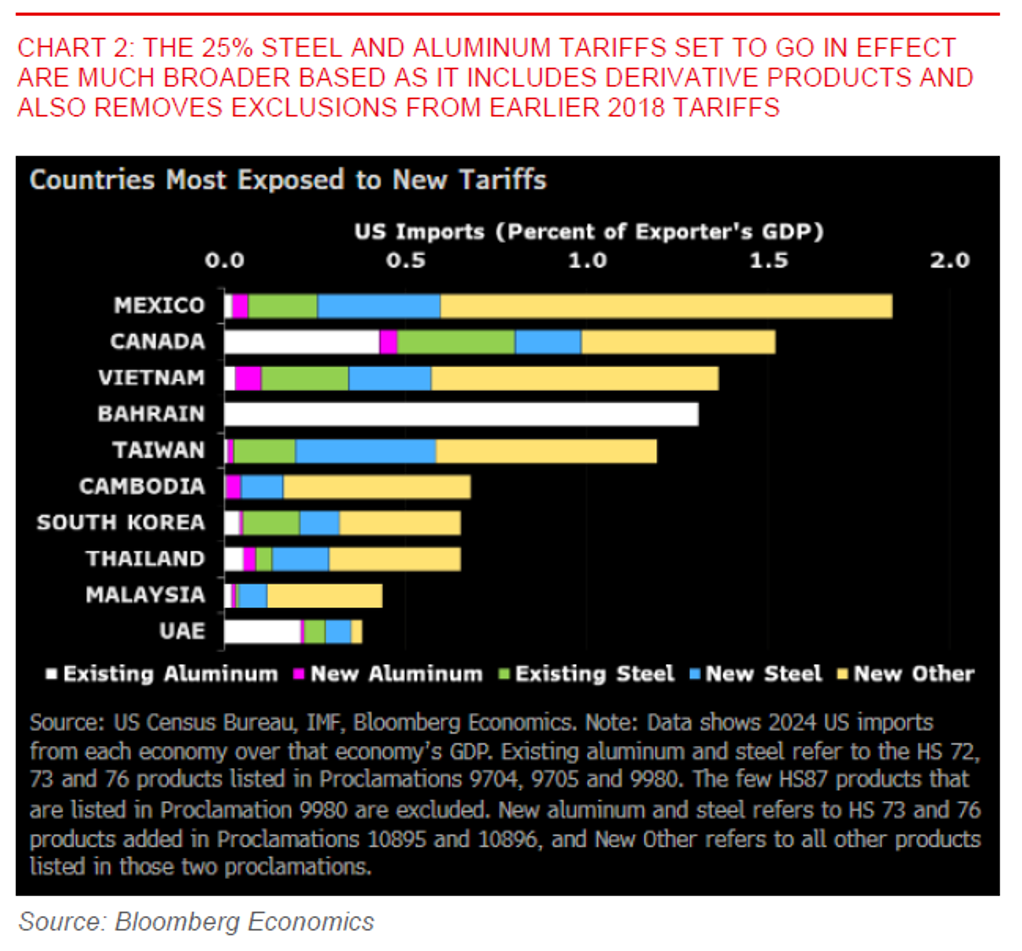

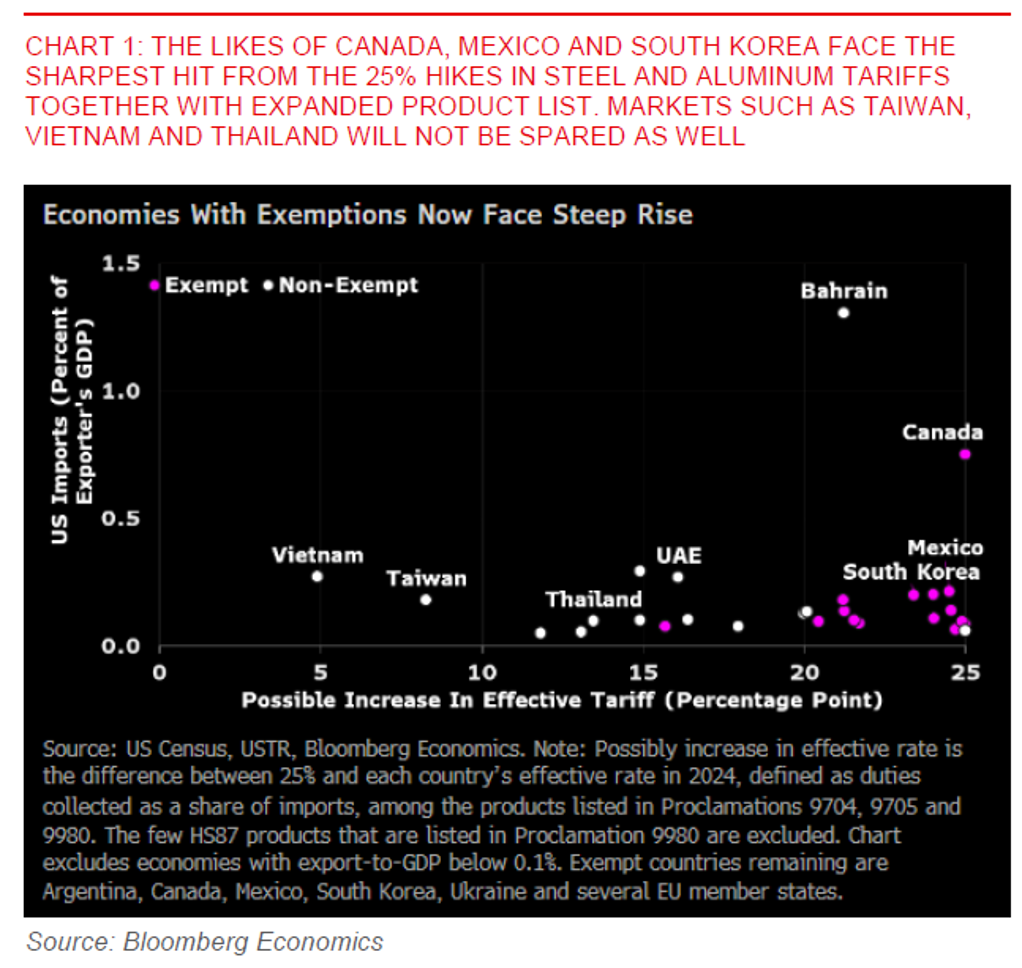

Nonetheless, the 25% tariff increase on steel and aluminum is still set to go into effect on Wednesday. It’s important to note that these tariff increases are much broader with the inclusion of derivative steel and aluminum products (although this will only be levied on the declared foreign metal content), coupled with the removal of exemptions from earlier Section 232 investigations in 2018. Analysis by Bloomberg Economics shows that markets such as South Korea, Canada and Mexico face the sharpest hit as they will likely see the highest rise in tariff increases, while also suffer most from expanded product list. Markets such as Vietnam, Taiwan and Thailand will not be spared as well as they will be hit from expanded product list even as they were already subject to previous Section 232 tariff rates imposed in 2018.)

Regional FX

From a markets perspective, it’s interesting to note that tariff headlines have so far continued to induce further Dollar weakness with questions over US growth and US exceptionalism, although this has not been entirely broad-based and more concentrated in core G10 given the EUR positive story as well.

Asian currency performance were somewhat mixed and overall lagging the broader Dollar weakness, with a good performance in CNH (+0.45%) and SGD (+0.2%), but with underperformance in the likes of IDR (-0.7%) and INR (-0.4%). Overall, we do think that markets are underpricing the downside growth risks to Asian growth somewhat and see the risk reward still tilted towards Asian FX weakness over the next few months. The Indonesian Rupiah continues to face some pressure due to domestic reasons such as questions around the sovereign wealth fund and monetization by Bank Indonesia of the government’s housing programme. Meanwhile, we expect India’s CPI out later today to show a decent moderation to slightly below 4%, which will likely increase expectations for further RBI rate cuts. We think that RBI is continuing to pivot towards growth and we think that the bias for INR is for it to still climb weaker through 2025.